By RoboForex Analytical Department

Brent crude oil prices surged to $86 per barrel on Tuesday, marking the highest level in two months. This rise was driven by escalating geopolitical risks in Eastern Europe and the Middle East, particularly the ongoing confrontation between Israel and Hamas, which shows no sign of abating despite the involvement of international mediators backed by the US.

On the demand side, uncertainties persist. China, the world's largest oil importer, continues to face significant economic challenges, contributing to the volatile market sentiment. The retail sector in China is under pressure following disappointing results from the mid-year online sales, with Chinese consumers showing reluctance to spend amidst concerns about personal wealth, the ongoing property market crisis, delayed wages, and high youth unemployment. These factors are critical as they jeopardise China’s GDP growth target of around 5% for the year.

Brent Technical Analysis

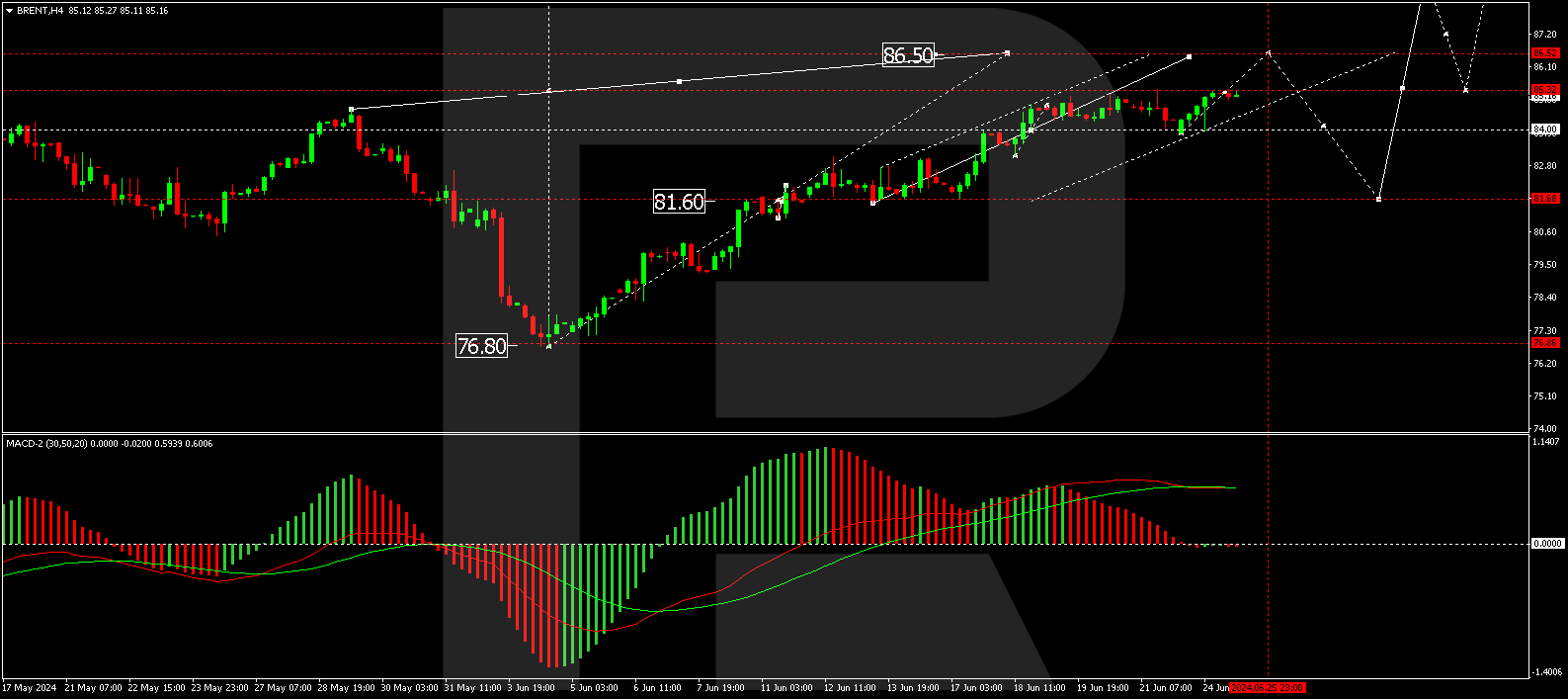

On the H4 chart, Brent is currently advancing towards the $86.50 level, which is identified as the immediate target. Once this level is reached, a potential correction to $81.60 may occur, testing from above. Subsequently, the market might initiate a new growth wave aiming for $89.00, with potential to extend up to $94.00. This bullish outlook is supported by the MACD indicator, whose signal line is above zero and climbing steeply.

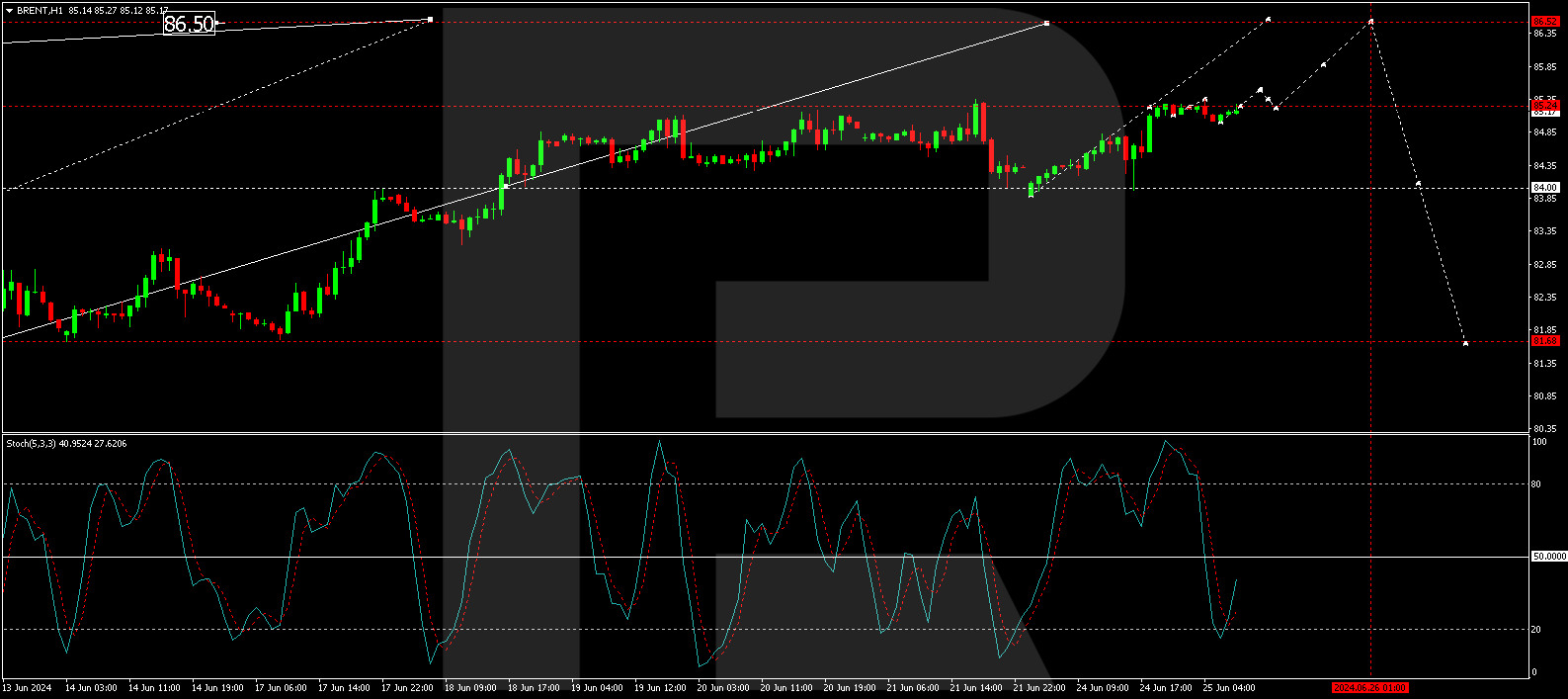

On the H1 chart, Brent found support at $84.00 and is now progressing through the latter stages of the current growth wave. The market has already achieved the $85.24 mark. We anticipate the formation of a narrow consolidation range around this level, with a breakout above potentially leading to further growth towards $86.50. This scenario is technically reinforced by the Stochastic oscillator, with its signal line poised above 20 and gearing up for an ascent to 80.

Market Outlook

Investors should closely monitor developments in geopolitical hotspots and economic indicators from major economies like China and the US, as these could significantly sway oil prices. The current trajectory suggests bullish momentum for Brent crude, but the volatile nature of geopolitical events and economic data releases warrants cautious optimism.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.