The following originally appeared on finbox.io

Coach's Acquisition Spree

Coach Inc COH is a luxury lifestyle brand which has been on an acquisition spree with the aim of converting itself into an American version of European luxury conglomerate LVMH Moet Hennessy Louis VuittonLVMHF.

Its aim at this reinvention as a multi-brand company received a boost when it was able to reach a deal to acquire Kate Spade & Co. KATE for around $2.38 billion. The Kate Spade brand adds a fashion house that designs and markets a range of women's and men's apparel, handbags, accessories, and fragrance products. Coach expects that this acquisition will help the company save around $50 million in synergies over the next three years. These savings will be driven by inventory management, supply chain efficiencies, and improved scale.

The company also acquired the luxury shoe brand Stuart Weitzman for $574 million in 2015. Coach was also rumored to have considered buying Jimmy Choo in a billion dollar deal. These rumors have been put to rest in the wake of the Kate Spade buyout, however, Coach has the financial arsenal to pursue this acquisition in the future. Although Kate Spade is its biggest deal to date, it had also tried to unsuccessfully merge itself with Burberry, the iconic British fashion powerhouse. The discussions which took place in 2016 would have created a 20 billion dollar fashion giant. Ultimately, talks ended with Burberry rejecting its offers.

But after instating Joshua Schulman earlier this year in a newly formed position as leader of the Coach brand, it is safe to say that the company will likely remain active on the M&A front for the foreseeable future.

Market Gives Thumbs Up To The Deal

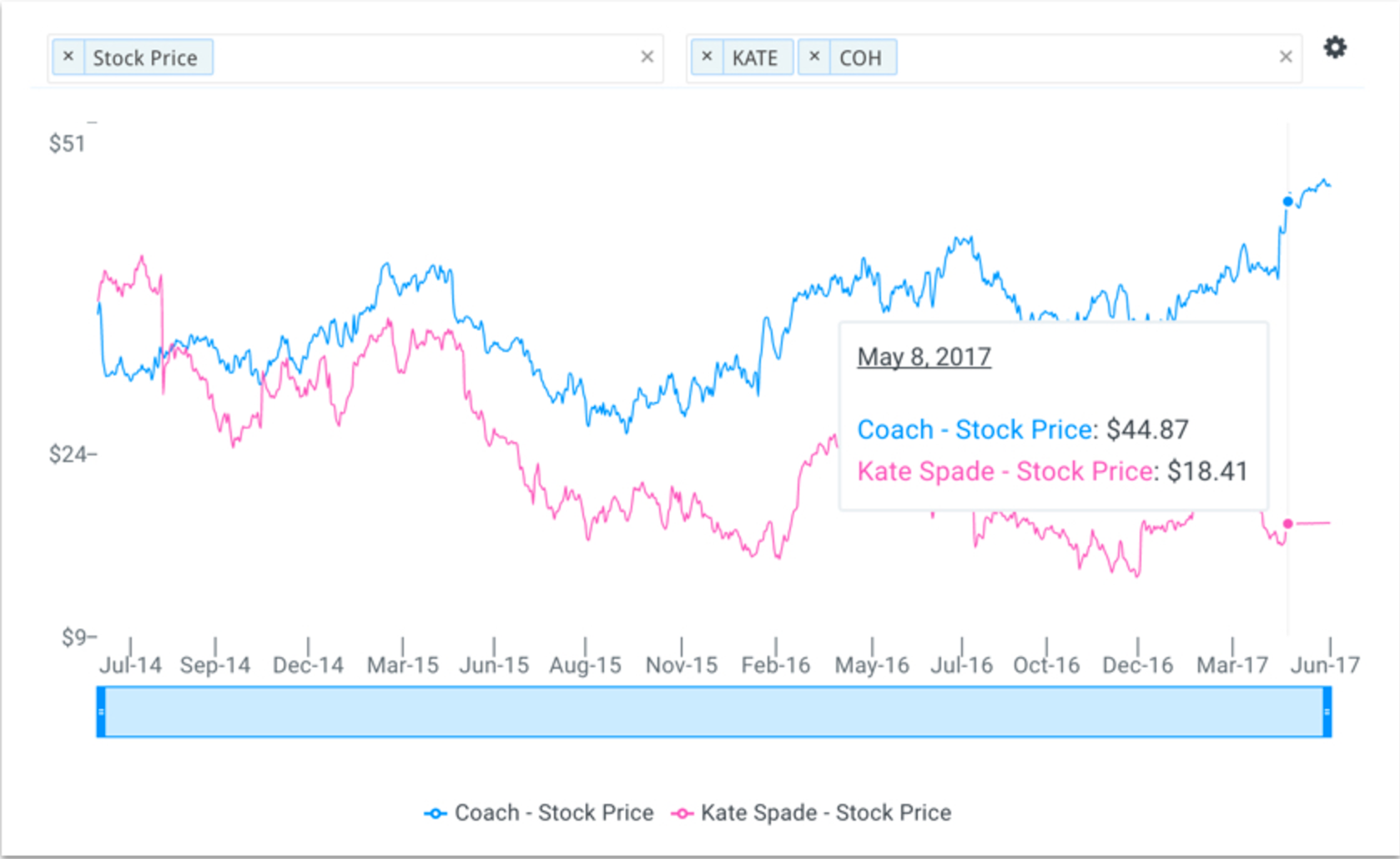

Shares of Coach are currently trading around $46.00 per share which is near the highest level observed over the last year. The stock jumped over 15% since news of the Kate Spade deal were rumored. Overall, Wall Street analysts praised the deal, both in terms of the premium paid for the brand and the brand fit in the overall portfolio.

Acquisitions Stimulate Growth Tailwinds

As a result of the Coach's recent acquisitive nature, analysts believe that the company will grow at a faster pace over the next five years than its competition: Michael Kors Holdings Ltd KORS, Tiffany & Co. TIF, Ralph Lauren Corp RL and American Eagle Outfitters AEO.

Coach’s projected 5-year CAGR for revenue and net income of 7.4% and 16.3%, respectively, is well above the entire peer group. Wall Street clearly has high hopes for the company’s ability to increase its revenue base and expand margins by streamlining operations of its portfolio brands.

Coach’s Multi-Brand Play And Its PE Ratio Impact

Coach currently trades at 24.9x LTM earnings as compared to under 10.0x for Michael Kors. This reflects how bullish the market sentiment is for Coach and its growth prospects via acquisitions going forward. However, Tiffany trades at 25.3x earnings with mediocre growth prospects demonstrating that investors are willing to pay a premium for a luxury brand that is growing and well run.

Coach’s LTM PE ratio has traded at 18.7x on average over the last five years which is well below its current multiple. However, the premium that the market has built into Coach’s multiple is likely the result of the Kate Spade buyout in addition to potentially acquiring other iconic brands in the future. A multi-brand company will also make LVMH a better comparison which trades at 28.3x earnings. So at 24.9x earnings, Coach may not be considered a cheap stock but it is also not an expensive stock relative to LVMH.

A Multi-Brand Company Offers Nice Upside

As an investor, the consolidation approach being pursued by Coach can be extremely lucrative. The opportunity for cost savings is significant as duplication of procurement and other operational and corporate expenses are phased out. These savings directly flow to the bottom line making the case for buying Coach even more compelling.

Furthermore, excluding these cost savings and simply selecting a multiple of 26.8x (the average multiple of LVMH and Tiffany) to capitalize Coach’s current earnings implies a fair value of nearly $50 per share. This represents that the stock still has over 10% upside on a relative basis.

The Future Looks Bright

Coach is an iconic brand but its vision to manifest itself into a luxury powerhouse with multiple brands will give it a platform to cut costs, drive better deals with marketers and push cross-pollination of brands online. Kate Spade offers a new avenue for reaching millennials while Coach’s luxury brand is a natural progression as this group grows older and wealthier.

CEO Victor Luis has made it clear since taking over in 2014 that the leathered goods maker (traditionally) plans to be acquisitive while it transforms itself into a multi-brand portfolio company. The new executives hired in April will help stimulate this push forward as another billion dollar acquisition is likely on the horizon. Shareholders should also expect continued expansion of Coach’s valuation multiples as the company’s portfolio grows. When all said and done, the stock may end up being considered a bargain at its current price.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.