Zinger Key Points

- Carvana was nearly left for dead by investors with concerns of bankruptcy over the last two years.

- Shares are up over 200% in 2024 and even more from lows under $5 in early 2023.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

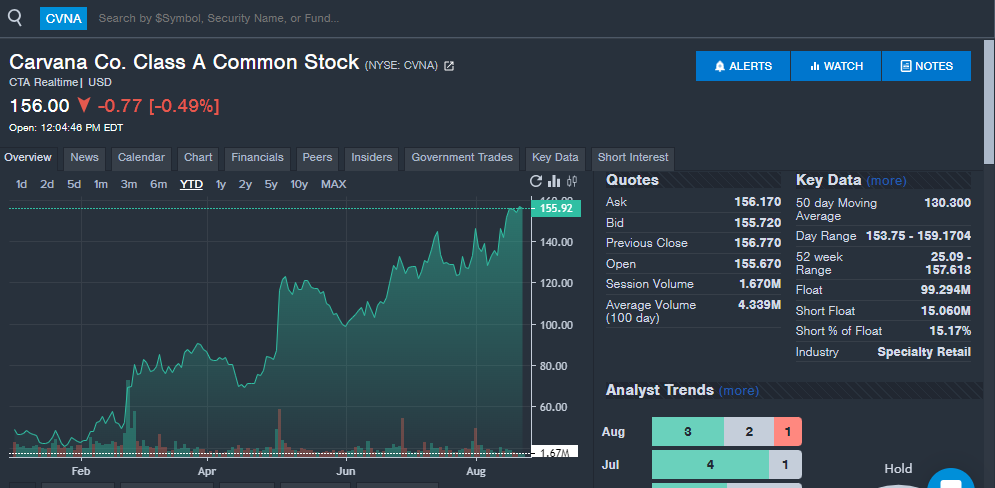

Online used car retailer Carvana Co CVNA has been one of the top performing stocks in 2024 with shares up 217% year-to-date and new 52-week highs hit after second-quarter financial results.

The company was nearly left for dead by investors over the last two years before taking on a strategic turnaround that has rewarded patient or timely investors.

What Happened: Carvana reported second-quarter revenue of $3.41 billion and earnings of 14 cents per share, with both figures beating estimates from analysts and leading to price targets being hiked.

In fact, analysts were expecting the company to report a loss of 12 cents per share in the second quarter. The online used car retailer has now beaten analysts estimates for earnings in five of the last six quarters and revenue in four of the last six quarters according to data from Benzinga Pro.

Carvana sold 101,440 vehicles in the first quarter, up 33% year-over-year.

"We not only led the industry in retail unit growth, which accelerated from Q1, but also delivered 1.4% Net Income margin and a new record 10.4% Adjusted EBITDA margin, which sets an all-time high-water mark for public automotive retailers," Carvana CEO Ernie Garcia said of second-quarter results.

The results from Carvana continue the acceleration in financials and a turnaround for a company once thought to be going bankrupt. A look at the Benzinga Pro chart below shows the year-to-date performance.

Shares of Carvana traded under $10 in May 2023 and under $5 in January 2023. The company faced investor concerns about potential bankruptcy in 2022 and 2023 due to its debt obligations.

Some investors recognized a potential turnaround and others saw a potential short squeeze with a high level of shares shorted due to the bankruptcy concerns.

The company restructured operations and debt and took on the task of turning things around.

Management called 2023 an "exceptional year for Carvana."

"Our deliberate focus on efficiency and profitability drove fundamental business improvements that not only led to our best-ever financial results but also increased customer NPS throughout the year," Garcia said after fourth-quarter results.

Garcia said the company had a clear path to its goals of "becoming the largest and most profitable automotive retailer."

Fast forward to the second-quarter results and shares at 52-week highs and Garcia appears to have delivered on many of the company goals.

Read Also: Carvana Is A ‘Secular Growth Story With A Cyclical Recovery Kicker,’ Says Bullish Analyst

What's Next: Carvana expects full-year 2024 adjusted EBITDA of $1 billion to $1.2 billion, up from $339 million in fiscal year 2023.

"We couldn't be prouder of our team and remain just as ambitious looking forward as we tackle the many opportunities to make our business and customer offering even better as we drive toward buying and selling millions of cars per year," Garcia said in the second-quarter earnings report.

Piper Sandler analyst Alexander Potter raised the price target from $105 to $151 and said that the first and second quarters could prove that profitability gains "are here to stay."

The last two quarters of 2024 could be important for the company to continue to show signs of profitability and continuing the turnaround plan while also growing through new retail locations.

Needham analyst Chris Pierce said the next leg of company growth could be showing that it can create profitable unit growth. The analyst raised the price target from $160 to $200. Potter said Carvana is uniquely positioned in the sector with "physical and technology moats" that can provide share gains.

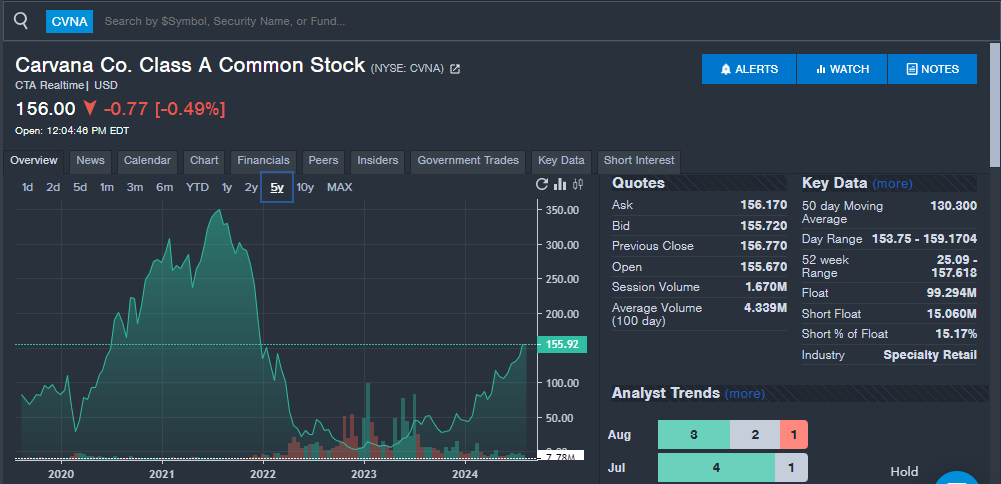

Carvana shares hit highs of more than $300 in 2021, as seen on the Benzinga Pro chart below. Investors would love for the continued turnaround to send shares back to these all-time highs.

Carvana shares are up 95% over the last five years.

CVNA Price Action: Carvana shares trade at $155.96 versus a 52-week trading range of $25.09 to $159.12.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.