By RoboForex Analytical Department

EUR/USD halted its decline near a four-week low at 1.1034 on Wednesday. The information flow currently appears congested. The market is awaiting today’s US inflation release for August and is keeping an eye on the upcoming political debates between the main US presidential nominees. In addition, yesterday, the Fed outlined a plan to increase the capital of large banks by 9%. The banking sector was disappointed by this, with the proposal immediately gaining many critics.

Despite the abundance of news and events ahead, none of them is likely to influence the Fed’s upcoming interest rate decision. The meeting is scheduled for next week. The main scenario suggests a 25-basis-point reduction in borrowing costs, with the likelihood of the scenario estimated at 67%.

As for inflation expectations, CPI could have decreased to 2.6% y/y in August from the previous 2.9%. The indicator is projected to increase by 0.2% month-over-month as in July. Core inflation could have remained at 3.2% y/y. This data appears rather moderate largely due to core prices remaining unchanged. This may mean that the trend towards easing inflationary pressures is not as strong as wished to be.

EUR/USD Technical Analysis

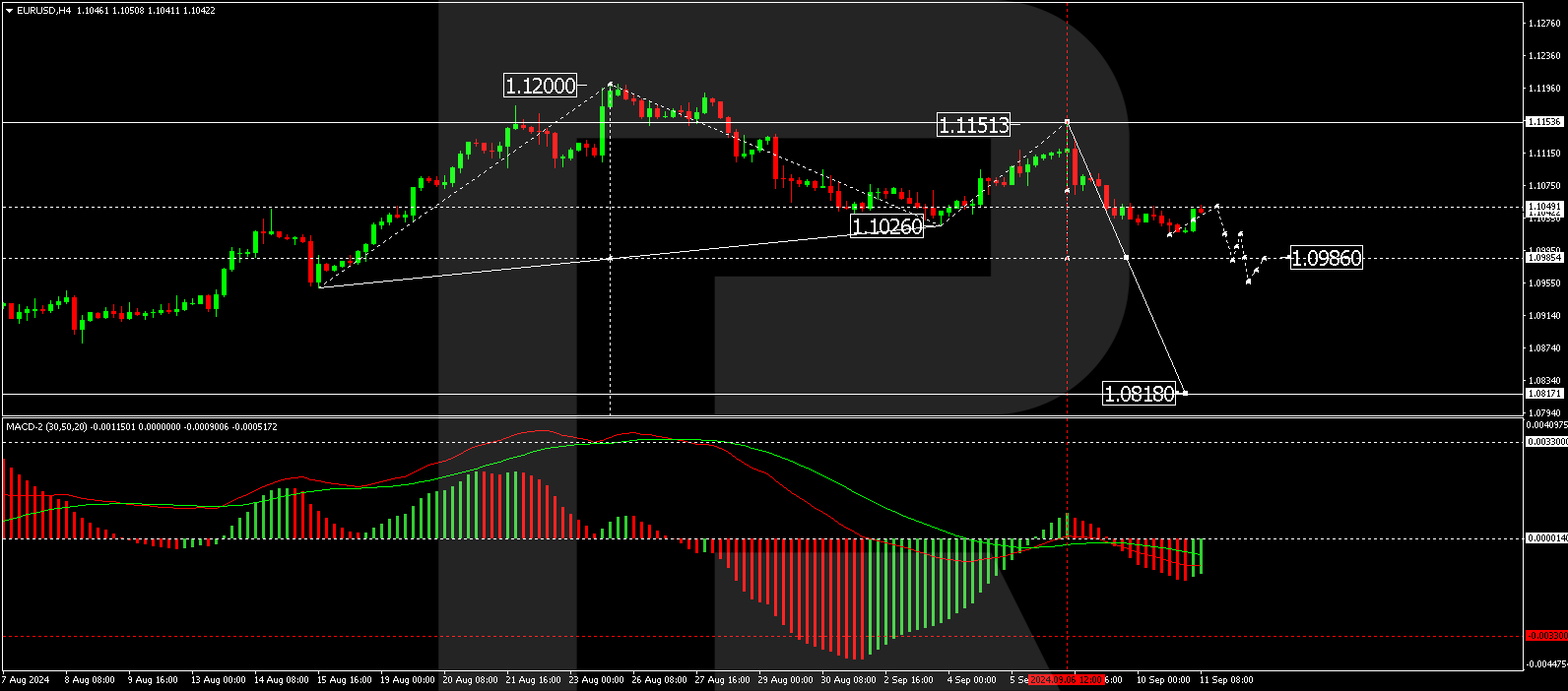

On the EUR/USD H4 chart, the market is forming a downward wave structure, aiming for 1.0985. The price could reach this target level today. Subsequently, a consolidation range is expected to develop, extending up to 1.1026 and down to 1.0960. A breakout below the 1.0960 level may be considered a signal for a continuation of the trend to 1.0818. This scenario is technically supported by the MACD indicator, with its signal line below the zero level and pointing sharply downwards.

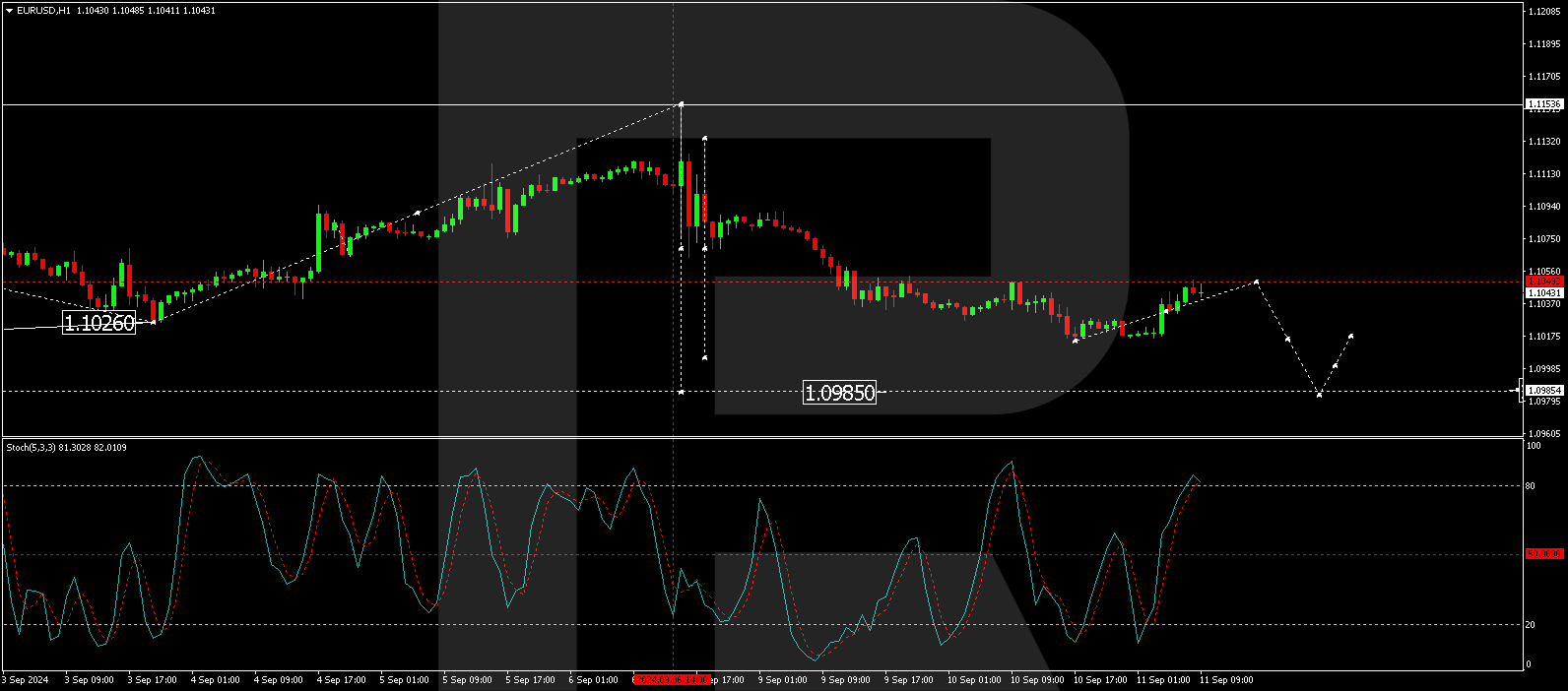

On the EUR/USD H1 chart, the market has completed a downward wave, reaching 1.1015, and today corrected towards 1.1049. The price is expected to decline to 1.0985. Subsequently, a consolidation range might form above this level, with the price expected to break below it. The third downward wave is forming, targeting 1.0818. This scenario is also technically supported by the Stochastic oscillator, whose signal line is above 80 and poised for a decline to 20.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.