Marriott International Inc MAR stock made new all-time highs on Jan. 8 as it closed above $228, up 2.6% for the day.

The high-end of the 52-week range for the stock now stands at $228.29. The hospitality sector firm known for its hotels, resorts, and lodging facilities has been buoyed through 2023 by post-covid tailwinds.

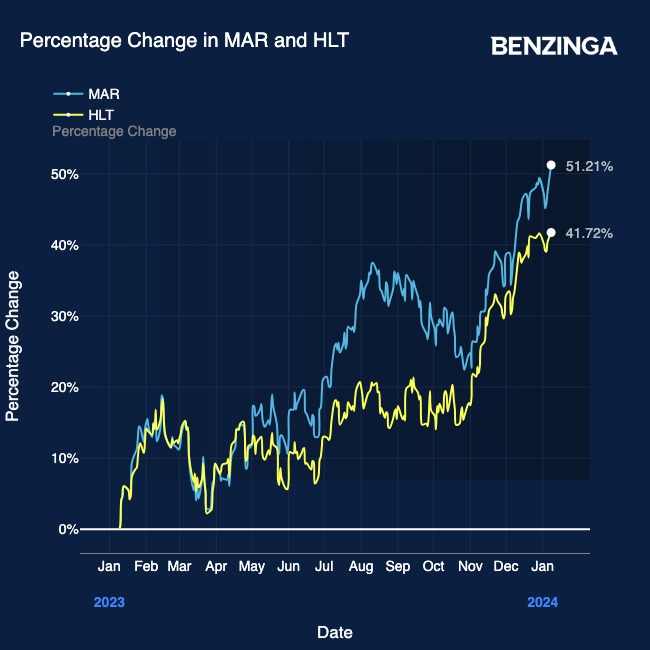

Pent-up demand for tourism steered the stock up over 50% over the past year, surpassing its peer Hilton Worldwide Holdings Inc HLT and the S&P 500.

For the past year, Marriott International’s stock has been fueled by:

- Pent-up post-covid demand helping the top line.

- Operational excellence protecting the bottom line of the business.

Marriott’s business fundamentals remain solid. The company has maintained impeccable top-line growth amid its sustained expansion. Marriott also has adequate liquidity to cover its operations and dividends while increasing its operating capacity.

Also Read: Hotel Brand Marriott Tightens Annual EPS Forecast; Records 12% Topline Growth In Q3

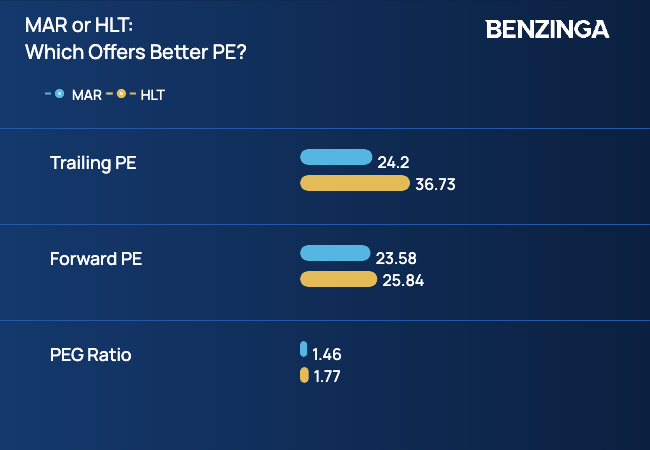

On the valuation front, Marriott International stock currently offers better value relative to its close competitor, Hilton Worldwide Holdings. On a forward P/E basis, the difference gets marginal.

However, analyst consensus on the stock does not indicate an upside from here. Jefferies analyst David Katz, who recently rated the stock on Jan. 2 maintained a Hold rating with a price target of $227.

Consensus Wall Street analyst ratings indicate an average price target of $213.84, 6.31% below the new all-time-high level the stock just made.

Could it be time to take profits off the table?

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.