Zinger Key Points

- Elliott Management has launched several activist battles against publicly traded companies in 2024.

- A new 13F filing shows which stocks the activist investor increased positions in for the second quarter.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Activist fund Elliott Management has made several moves in 2024 including targeting coffee chain Starbucks Corporation SBUX, which recently announced a new CEO.

A new 13F filing reveals three other key areas Elliott is increasing focus on.

Match Group: Online dating company Match Group Inc MTCH is one of the stocks that saw an increased position from Elliott in a new 13F filing.

Elliott Management owns 11,705,013 shares of Match Group, up 184% from a previous total of 4.125 million shares. The increased stake comes as activist hedge fund Starboard Value has acquired a reported 6.5% stake and is pushing for changes.

Starboard is pushing Match Group to expand its margins or consider a sale of the company. The hedge fund highlighted the strength of the Tinder and Hinge brands in its comments on the company.

Elliott Management took a stake in the company earlier this year and is also said to be pushing for changes.

Last month, Match Group reported second-quarter financial results, with revenue exceeding analyst estimates and earnings per share meeting expectations.

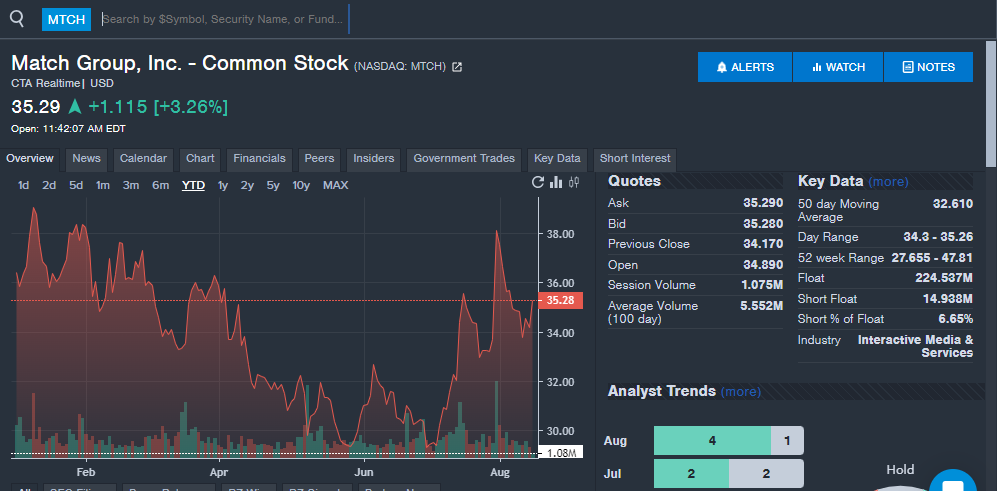

Match Group shares are down 3.6% year-to-date in 2024, as seen on the Benzinga Pro chart below. Match shares trade at $35.18 versus a 52-week trading range of $27.66 to $47.81.

Read Also: Benzinga’s ‘Stock Whisper’ Index: 5 Stocks Investors Secretly Monitor But Don’t Talk About Yet

Etsy Stake: Elliott Management doubled a stake in ecommerce company Etsy Inc ETSY in the second quarter. The fund now owns 4,500,000 shares, up from 2,250,000 shares owned previously.

Elliott's senior portfolio manager Marc Steinberg was added to the Etsy board of directors earlier this year as the activist investor pushes for changes after underperformance.

"Etsy has a highly differentiated position in the e-commerce landscape and a uniquely attractive business model, supported by a distinctive and engaged community. We became a sizable investor in Etsy and I am joining its board because I believe there is an opportunity for significant value creation," Steinberg said at the time.

Etsy recently beat second-quarter revenue and earnings per share estimates from analysts and said the copay is making progress on "bold moves." Active buyers were up 1% year-over-year in the second quarter.

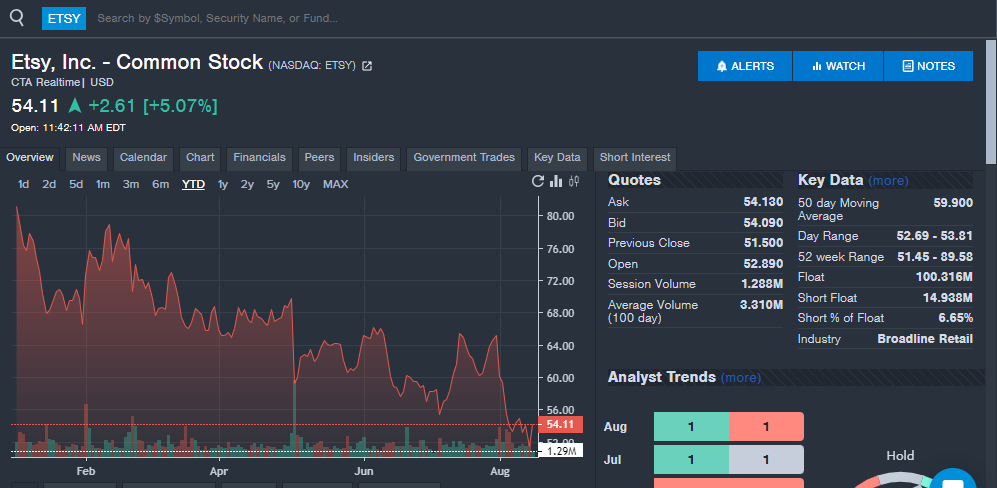

Etsy shares are down 33.3% year-to-date, as seen on the Benzinga Pro chart below. Etsy shares trade at $54.03 versus a 52-week trading range of $51.45 to $89.58.

Airline Stocks: Elliott Management has made recent headlines for their stake in airline company Southwest Airlines Company LUV and pushing for changes to the company's board of directors.

The 13F filing revealed additional purchases of shares of Southwest Airlines, bringing the total ownership to 48,948,500 shares, as indicated in a 13D filing.

Elliott plans to nominate 10 independent candidates for Southwest's board in the ongoing activist battle. Elliott is pushing for a change to the board, new leadership and a business review to boost the underperforming stock.

Southwest and Elliott have agreed to a meeting in September to discuss a resolution to their battle against one another. The airline company also has an Investor Day planned for late September that could offer more insight into its plans to turnaround the company.

The Elliott 13F filing also revealed U.S. Global Jets ETF JETS puts owned, with a position representing 9,500,000 shares increasing 660% over the last quarter. Southwest is the largest weighting in the ETF representing 10.4% of assets, which could make the put a hedge against the Southwest stake or a belief that the entire airline sector could underperform.

The filing also showed 11.5 million shares of American Airlines Group AAL represented by puts, potentially betting against one of the largest airlines and Southwest rivals.

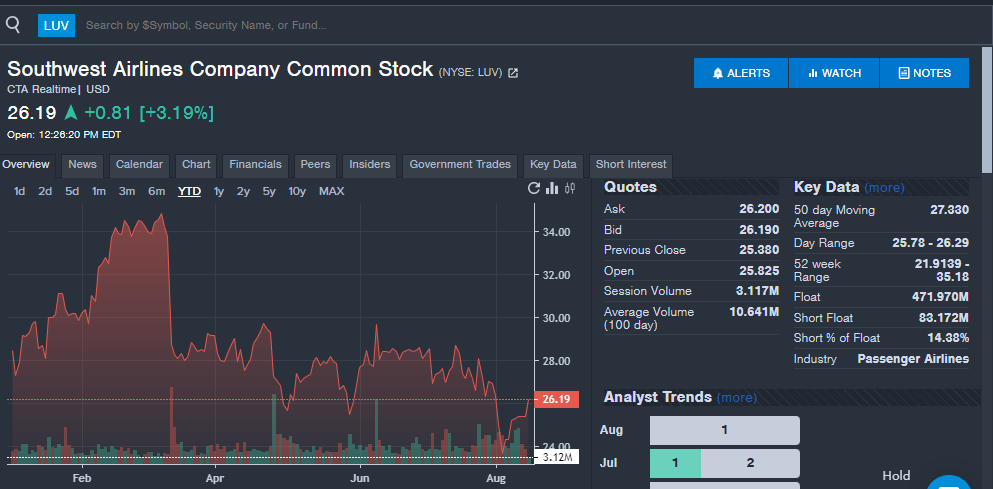

Southwest Airlines stock is down 9.4% year-to-date in 2024, as seen on the Benzinga Pro chart below. Southwest shares trade at $26.17 versus a 52-week trading range of $21.91 to $35.18.

Read Next:

- ‘Poison Pill’ Activated: Southwest Airlines Counters Elliott Investment’s Move With Defense Strategy

Image created using artificial intelligence via Midjourney.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.