Zinger Key Points

- Mortgage applications in the U.S. rose 1.9% for the week ending May 17, marking the third consecutive week of growth.

- The increase in applications coincides with a decrease in average mortgage rates, hitting a seven-week low amid lower inflation expectations

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Mortgage applications in the U.S. saw an increase of 1.9% for the week ending May 17, continuing an upward trend following a 0.5% rise the previous week. This marks the third consecutive week of growth in mortgage demand, according to data released Wednesday from the Mortgage Bankers Association (MBA).

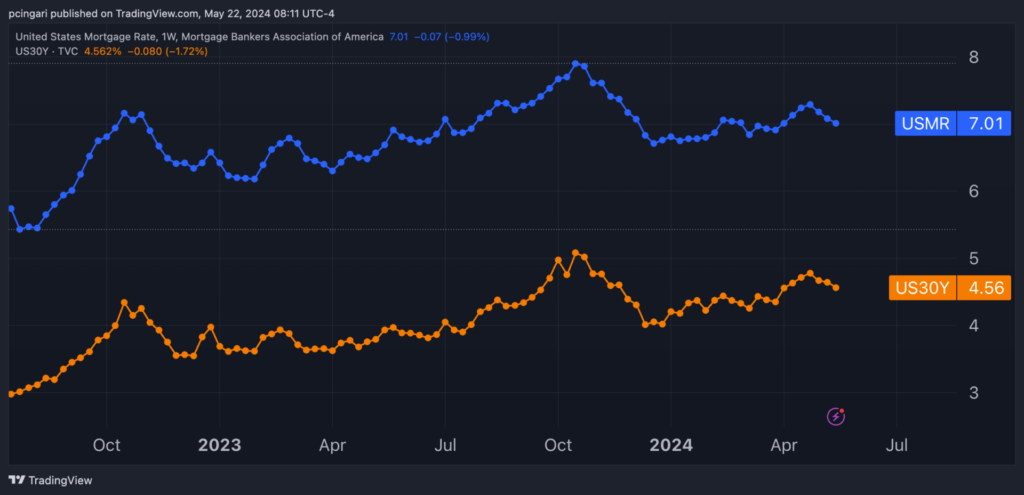

The rise in applications aligns with a decrease in average mortgage rates, which reached a seven-week low due to expectations of lower inflation reducing long-dated Treasury yields.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased by 7 basis points to 7.01% during the week ending May 17, MBA data indicated. This decline, the third in a row, brought mortgage rates to their lowest level in over a month.

The yield on a 30-year Treasury bond, a critical indicator for mortgage rates, dropped by 8 basis points to 4.55% last week, following an inflation report for April that met expectations.

Refinancing applications, which are highly sensitive to changes in interest rates, surged by 7%, building on a 5% increase the previous week. This significant rise in refinancing applications compensated for a 1% decline in mortgage applications for home purchases, reflecting ongoing challenges such as limited housing supply and intense market competition.

Chart: 30-Year Mortgage Rates Slow In Tandem With 30-Year Treasury Yields

Mortgage-Linked Stocks On The Rise

The uptick in mortgage activity and the ease in mortgage rates have positively impacted stocks of mortgage-sensitive real estate firms in recent weeks.

The iShares Mortgage Real Estate ETF REM is currently experiencing a five-week winning streak, its longest since January 2023.

Among the top-performing mortgage Real Estate Investment Trusts (REITs) over the past month are TPG RE Finance Trust, Inc. TRTX, Redwood Trust, Inc. RWT, Invesco Mortgage Capital Inc. IVR, and Arbor Realty Trust, Inc. ABR, with gains ranging from 12% to 16%.

Read now: AMC Bonds Hold Gains After Meme Stock Selloff: Is It A Better Bet Than Buying Shares?

Image generated using artificial intelligence via Midjourney.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.