The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

The real estate industry has been one of the slowest adopters of technology, while other industries in the financial world have been embracing it to provide more opportunities and help investors make smarter decisions.

Real estate is making strides in its efforts to catch up to the rest of the financial world, according to a report released today by Jones Lang LaSalle Inc. JLL,

What The Report Shows: The first half of 2021 has seen over $9.7 billion in funding activity for property technology (proptech) startups, the most active first half on record.

The market is also showing signs of maturation as funding begins to shift toward more established companies and industry leaders emerge as consolidation increases.

The number of startups across the real estate industry has grown rapidly in the last decade, from under 2,000 to nearly 8,000, as companies look to apply new technologies like computing power, analysis and connectivity.

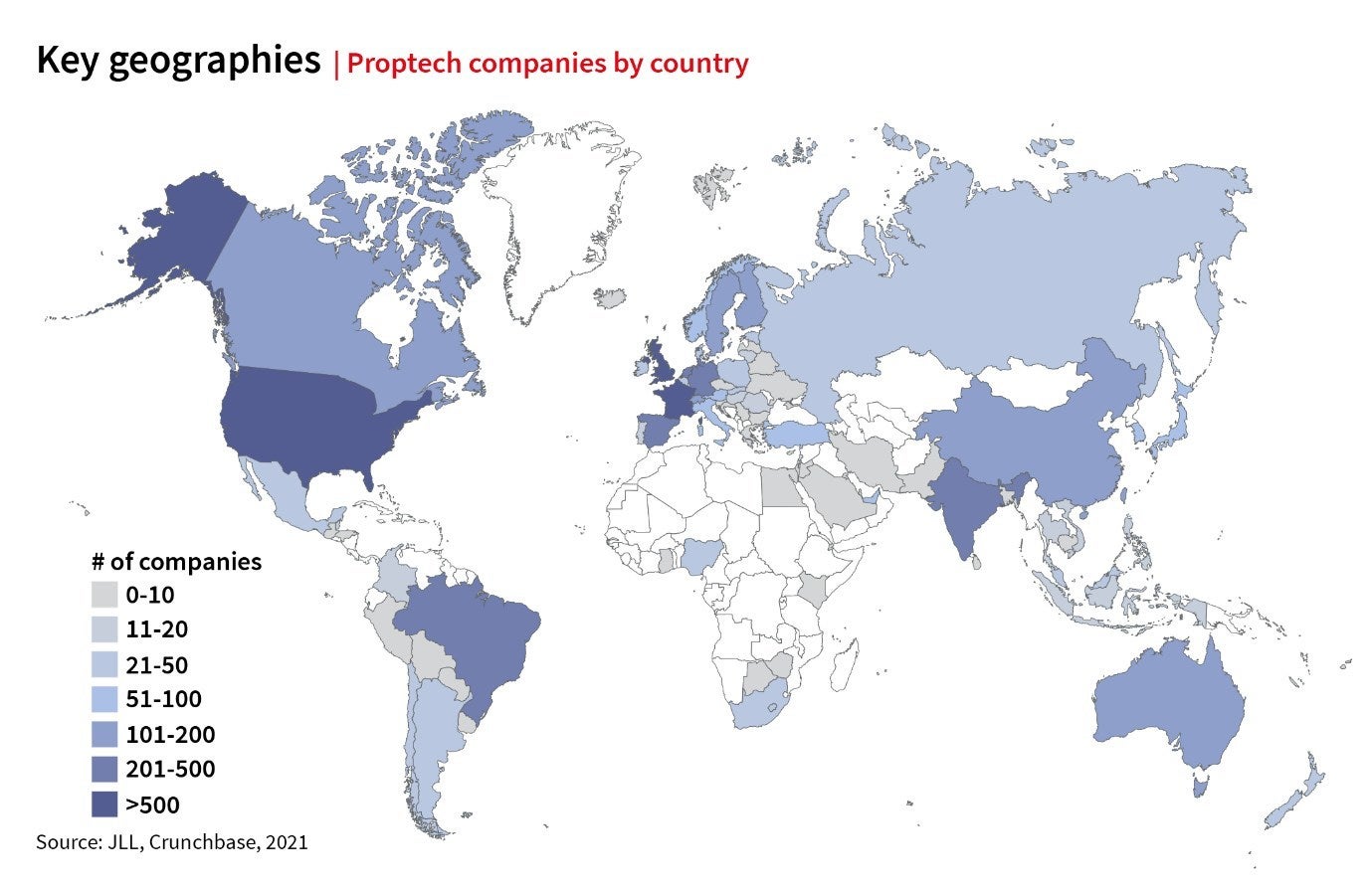

While real estate technology companies can be found in most countries around the world, the U.S. continues to account for the most company conceptions and fundraising. Other countries with considerable growth in proptech include Brazil, China, India, the U.K. and Germany.

Proptech companies are applying technology across many aspects of the real estate industry, including:

- Acquisitions and dispositions

- Portfolio management

- Design and construction

- Finance and valuation

- Leasing and marketing

- Urban governance and planning

- Sustainable buildings

- Workplaces of the future

JLL On The Rise of Proptech: "While real estate technology adoption was on the rise before the COVID-19 pandemic, it has become essential for today's leading real estate players, buildings and spaces," said Ben Breslau, chief research officer at JLL.

"Technology is at the center of the most important trends shaping business and real estate. That includes hybrid work, health and safety, and sustainability initiatives, all of which are in high demand. That's why we expect funding within this sector to break records this year."

Challenges, Opportunities In Proptech:

Companies have been using COVID-19 as an opportunity to experiment and accelerate technology adoption across the real estate industry, with potential to make buildings more sustainable, healthier and more human-centric.

A recent survey conducted by JLL found that the top priorities among leading global occupiers and investors are to create places that are human and green. The largest focus is on decarbonization, which real estate investors believe can deliver value and a competitive advantage.

However, a range of issues are slowing progress, including a fragmented technology landscape, lack of industry standards and privacy and security needs among the top issues slowing progress in creating green and sustainable buildings.

Notable Proptech Companies: According to Crunchbase, these companies have raised the most funds in the proptech space so far in 2021.

- Service Titan: $500 million raised

- Loft: $425 million raised

- Procore Technologies, Inc. PCOR: $635 million raised through IPO in May 2021.

- SmartRent, Inc. SMRT completed its business combination with Fifth Wall Acquisition Corp FWAA to go public.

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.