By RoboForex Analytical Department

The EUR/USD currency pair remains steadfast near 1.0710 on Tuesday, maintaining proximity to the six-week highs set the previous day.

The USD has seen a tempered performance, influenced by recent U.S. labor market statistics for October and the resultant stock market adjustments. The data pointed to pockets of weakness in the employment sector, leading investors to infer that the cooling may be an effect of tighter credit and monetary policies. Consequently, there has been a recalibration of expectations regarding the trajectory of future Federal Reserve rate hikes.

In detail, the U.S. unemployment rate edged up to 3.9%, slightly higher than the previous 3.8%. Nonfarm payrolls showed an increase of 150 thousand, which was shy of the forecasted 178 thousand. Additionally, the average wage increment was a modest 0.2% month-over-month, missing the anticipated mark.

Market sentiment now appears to lean towards the belief that the current interest rates may represent the zenith of the present monetary tightening cycle.

EUR/USD Technical Analysis

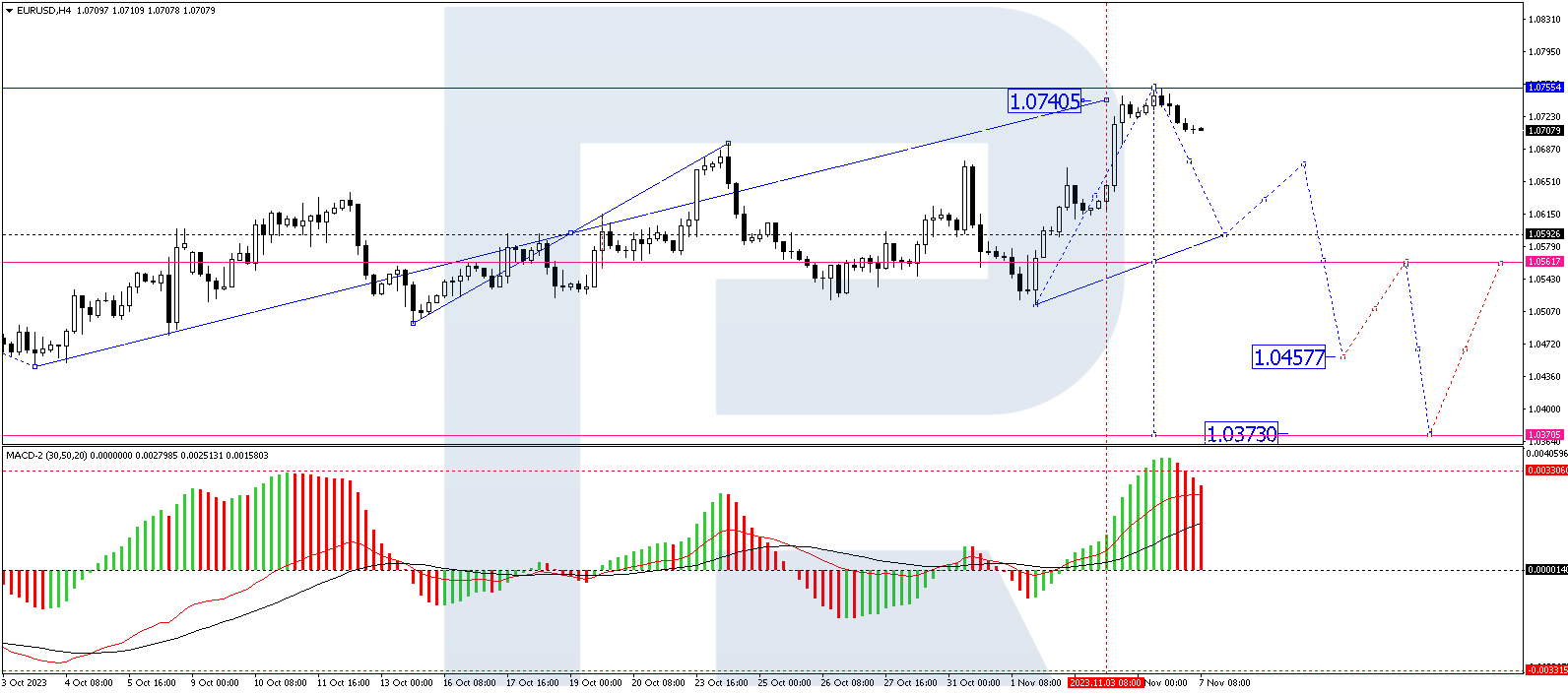

On the H4 chart for EUR/USD, the currency pair has attained the correctional target at 1.0755. The trend now seems to be tilting downwards, with a trajectory set towards the 1.0655 level. A consolidation phase around this mark is probable. A break below this consolidation could signal a further decline to 1.0633, and potentially, should this support give way, a fall to 1.0515 could be on the horizon. The MACD indicator suggests a peak formation, with its signal line at the highs and anticipating a downturn.

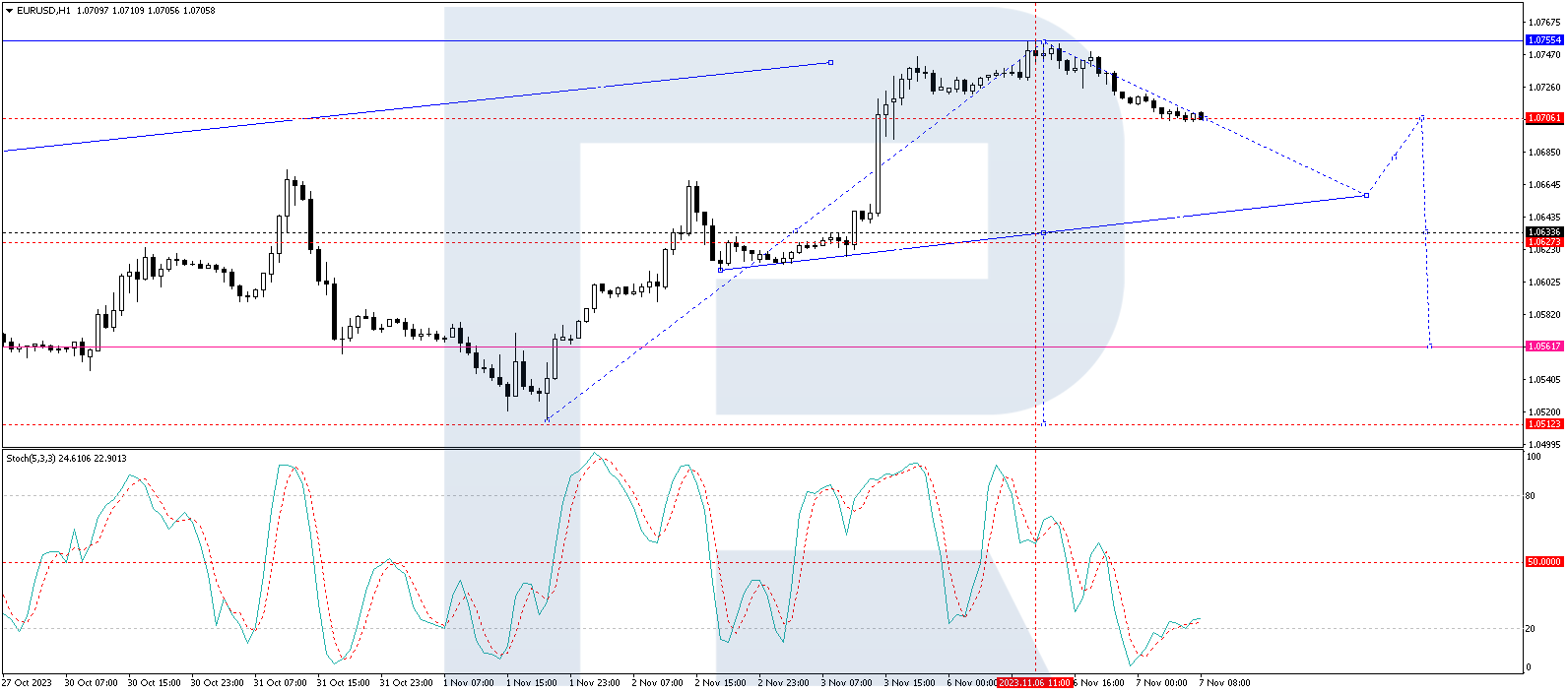

The H1 chart reveals a continuation of the downward wave targeting 1.0655. Should the pair touch this level, a corrective move upwards to around 1.0700 might ensue. Subsequent to this correction, the market may witness a renewed descent towards 1.0633. The Stochastic oscillator provides technical affirmation for this bearish outlook, with its signal line dropping below 50 and aiming for the 20 level.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.