Zinger Key Points

- The Benzinga Stock Whisper Index highlights five stocks each week seeing an increase in interest from readers.

- Interest rate cuts and a Chinese stimulus are among the trends that boosted interest in stocks on this week's list.

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here's a look at the Benzinga Stock Whisper Index for the week of Sept. 27:

Monolithic Power Systems MPWR: A chipmaker specializing in power management systems saw shares trade higher on the week and interest increase after a raised price target from Stifel.

The analyst maintained a Buy rating and raised the price target from $1,000 to $1,100.

Monolithic reported second-quarter financial results in August. In the second quarter, revenue was up 15.0% year-over-year to $507.4 million. CEO Michael Hsing highlighted that the results showed the company's transformation from being just a chip supplier "to a full solutions provider."

Monolithic shares were up 3.3% over the last five trading days, as seen on the Benzinga Pro chart below, and are up 53.5% year-to-date in 2024.

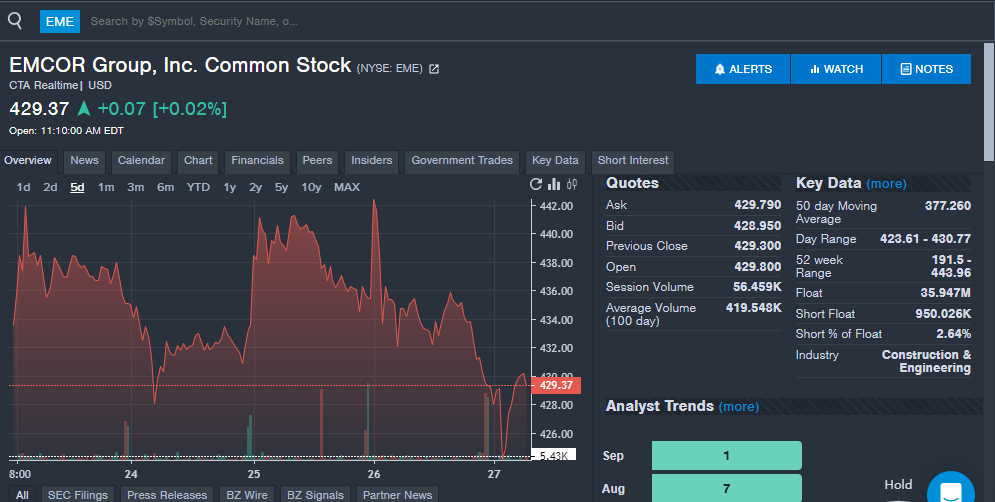

EMCOR Group EME: The electrical and manufacturing construction and facilities services provider gained interest from readers over the week, which could be related to upcoming earnings or the recent Fed rate cut.

The company is set to report third-quarter financial results in October. Analysts expect the company to report revenue of $3.77 billion and earnings per share of $4.98, up from $3.21 billion and $3.61, respectively, in last year's third quarter.

EMCOR Group has beaten analyst revenue estimates in 16 straight quarters and earnings per share estimates in nine straight quarters. The recent interest rate cut could prove beneficial to the company as this could lead to increased spending by the private sector.

EMCOR shares were down 2% over the last five trading days, but remain up over 50% year-to-date.

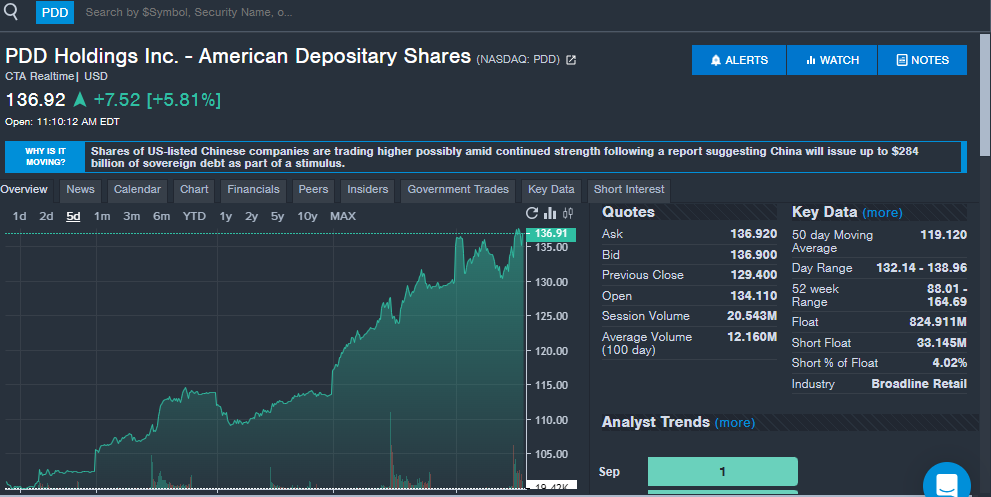

PDD Holdings Inc – ADR PDD: The Chinese commerce company was one of several to enjoy a boost with the country announcing a monetary stimulus to residents.

Of the Chinese stocks, PDD Holdings saw the largest increase in interest from Benzinga readers over the last week.

The owner of several commerce platforms in China and Temu in the U.S. could benefit from the stimulus and increased spending in China as it also looks to grow in other international markets.

PDD Holdings shares are up 35% over the last five days, but remain down on a year-to-date basis.

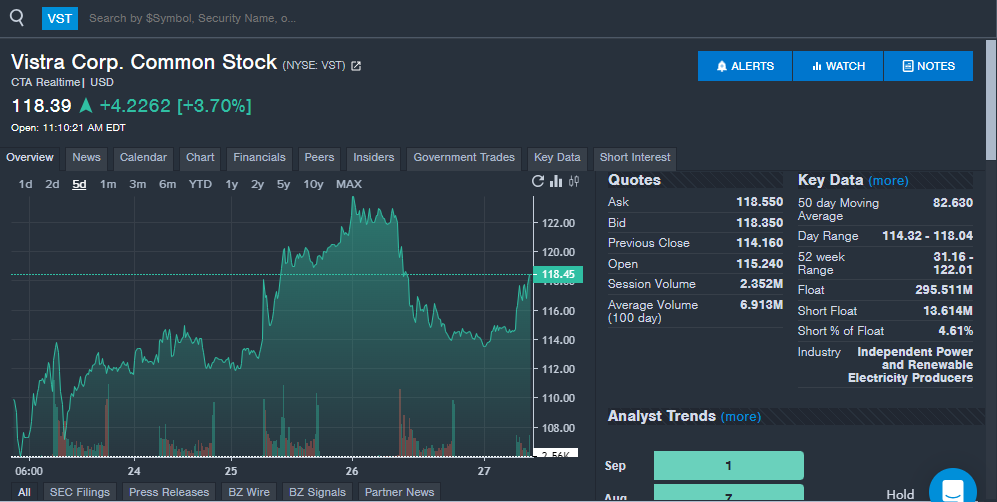

Vistra Corp VST: Vistra was one of several energy related companies to see a lift in share price and interest related to a large deal between Constellation Energy and Microsoft. The energy sector, especially companies with exposure to nuclear energy, are seeing rising interest thanks to the growing demand for data centers and AI infrastructure. Vistra has been getting increased attention from analysts in September.

Jefferies initiated coverage of the stock with a Buy rating and $99 price target, only to raise its price target to $137 several weeks later. BMO maintained an Outperform rating and raised the price target from $120 to $125. Morgan Stanley maintained an Overweight rating and raised the price target from $110 to $132.

Vistra stock was up 8% over the last week. With a year-to-date gain of over 209%, Vistra is one of the best-performing stocks in 2024.

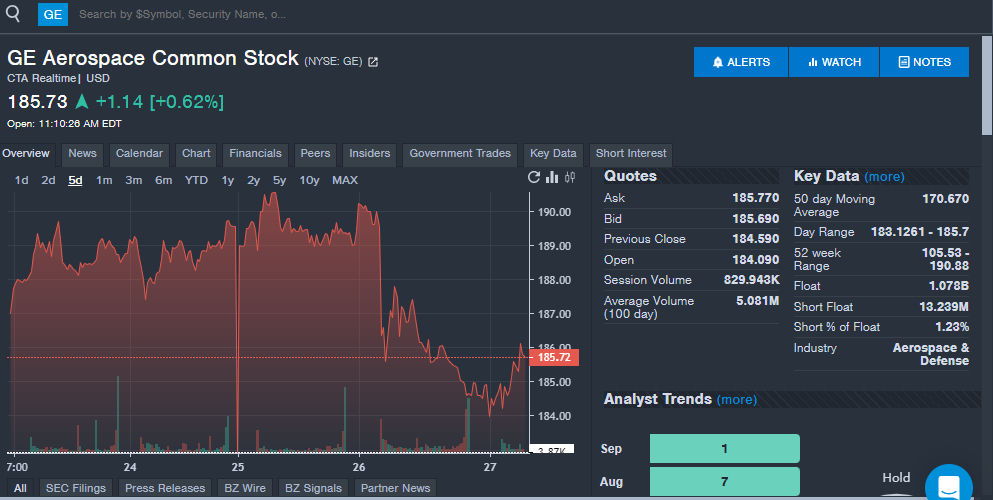

GE Aerospace GE: The aerospace giant saw increased interest from readers during the week as shares trade near 52-week highs. The company announced the launch of AI Wingmate in collaboration with Microsoft during the week, an initiative that could boost employee productivity.

"The launch of AI Wingmate will transform employee productivity, allowing our people to spend more time solving our customers' toughest problems," GE Aerospace Chief Information Officer David Burns said.

GE Aerospace previously appeared on the Stock Whisper Index thanks to increased interest in the defense sector ahead of the 2024 presidential election. Freedom Capital Markets Chief Global Strategist Jay Woods previously told Benzinga the defense stock could be a winner whether its Donald Trump or Vice President Kamala Harris that wins the election.

The aerospace company is set to report third-quarter financial results in October. The company has beaten revenue estimates from analysts in 10 straight quarters and beaten earnings per share estimates from analysts in seven straight quarters.

GE Aerospace shares are up over 80% year-to-date in 2024, with the chart below showing the dip on the week.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.