Zinger Key Points

- The Benzinga Stock Whisper Index looks at five stocks seeing increased interest from readers during the week.

- October earnings season has several stocks seeing increased interest ahead of quarterly financial results.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here's a look at the Benzinga Stock Whisper Index for the week of Oct. 11:

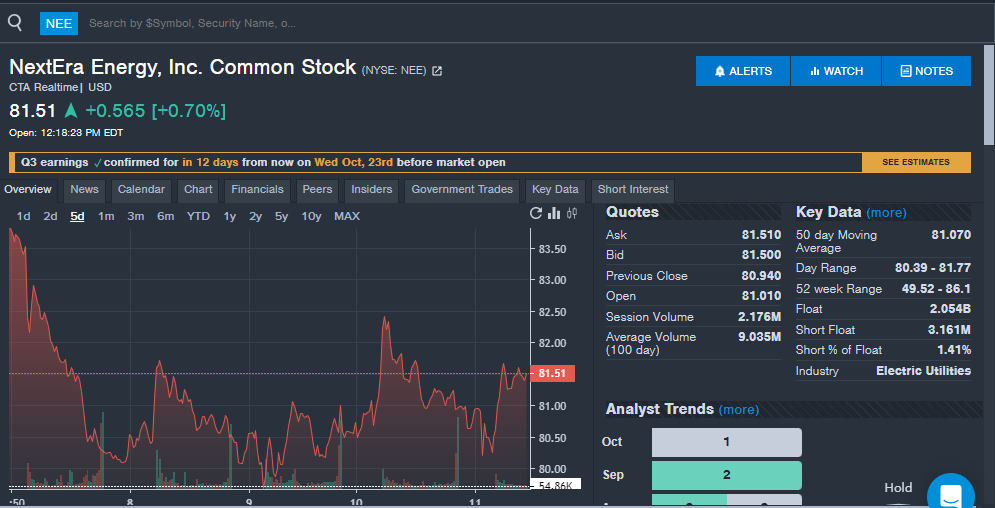

NextEra Energy NEE: The utility company saw headlines during the week related to Hurricane Milton and power outages in the state of Florida, which likely increased interest from Benzinga readers.

The company owns Florida Power & Light, which has more than six million customers in Florida. A report said over 900,000 lost power after Hurricane Milton struck the state. While the power outages could have a short-term negative impact on the company, NextEra is also the owner of a renewable energy segment and should be able to recover from the hurricane impact over the long term.

The company is set to report third-quarter financial results on Oct. 23, which could provide more commentary on the storm's impact. The company has beaten analyst estimates for earnings per share in nine of the past 10 quarters and beaten revenue estimates in six of the past 10 quarters.

Shares were slightly up the past week, as seen on the Benzinga Pro chart below, and are up over 30% year-to-date in 2024.

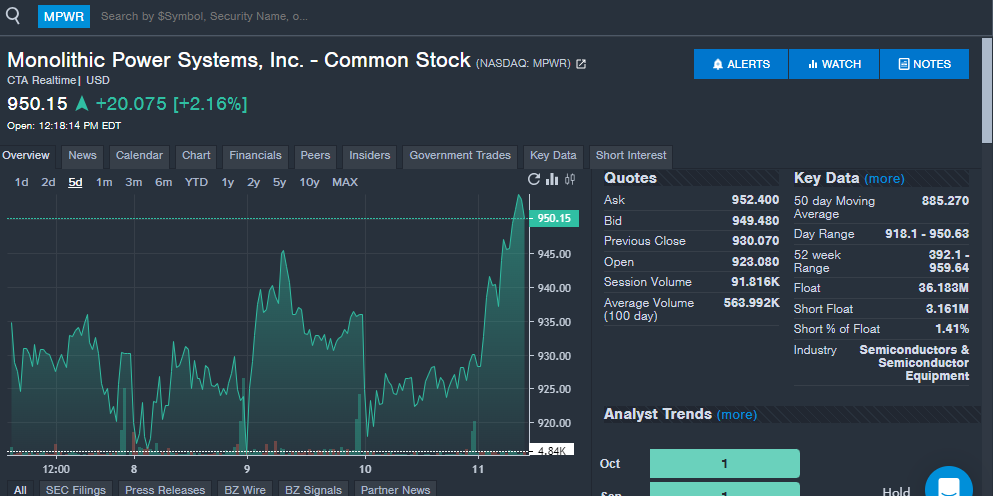

Monolithic Power Systems Inc MPWR: A chipmaker specializing in power management systems, Monolithic Power Systems continues to see elevated interest from Benzinga readers.

The company appeared on the Stock Whisper Index two weeks ago after Stifel increased its price target from $1,000 to $1,100 while maintaining a Buy rating.

The company is expected to report third-quarter financial results in October. The chipmaker has beaten analyst estimates for earnings per share in more than 10 straight quarters and beaten revenue estimates from analysts in six straight quarters. A strong earnings report could send shares higher.

Monolithic shares were up more than 2% on the week and are up over 57% year-to-date in 2024.

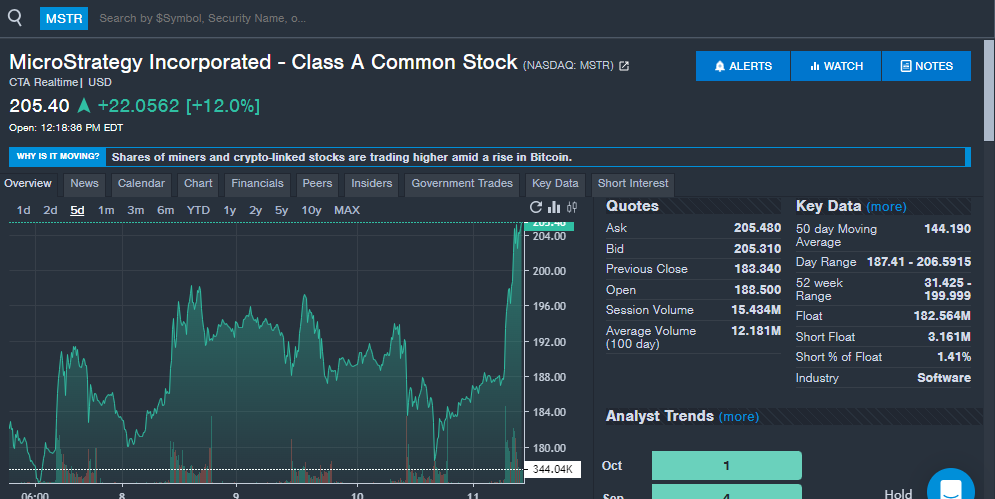

MicroStrategy Inc MSTR: The software company and Bitcoin BTC/USD owner is no stranger to the Stock Whisper Index, making frequent appearances on the list thanks to growing interest in cryptocurrency and the company's strategy of buying Bitcoin with cash and by raising funds.

The company recently announced the newest release of MicroStrategy ONE, which includes integrations with Microsoft Teams and has new features for its AI bot. While many know the company as a major Bitcoin owner, MicroStrategy's software segment helps bring in cash flow to fuel the Bitcoin purchases.

MicroStrategy recently announced it bought $1.1 billion worth of Bitcoin bringing its total up to 244,800 Bitcoin. The company recently raised over $800 million to redeem $500 million in senior secured notes and to buy additional Bitcoin.

MicroStrategy began buying Bitcoin in August 2020 and will continue to add more Bitcoin, as co-founder and Executive Chairman Michael Saylor previously told Benzinga.

“We have a simple strategy and our strategy is we just acquire Bitcoin, and we hold the Bitcoin,” Saylor told Benzinga.

New leveraged and inverse ETFs targeting MicroStrategy also recently launched, which could increase interest in the company.

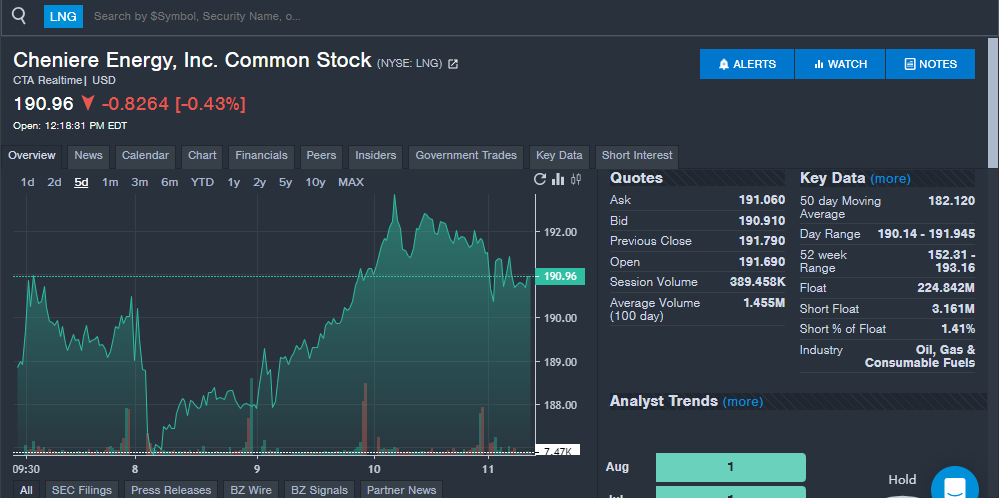

Cheniere Energy LNG: The natural gas company saw increased interest from Benzinga readers over the trading week. The surge in interest could be related to natural gas being volatile related to increased tension in the Middle East.

Cheniere Energy will report third-quarter financial results on Oct. 31. The company has beaten analyst estimates for earnings per share in six of the past seven quarters and beaten revenue estimates from analysts in eight of the past 10 quarters.

Cheniere shares have traded near 52-week highs, as seen on the chart below. The stock is up 13% year-to-date.

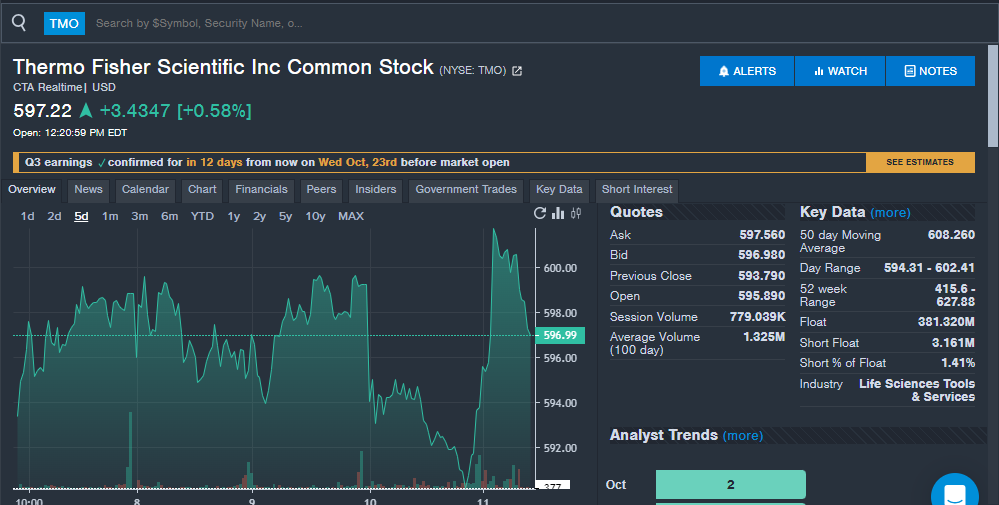

Thermo Fisher Scientific TMO: The scientific instruments and life sciences company saw a surge in interest from readers during the week.

The increased attention could be related to Stephens initiating coverage on the stock with an Overweight rating and $680 price target. The analyst sees the company benefiting from contract services and the surging demand for GLP-1 weight loss drugs.

Stephens also highlighted the company's disciplined M&A strategy to help with long-term growth. Evercore ISI Group also recently raised the price target on the stock from $605 to $630 while maintaining an Outperform rating.

The company is set to report third-quarter financial results on Oct. 23. Thermo Fisher has beaten analyst estimates for earnings per share in seven of the past 10 quarters and beaten revenue estimates from analysts in seven of the past 10 quarters.

Thermo Fisher shares are up 0.5% over the past five days and up around 10% year-to-date in 2024.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.