Zinger Key Points

- Academic study raises alarms over unusual stock trading activities in Israeli ETFs and companies before October 7th terrorist incident.

- As the date of the Hamas attack approached, a significant divergence in trading trends on Israeli stocks and options became evident.

- Get 5 stock picks identified before their biggest breakouts, identified by the same system that spotted Insmed, Sprouts, and Uber before their 20%+ gains.

An academic study by New York University’s Robert J. Jackson, Jr. and Columbia University’s Joshua Mitts published on Dec. 4 uncovers a troubling pattern in the financial markets: traders potentially capitalizing on foreknowledge of terrorist attacks.

The study meticulously documents unusual trading patterns in Israeli company stocks and ETFs before the Hamas attack on Oct. 7, 2023, raising serious ethical and legal concerns.

Unprecedented Short Selling Activity In Israel-Linked Stock ETF

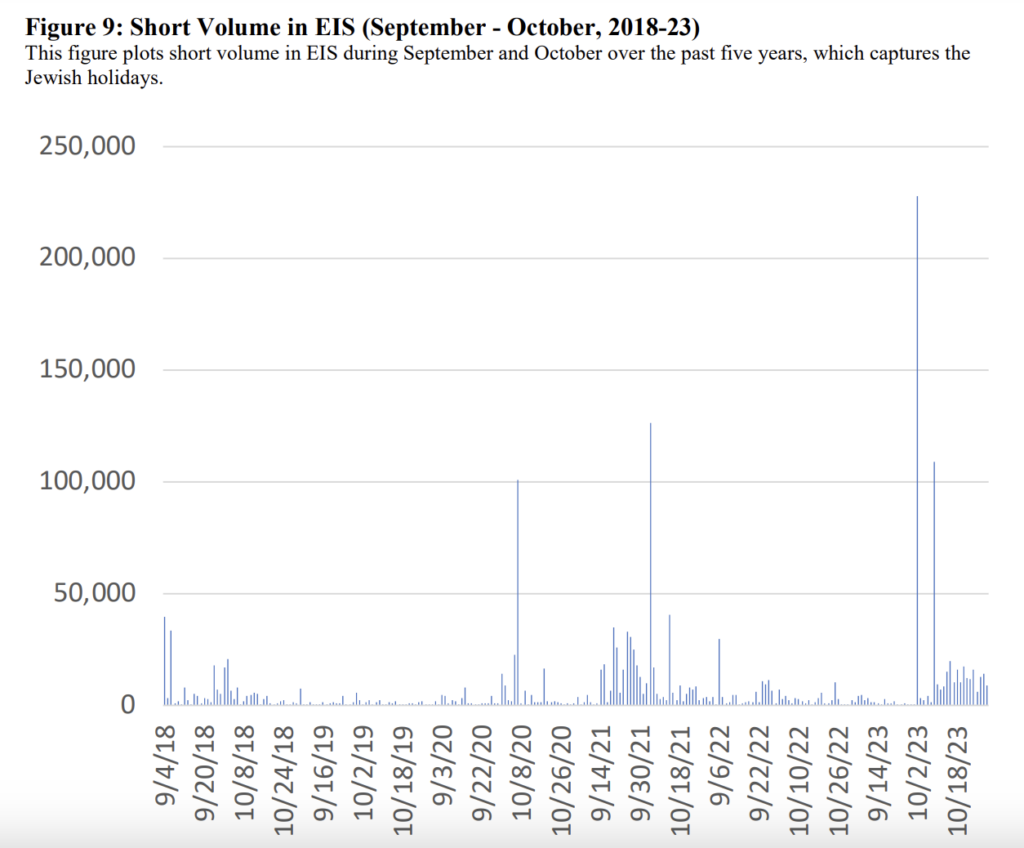

Researchers revealed that the iShares MSCI Israel ETF EIS witnessed a significant and atypical surge in short selling just five days prior to the Oct. 7 attack.

This phenomenon was not just statistically unusual but also economically significant, with nearly all off-exchange trading volume on Oct. 2 reported to FINRA consisting of short selling, as the study showed.

Jackson, Jr., Robert J. and Mitts, Joshua, Trading on Terror? (December 3, 2023). Available at SSRN: https://ssrn.com/abstract=4652027

Rise In Short Interest On Domestic-Traded Israeli Stocks, Sharp Increase In Put Options

The study also found that a significant rise in short interest was observed in the Tel Aviv Stock Exchange (TASE) right before the attack. However, the trend was not mirrored in Israeli companies on U.S. exchanges.

In a specific case, Bank Leumi BLMIF experienced substantial short selling activity, where 4.43 million new shares were sold short from Sept. 14 to Oct. 5. This trading activity led to profits or potential avoided losses estimated at 30 million NIS, highlighting just one instance among hundreds of securities traded on the TASE.

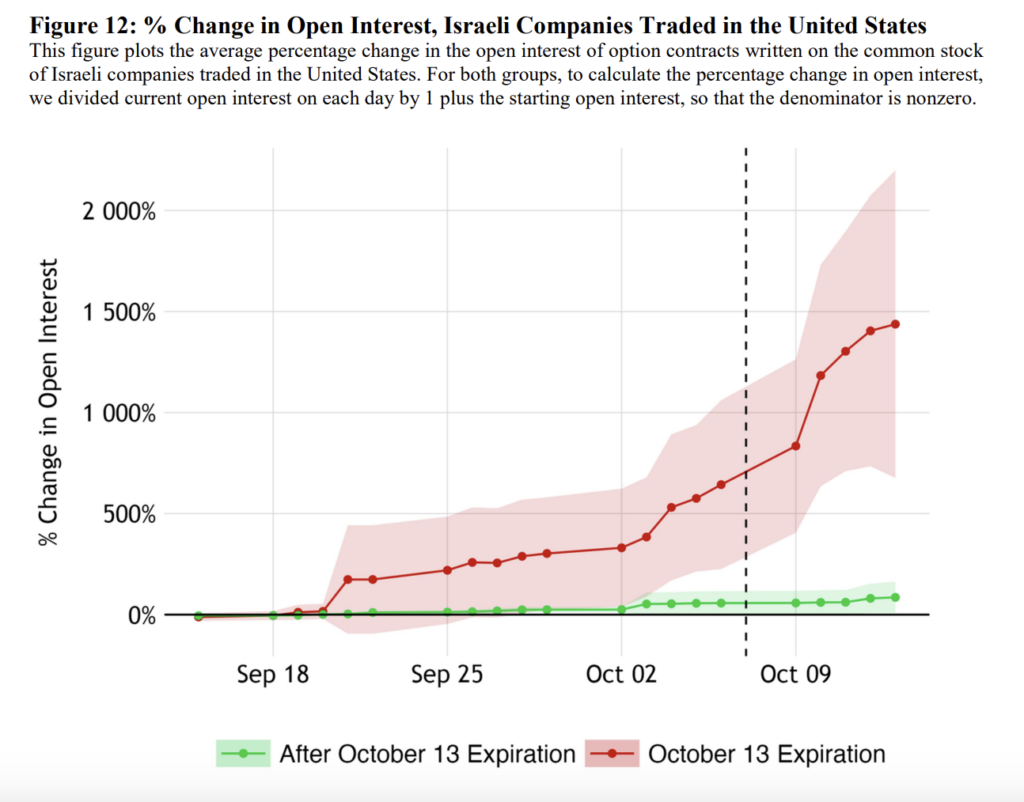

The researchers also point out a substantial increase in open interest for risky short-dated options contracts on Israeli firms traded on U.S. exchanges. Due to the nature of the option trading, these type of products were most likely to yield a profit immediately after Hamas’ attacks on Oct. 7, 2023.

The study contrasts two sets of options on Israeli stocks: one set expiring on Oct. 13 and the other expiring after that date. Initially, both groups displayed similar levels of open interest in early September. However, as the date of the Hamas attack approached, a significant divergence in the trends became evident.

Specifically, the open interest for options expiring on Oct. 13 skyrocketed, showing an increase of over 500% before the attacks.

Implications And Recommendations From The Authors

Should society incentivize disclosure of such critical information to prevent tragedy? The authors propose replacing trading profits with different rewards for traders who report such information to authorities.

The study not only calls for a stringent review of market regulations and ethical standards to prevent the exploitation of sensitive information for financial gain, especially when it concerns matters of national security and human life. But it’s also a wake-up call to address a potentially dangerous loophole in the intersection of finance and global security.

Now Read: Gold’s Record High: Why Haven’t Gold Miners Followed Suit?

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.