By RoboForex Analytical Department

For the last month and a half, the crude oil market has been under a constant stress. Sentiment changes mostly because of the supply and demand forecasts. A Brent barrel price dropped to 75.65 USD yesterday.

The decline was triggered by the decision of Saudi Arabia to decrease prices for its buyers starting February, regardless of the region. The discount will amount to 2 USD, which is quite a lot.

The market thinks that the Saudis have either noticed a demand slump and are now trying to run ahead of it, or they have decided to shove away the competitors, such as the US crude oil producers.

Brent Technical Analysis

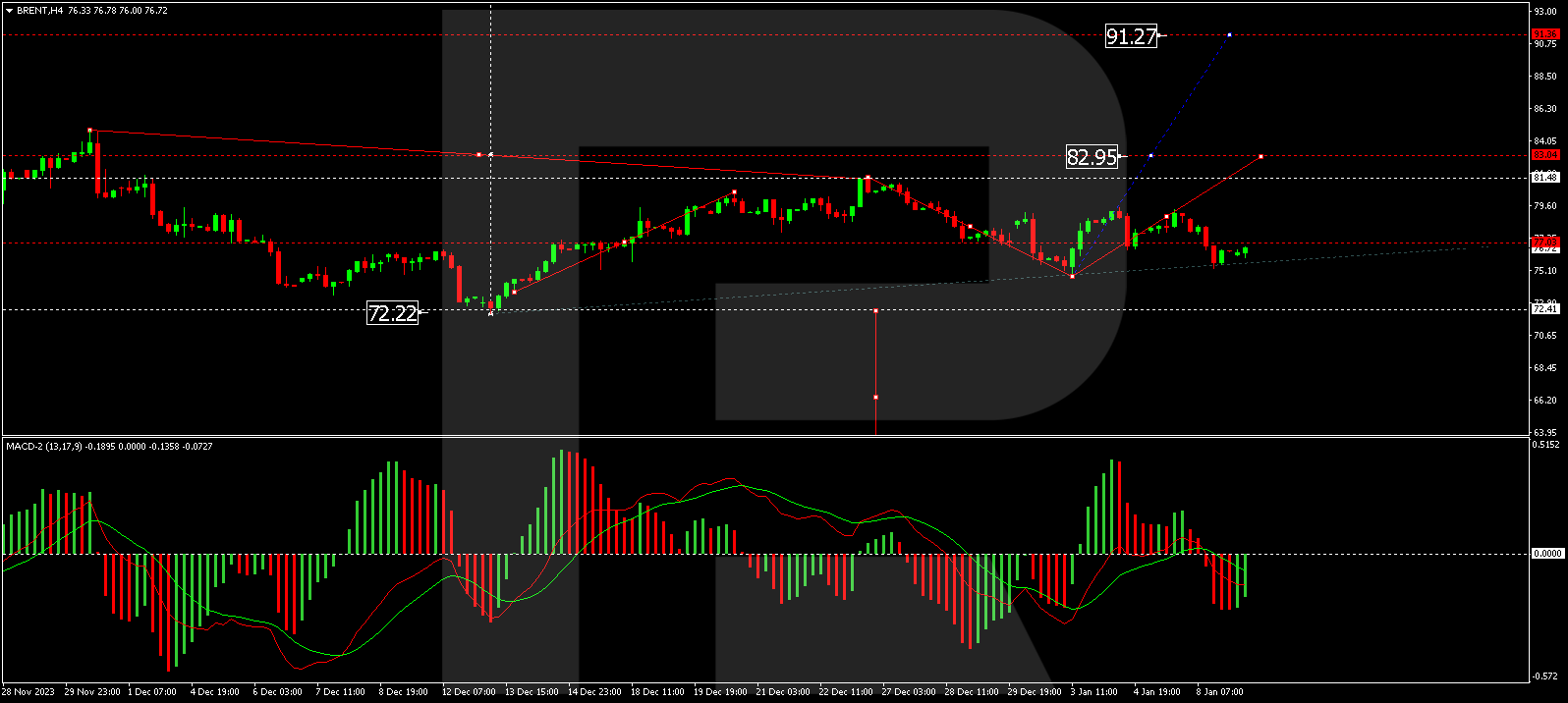

On the H4 Brent chart, the quotes have corrected to 74.74. A consolidation range is now forming around the 78.15 level. An escape from the range upwards might open the potential for a growth wave to 81.50. This is a local target. With an escape from the range downwards, the correction could continue to 70.00. Technically, this scenario is confirmed by the MACD, whose signal line is under zero, preparing to start growing.

On the H1 Brent chart, the quotes have completed a growth wave to 79.45 and a correction to 75.25. Today a growth link to 80.00 is expected to develop. If this level breaks, the wave could continue to 81.50. Technically, this scenario is confirmed by the Stochastic oscillator: its signal line is under 50, aimed strictly upwards to 80.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

This article is from an external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.