Trading below book value and paying a dividend are two key characteristics of a value stock, and these three real estate investment trusts (REITs) qualify: Dynex Capital Inc. DX, Hersha Hospitality Trust HT and RPT Realty RPT may be worth a closer look for investors seeking those qualities.

No guarantees of profitability exist, and value stocks can stay depressed for longer than is pleasant, but with these, you receive a dividend while you wait. The idea, developed by legendary investor Benjamin Graham in his books “The Intelligent Investor” and “Security Analysis”, is that eventually, the market discovers the value.

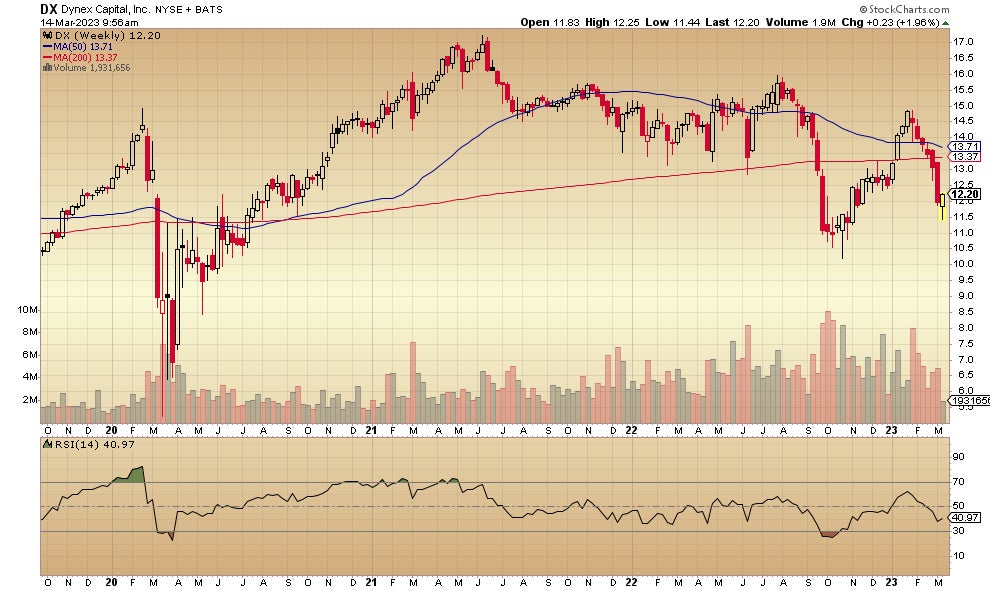

Dynex Capital is a mortgage REIT with a market capitalization of $674 million now trading at a 27% discount to its book value. The company’s price-to-earnings (P/E) ratio is 3.35 with a price-to-free cash-flow metric of 12.49. Over the past five years, funds from operations increased by 18% and last year’s growth came in at 14.2%.

Dynex Capital pays a dividend of 13.03%.

Hersha Hospitality Trust is a hotel and motel real estate investment trust with a market capitalization of $278 million, a relatively low figure for the sector. Shares are available for purchase at just 40% of book value. The REIT is trading with a price-to-earnings ratio of 2.33, one of the lowest P/Es in the group. Funds from operations increased by 284% over the past 12 months and by 27.8% over the past five years.

It’s relatively lightly traded for a New York Stock Exchange (NYSE) security with an average daily volume of 428,000 shares. Hersha Hospitality Trust pays a 2.92% dividend.

RPT is a retail REIT focused on a portfolio of mostly open-air shopping centers around the country. It trades with a price-to-earnings ratio of 10 and at a 7% discount from its book value. Market capitalization is $861 million. The price to free cash flow for the REIT is 12.79.

Funds from operations grew by 19.7% in 2022, and by 2.8% over the past five years. RPT has an average daily trading volume of 463,000 shares, a relatively light figure on the NYSE. The company is paying a dividend of 5.86%.

These real estate investment trusts are subject to interest rate moves made by the Federal Reserve in their efforts to reduce inflation. Investors would be wise to keep an eye on that area of great importance to the sector.

Not investment advice. For educational purposes only.

Weekly REIT Report: REITs are one of the most misunderstood investment options, making it difficult for investors to spot incredible opportunities until it’s too late. Benzinga’s in-house real estate research team has been working hard to identify the greatest opportunities in today’s market, which you can gain access to for free by signing up for Benzinga’s Weekly REIT Report.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.