After several months of deep price declines and an avalanche of analyst downgrades, real estate investment trust (REIT) stocks bottomed in mid-October and have been moving higher ever since.

Even with REITs bouncing back for the past month, many analysts have been reluctant to upgrade them until recently. But with the slightly better consumer price index (CPI) and producer price index (PPI) numbers out in the past two weeks, analysts are beginning to warm up to the REIT sector.

Here are three REITs that have had analyst upgrades within the last few weeks:

Prologis Inc. PLD is a San Francisco-based industrial REIT that owns and manages industrial logistics properties across the U.S. and 18 other countries. Founded in 1983, Prologis has been a leader in appreciation among REIT stocks. Although Prologis has an annual dividend of $3.16, it’s more growth- than income-oriented, and the annual dividend yield of 2.8% is usually well below other REITs in its peer group.

From October 2017 to April 2022, Prologis gained approximately 210%. Very few REITs matched that performance. But interest rate hikes slammed Prologis’s stock price from $174 to a low of $98 in mid-October. It recently closed at $113.65.

On October 17, Scotiabank analyst Nicholas Yulico upgraded Prologis from Sector Perform to Sector Outperform but still lowered his price target from $137 to $116. At the time, Prologis was trading around $105. Other analysts have recently reinstated Buy and Overweight ratings on Prologis while projecting target prices as high as $140.

Kite Realty Group Trust KRG is an Indianapolis-based retail REIT with open-air and mixed-use properties from Vermont to California. Its strip malls are mostly grocery store-anchored. Other tenants include CVS Pharmacy Inc., The Fresh Market, Best Buy Co. Inc., Burlington, Ross Stores Inc. and Costco Wholesale.

Kite Realty recently declared a dividend of $0.24 per share, an increase of 9% from the previous quarter. Forward funds from operation (FFO) of $1.89 easily covers the $0.96 annual dividend and presently yields 4.4%.

On Nov. 9, Bank of America Securities analyst Craig Schmidt upgraded Kite Realty Group Trust from Neutral to Buy, while simultaneously raising his price target from $22 to $25. The 52-week range is $16.42 to $23.35, and the most recent closing price was $21.62.

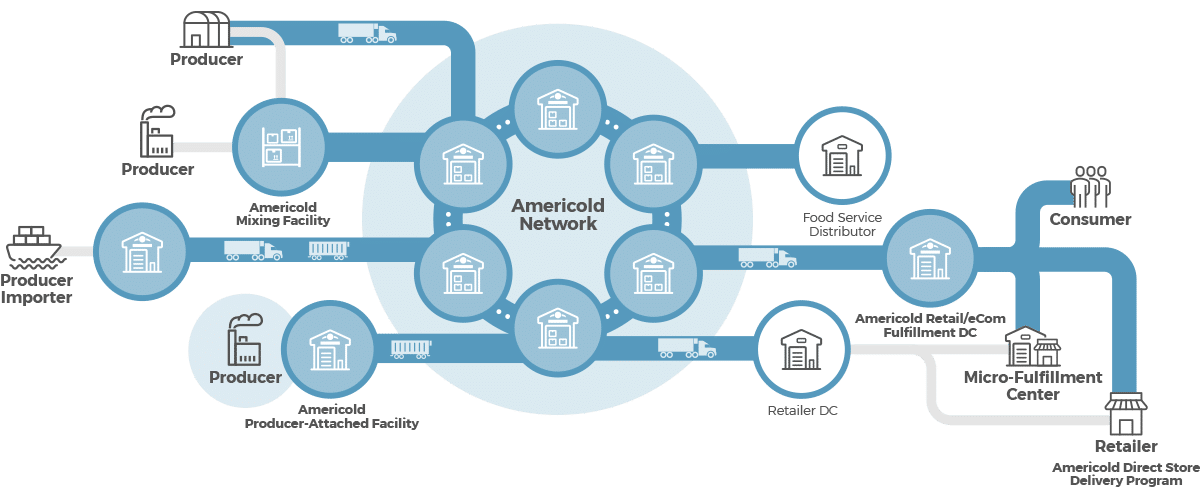

Americold Realty Trust Inc. COLD is a storage REIT that uses advanced technology to cold store food for supermarkets, food producers and international food and beverage organizations. It has 249 locations with different temperature zones. Its motto is, “From farm to fork and every step in between.” Its multifaceted network looks like this:

On Nov. 3, Americold Realty Trust delivered its third-quarter operating results. FFO of $0.29 per share was higher year-over-year and exceeded analysts’ views by $0.04, but the company missed analyst expectations on revenue by 1.3%.

Nevertheless, on Nov. 14, Bank of America Securities analyst Joshua Dennerlein upgraded Americold Realty Trust from Neutral to Buy and raised his price target from $27.50 to $33.50. In June, Dennerlein also upgraded Americold Realty Trust from Underperform to Neutral. No other analyst has upgraded it in 2022.

Americold Realty Trust has a 52-week range of $21.49 to $33.50. Its recent closing price was $28.95. The annual dividend is $0.88, and the current yield is 3.03%. Another positive is dividend growth, as Americold Realty Trust has raised its dividend by 57% over the past five years.

REIT investors will be hoping to see more analyst upgrades reported in the months ahead, especially on companies that can continue improving FFO numbers.

REITs are one of the most misunderstood investment options, making it difficult for investors to spot incredible opportunities until it’s too late. Benzinga’s in-house real estate research team has been working hard to identify the greatest opportunities in today’s market, which you can gain access to for free by signing up for Benzinga’s Weekly REIT Report.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.