Zinger Key Points

- The Benzinga Stock Whisper Index looks at five stocks seeing increased interest from readers during the week.

- The theme of quantum computing sees several stocks make their debut on the list.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here's a look at the Benzinga Stock Whisper Index for the week ending Dec. 20:

D-Wave Quantum QBTS: The company was one of several quantum computing stocks that continued to see strong interest from readers during the week. The stocks traded higher on the week after news from Google that its Willow quantum chip made a breakthrough in quantum computing. The breakthrough of Willow has investors looking for quantum computing companies that could benefit as more eyes are on the sector heading into 2025. Analysts are taking notice as well with Craig Hallum maintaining a Buy rating and raising the price target from $2.50 to $9, Benchmark maintaining a Buy rating and raising the price target from $3 to $8 and Roth MKM maintaining a Buy rating and raising the price target from $3 to $7.

The stock was up significantly over the last five days, as shown on the Benzinga Pro chart below. The stock is up over 800% year-to-date in 2024.

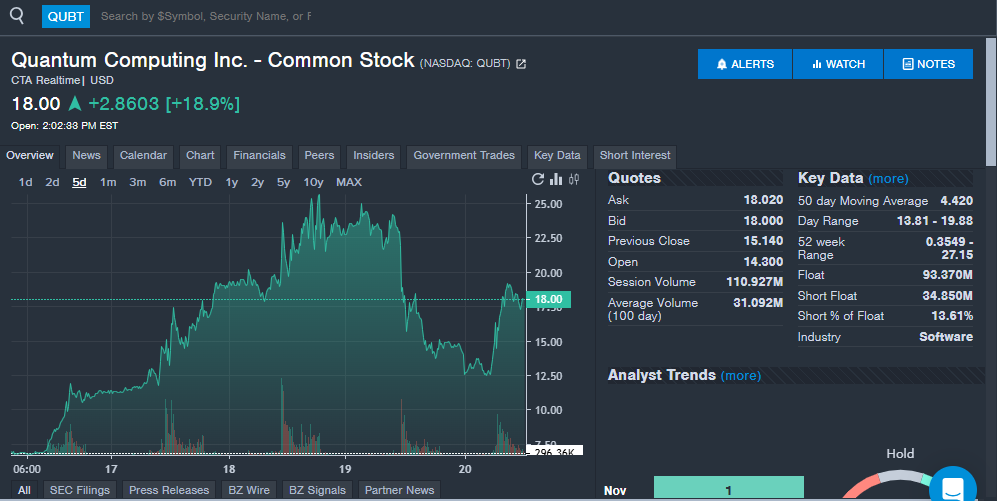

Quantum Computing QUBT: Similar to D-Wave, Quantum Computing is one of the handful of stocks seeing increasingly more attention from readers thanks to soaring interest in the quantum computing space. The company recently announced a prime contract from NASA for imaging and data processing support that will use the company's Dirac-3 entropy quantum optimization machine. Quantum Computing said the contract could lead to additional deals if successful. The company has also announced a share offering to strengthen its financial position.

The stock was up significantly over the past week. Shares are up over 1,800% year-to-date in 2024.

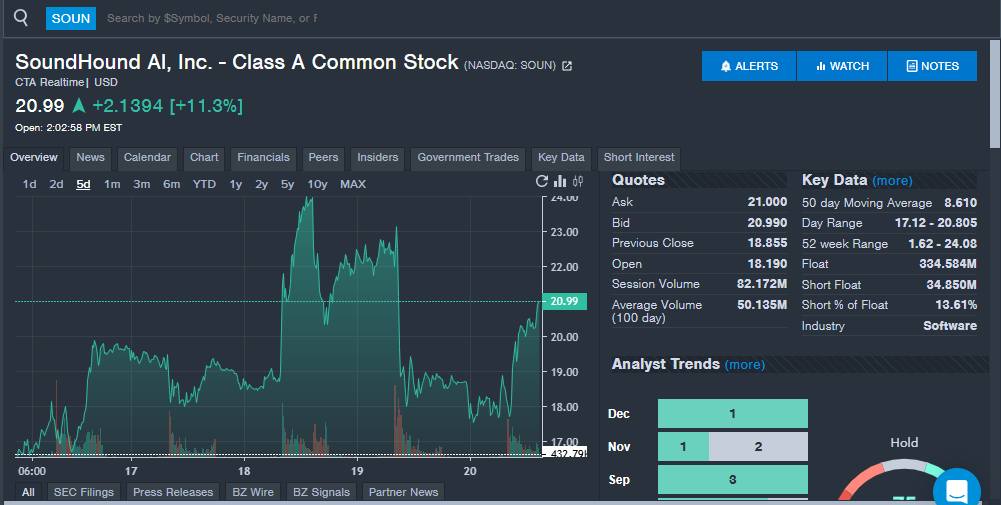

SoundHound AI SOUN: The voice AI company returns to the Stock Whisper Index for a second time in December. The company recently highlighted its awards and recognition it has received in the conversational AI market. A partnership with Church's Texas Chicken for voice AI drive-thru ordering solutions has also put the company into the spotlight as it continues to help restaurants reduce wait times, streamline operations and improve costs with its AI offerings. When SoundHound last appeared in the Stock Whisper Index, the company's AI Smart Ordering system was highlighted. The company’s AI-powered restaurant solutions are in use at more than 10,000 locations around the world, with the technology helping with phone, kiosk, drive-thru and headset ordering systems. The company also recently said its Amelia conversational AI agent has handled over 100,000 customer calls in 2024, helping with operational efficiency for customers. The stock has also been mentioned as a potential short squeeze with 13.6% of the float short according to Benzinga Pro data.

Hear more about SoundHound from the company's CEO Mike Zagorsek in an exclusive interview with Benzinga here.

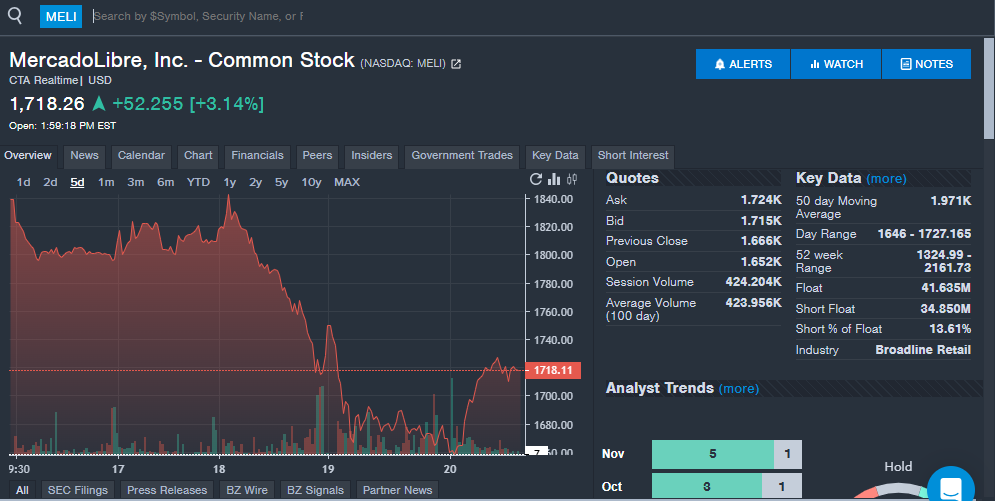

MercadoLibre Inc MELI: The Latin American e-commerce company saw strong interest from readers without any major news from the company. The stock may have fallen on concerns of Brazilian stocks due to lower valuations for its currency. The 2024 election and questions about international relations may also have sent shares of Latin American stocks lower in recent weeks. MercadoLibre reported third-quarter financial results in November with earnings per share missing analyst estimates and revenue beating analyst estimates for an eighth straight quarter. Several analysts maintained bullish ratings on the stock, but lowered price targets after the recent financial results.

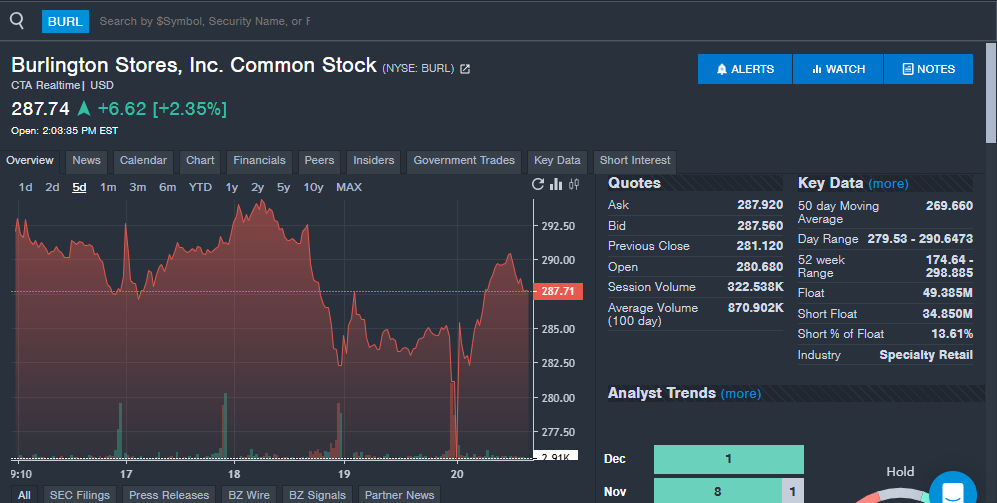

Burlington Stores BURL: The discount apparel retailer saw increased interest from readers during the week, which comes after third-quarter financial results were reported in late November. The company saw revenue up 11% year-over-year in the quarter, but the revenue figure missed analyst estimates. The company cited warmer weather as a reason for comparable sales being lower than expected. Management was optimistic that the fourth quarter would see strong growth. The majority of analysts raised their price targets on the stock after the quarterly financial report.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.