In this article we will test a trading system based on a trend-following breakout logic, applied to one of the world's most famous and most traded indexes, the Nasdaq. Since we are trading the CME market’s futures (NQ) contract, we will look for the volatility explosions that often characterize this underlying asset and try to ride them using a trend-following approach.

To determine our entry point, we check if the price reached by the market exceeds a certain level calculated from the opening value of the current session. We add or subtract the Average True Range (ATR) multiplied by a certain factor to this value. Remember that the ATR is the average of price ranges over a certain period, which also considers possible opening gaps.

If the price crosses the upper level to the upside, or the lower level to the downside, it is assumed that the balance of power between buyers and sellers is unbalanced in that direction. In this case, the strategy can open a long or short trade to exploit the trend that could develop from this point.

Let’s assume we are using a 15-minute time frame and a data history from January 2008 to December 2022. To define the two entry levels of the example strategy, we calculate the ATR over the last 200 periods (period=200) and take the value 5 for both the long and the short sides as a multiplier (multiL=5, multiS=5). In other words:

- Long entry level: open+multiL*AvgTrueRange(period)

- Short entry level: open+multiS*AvgTrueRange(period)

We also set an initial stop loss of $1,500 and a take profit of $3,000. Finally, we consider trading from 5:15 p.m. (exchange time), i.e., 15 minutes after the open, and until 3 p.m. (one hour before the close), with the restriction of closing the positions at the end of the day at the latest.

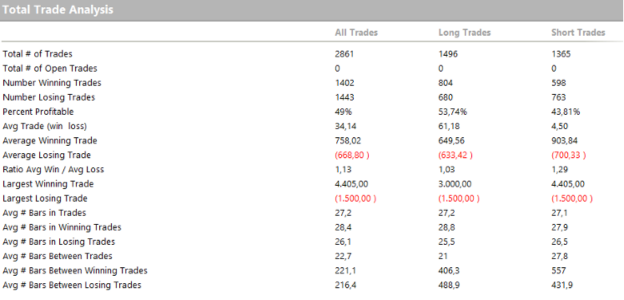

In Figures 1, 2 and 3, you can see the metrics resulting from the strategy just described: a good starting point with a rising equity line, even if not very constant. We notice a definite surge in profits only at the end of 2018, although this phenomenon reflects the Nasdaq’s "Buy&Hold" trend. The highlighted phenomenon and a decidedly low average trade make it clear that the strategy still needs some work to refine it.

Figure 1 - Equity curve of the Nasdaq trading system based on ATR.

Figure 2 - Strategy performance summary of the Nasdaq trading system based on ATR.

Figure 3 - Total trade analysis of the Nasdaq trading system based on ATR.

The average trade is just above $34, making the system unusable for live trading, as commission costs and slippage would consume a large part of the gains. Therefore, an optimization of the strategy’s key parameters should be performed to see if there is room for improvement.

First, one could optimize the ATR multipliers used to determine the long and short entry levels. Optimizing between 1 and 10 in steps of 0.5 allows us to opt for different pairs of values to find a balance between high net profit, good average trade and limited drawdown. However, as this is an exploratory exercise, we opt for the pair multiL=5.5 and multiS=8.

Figure 4 - multiL and multiS multiplier optimization of the Nasdaq trading system based on ATR

Given the general upward trend of stock indexes, we could try to filter short entries more. One example is to limit the time window for these trades, keeping in mind that the entire session runs from 5 pm to 4 pm the following day. If we do an optimization in 1-hour increments, we see that short trades are more effective when they take place between 9:00 pm and 12:00 am. The total average trade increases from $69 to $75. Similarly, on the long side, if we restrict the time window between 5:15 pm and 2:00 pm, we can achieve an average total trade of about $80.

This value is certainly higher than the original one, but as the total number of trades is still quite high (1787), we can think about filtering the trades further, especially on the long side which executes more than 1200 trades (more than 110 per year).

A possible filter could be the presence or absence of certain price patterns. We will use a proprietary list of patterns that includes several case histories to evaluate the best pattern through an optimization. After adding this filter to our system, the optimization of the default list will point us to several interesting patterns. For example, if we only trade when pattern 14 occurs, we increase the average trade (now $127) and decrease the drawdown (now $12.5k). Rule of pattern 14: the candlestick body formed between the open of 5 days ago and yesterday’s close must be less than 1.5 times the range defined by the high 5 days ago minus yesterday’s low. In other words, this pattern shows us, albeit in a somewhat strange way, a price decline over the last 5 days.

Figure 5 - Pattern optimization for the Nasdaq trading system based on ATR.

As a final step, we could apply a breakeven stop in case the open position reaches a certain profit level, to prevent a winning trade from turning into a loss. This type of stop is not always effective for the overall results of a strategy, but it allows the trader to sleep more soundly. In our case, sorting the results of an optimization by the best net profit-to-drawdown ratio (Custom Criteria in Figure 6), we could opt for a value of $1,300, which allows for a good performance with a limited drawdown.

Figure 6 - Breakeven optimization for the Nasdaq trading system based on ATR.

At this point, even without further filters and optimizations, our strategy is definitely improved, with a much more consistent equity line and a respectable average trade ($140).

Figure 7 - Equity curve optimized Nasdaq trading system based on ATR.

Trend-following breakout logic has proven to be a successful approach to trading Nasdaq futures, and, with appropriate adjustments, could be applied to other instruments that show similar behaviors. With these pointers, we leave it to our readers to experiment and perhaps improve the strategy even further.

See you next time and Happy trading!

Andrea Unger

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.