"Value will have its day in the sun"

That's what John Buckingham, a veteran value investor and chief investment officer at AFAM Capital Asset Management, recently told Kiplinger in an interview.

However, many investors are balking at the idea of value stocks making a comeback since growth stocks easily outperformed the latter in 2017. For example, the Russell 1000 Growth index (IWF) has a 12-month return of 32.2% while the Russell 1000 Value index (IWD) has a 12-month return of only 14.7%. But if you think that's the norm, you'd be mistaken.

John Buckingham has researched the subject in extreme detail and has found that, "while value stocks don’t win in every period, a long-term view finds that investing in high-quality, value stocks in a diversified portfolio is a worthwhile endeavor."

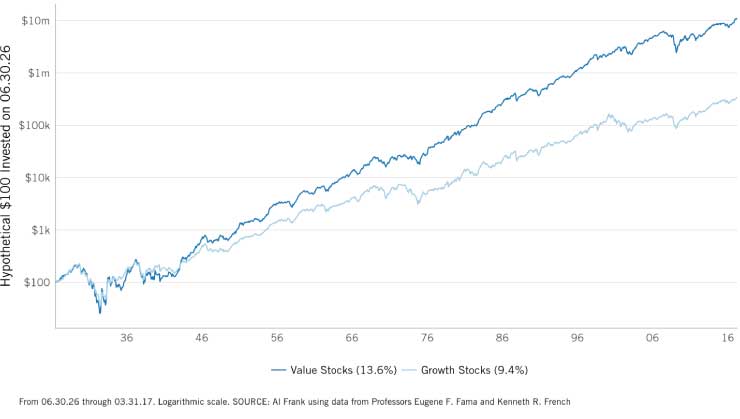

For example, take a look at the chart below where he compares nearly 100 years of data:

An investment of $100 in value stocks in 1926 would have grown into more than $10 million (13.6% annualized return) while a portfolio of growth stocks would not have reached $1 million (9.4% annual return) as of 2017. But unless you've found the Fountain of Youth, a holding period of nearly 100 years is unrealistic. However, you may not have to wait that long to see value stocks outperform. Kiplinger and Buckingham suggest that 2018 is the year that value stocks make a comeback for the following reasons:

- the reversion to the mean rule implies that irregularities seen in the market tend to vanish over time.

- since history favors value, being long value stocks means you ultimately have a tailwind.

- FANG stocks could fall in 2018 as they're becoming increasingly pricey and begin to resemble the tech bubble in 2000.

As a result, I decided to find the 10 best value stocks in the S&P 500. In order to find these value stocks, I downloaded the list of S&P 500 constituents and then used finbox.io's spreadsheet add-on to find which companies had the following:

- a P/E multiple that trades below its comparable public companies,

- an EBITDA multiple that also trades below its comparable public companies, and

- upside as calculated from finbox.io's fair value > 12%

Here are the 10 best value stocks in the S&P 500 that I found.

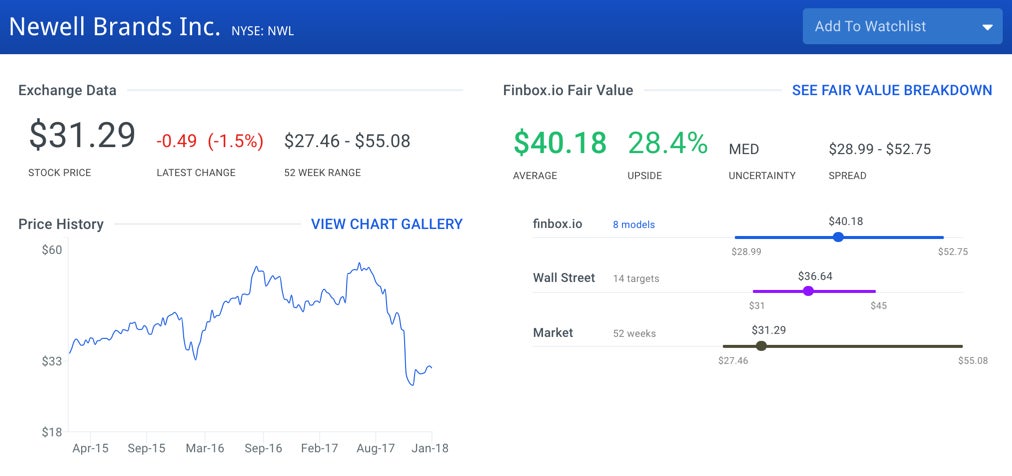

Top 10 Value Stocks In The S&P 500: Newell Brands

Newell Brands Inc NWL designs, sources, and distributes consumer and commercial products worldwide. The company offers markers, highlighters, pens, and pencils; art products; activity-based adhesive and cutting products; fine writing instruments; and labeling solutions under the Sharpie, Paper Mate, Expo, Prismacolor, Mr.Sketch, Elmer's, X-Acto, Parker, Waterman, and Dymo Office brands. The company was formerly known as Newell Rubbermaid Inc. and changed its name to Newell Brands Inc. in April 2016. Newell Brands was founded in 1903 and is headquartered in Hoboken, New Jersey.

Analysts covering the stock often compare the company to a peer group that includes Colgate-Palmolive Company CL, The Estée Lauder Companies Inc EL, Clorox Co CLX and Procter & Gamble Co PG.

The company's LTM EBITDA multiple of 12.4x is below all of its selected comparable public companies: CL (17.7x), EL (20.9x), CLX (15.4x) and PG (14.8x). Newell Brands' LTM P/E multiple of 12.3x is also below all of its selected comparable public companies: CL (29.1x), EL (35.0x), CLX (25.9x) and PG (15.0x).

Source: finbox.io

Shares of the company are down -31.8% over the last year. The stock last traded at $31.29 as of Thursday January 18 and eight separate valuation analyses imply that there is 28.4% upside relative to its current trading price.

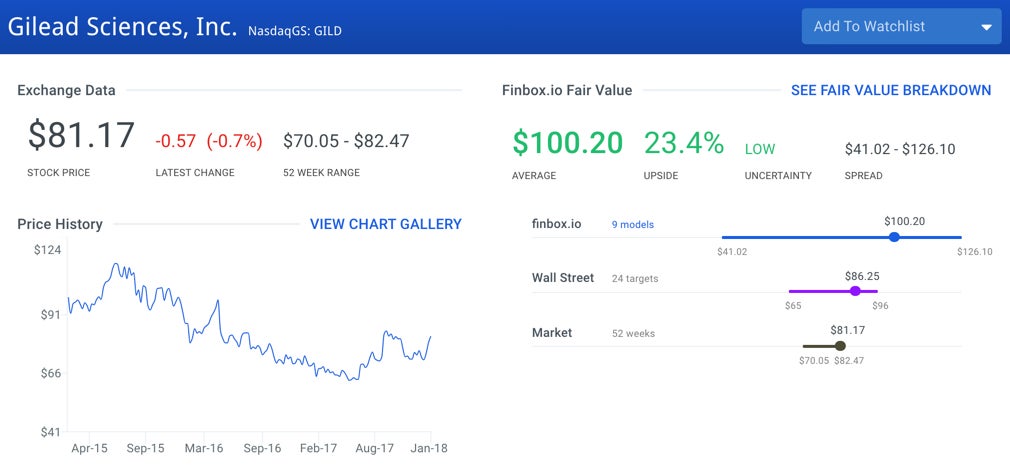

Top 10 Value Stocks In The S&P 500: Gilead Sciences

Gilead Sciences, inc. GILD discovers, develops, and commercializes medicines in Europe, North America, Asia, South America, Africa, Australia, India, and the Middle East. The company’s products include Descovy, Odefsey, Genvoya, Stribild, Complera/Eviplera, Atripla, Truvada, Viread, Emtriva, Tybost, and Vitekta for the treatment of human immunodeficiency virus (HIV) infection in adults.

Furthermore, it has product candidates in various stages of development for the treatment of HIV/AIDS and liver diseases, such as hepatitis C virus and hepatitis B virus. The company was founded in 1987 and is headquartered in Foster City, California.

On a comparable company basis, selected benchmark companies include AbbVie Inc ABBV, Eli Lilly and Co LLY, and Pfizer Inc., PFE and Bristol-Myers Squibb Co BMY. Gilead's LTM EBITDA multiple of 5.5x is below ABBV (16.5x), LLY (21.0x), PFE (12.5x) and BMY (16.0x). Similarly, the company's LTM P/E multiple of 9.1x is below ABBV (25.0x), LLY (40.3x), PFE (22.4x) and BMY (23.9x).

Source: finbox.io

Shares of Gilead Sciences are up 16.6% over the last year and finbox.io's fair value estimate of $100.20 per share calculated from nine cash flow models imply 23.4% upside. The average price target from 24 Wall Street analysts of $85.63 per share similarly imply upside.

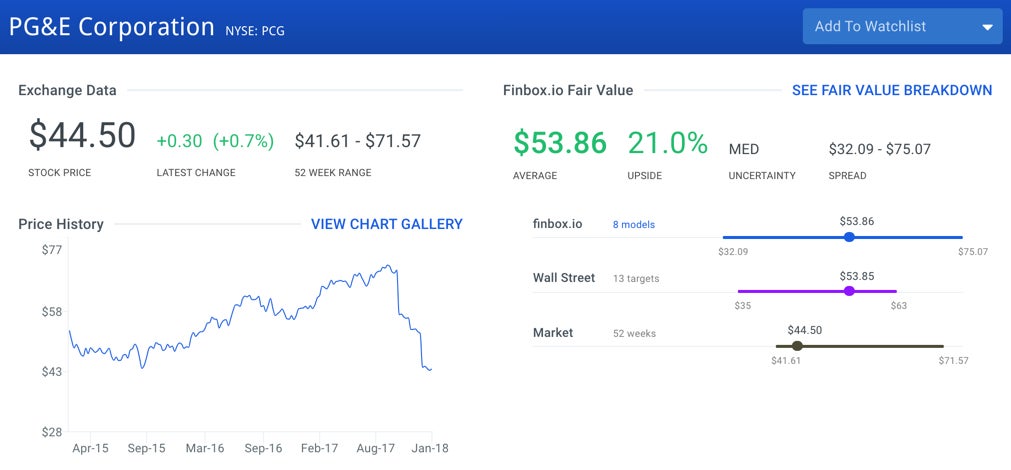

Top 10 Value Stocks In The S&P 500: PG&E Corporation

PG&E Corporation PCG, through its subsidiary, Pacific Gas and Electric Company, sells electricity and natural gas to residential, commercial, industrial, and agricultural customers primarily in northern and central California. PG&E Corporation was founded in 1905 and is headquartered in San Francisco, California.

The company's valuation multiples currently trade below all selected peers: NextEra Energy Inc NEE, Duke Energy Corp DUK, American Electric Power Company Inc AEP and Entergy Corporation ETR.

Source: finbox.io

PG&E Corporation's stock currently trades at $44.50 per share as of Thursday January 18, down -26.4% over the last year. Finbox.io's eight valuation analyses suggest that shares could increase 21.0% going forward.

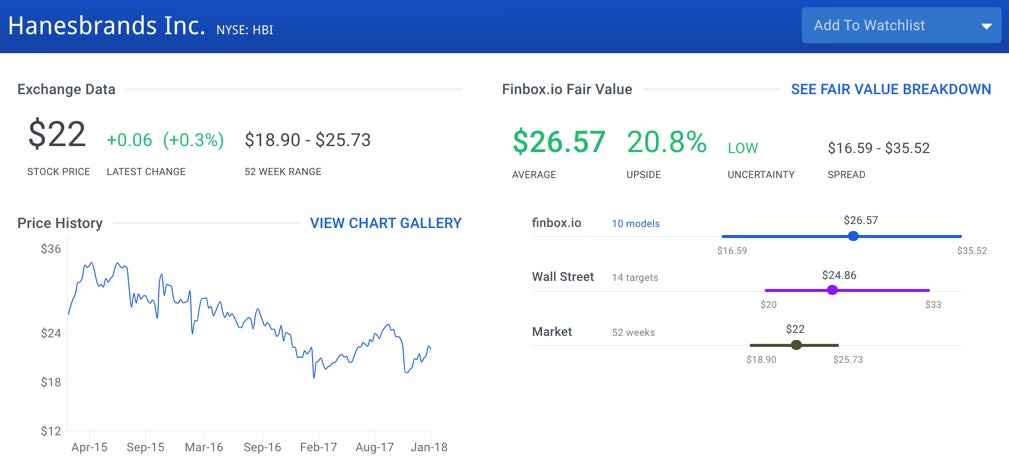

Top 10 Value Stocks In The S&P 500: Hanesbrands

Hanesbrands inc. HBI designs and sells various basic apparel for men, women, and children in the United States. The company operates through four segments: Innerwear, Activewear, Direct to Consumer, and International. It provides its products primarily under the Hanes, Champion, Maidenform, DIM, Playtex, L’eggs, Lovable, Wonderbra, and Zorba brand names. The company markets its products through retailers, wholesalers, and third-party embellishers, as well as directly to consumers. As of December 31, 2016, it operated 252 outlet stores in the United States as well as 460 retail and outlet stores internationally. Hanesbrands was founded in 1901 and is headquartered in Winston-Salem, North Carolina.

Analysts covering the stock often compare Hanesbrands to a peer group that includes Under Armour Inc UAA, Ralph Lauren Corp RL, PVH Corp PVH and Carter's inc. CRI. The company's LTM EBITDA multiple of 12.4x is slightly above PVH (12.3x) and below UAA (16.6x), RL (17.7x) and CRI (12.6x). Hanesbrands' LTM P/E multiple of 13.3x is below all comparable public companies: UAA (40.5x), RL (110.0x), PVH (21.1x) and CRI (22.2x).

Source: finbox.io

Shares of the company are trading 2.5% higher year over year. However, the stock price could end up trading 20.8% higher in 2018 based on Hanesbrands's future cash flow projections.

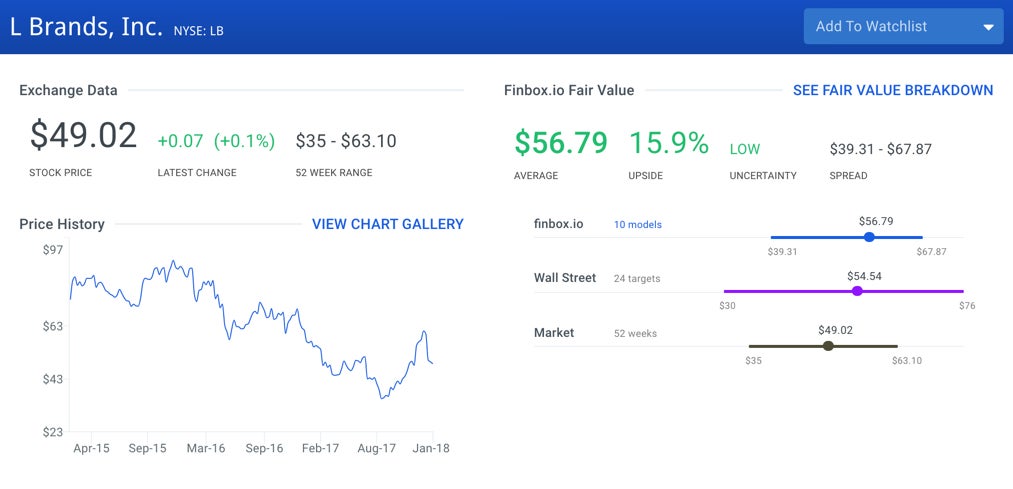

Top 10 Value Stocks In The S&P 500: L Brands

L Brands Inc LB operates as a specialty retailer of women’s intimate apparel, beauty and personal care products, and accessories. The company operates in three segments: Victoria’s Secret, Bath & Body Works, and International. The company offers its products under the Victoria’s Secret, PINK, Bath & Body Works, La Senza, Henri Bendel, C.O. Bigelow, White Barn, and other brand names. L Brands, Inc. sells its merchandise through company-owned specialty retail stores worldwide and through its Websites. L Brands, Inc. was founded in 1963 and is headquartered in Columbus, Ohio.

On a comparable company basis, selected benchmark companies include Gap inc GPS, Nordstrom, Inc. JWN, V.F. Corp VFC and TJX Companies Inc TJX. The company's LTM P/E multiple of 14.6x currently trades below its entire peer group: GPS (15.2x), JWN (17.4x), VFC (32.1x) and TJX (20.3x).

Source: finbox.io

L Brands' stock currently trades at $49.02 per share as of Thursday January 18, down -15.6% over the last year. On a fundamental basis, the company's stock is trading at a 15.9% discount to finbox.io's intrinsic value estimate.

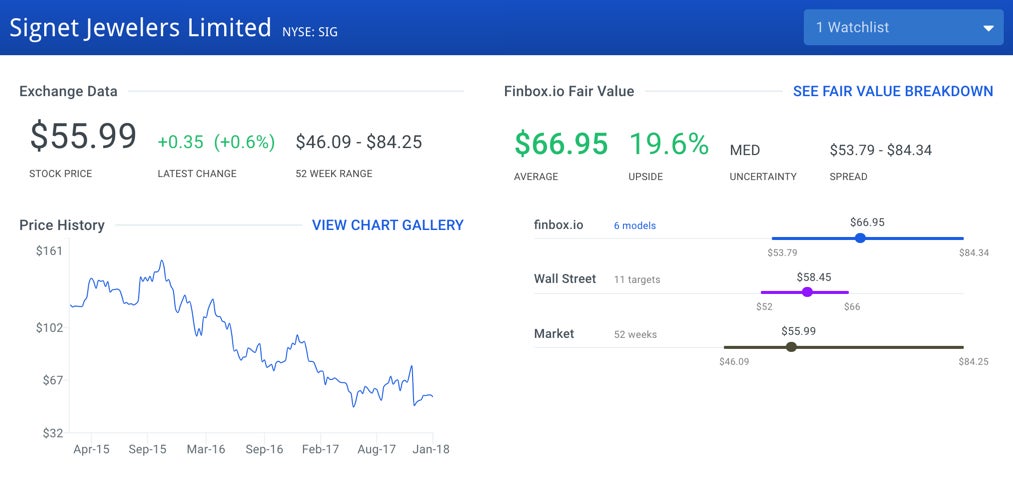

Top 10 Value Stocks In The S&P 500: Signet Jewelers

Signet Jewelers Ltd. SIG engages in the retail sale of diamond jewelry, watches, and other products worldwide. Its stores are operated in malls and off-mall locations primarily under the Kay Jewelers, Kay Jewelers Outlet, Jared The Galleria Of Jewelry, Jared Vault, and various mall-based regional brands. Signet Jewelers Limited was founded in 1950 and is based in Hamilton, Bermuda.

The company's valuation multiples implied by the market currently trade below all selected comparable companies: Tapestry Inc TPR, Tiffany & Co. TIF, Michael Kors holding Ltd KORS and TJX Companies inc TJX.

Source: finbox.io

Shares of the company are down -31.0% over the last year. The stock last traded at $55.99 as of Thursday, January 18 and six separate valuation analyses imply that there is 19.6% upside relative to its current trading price.

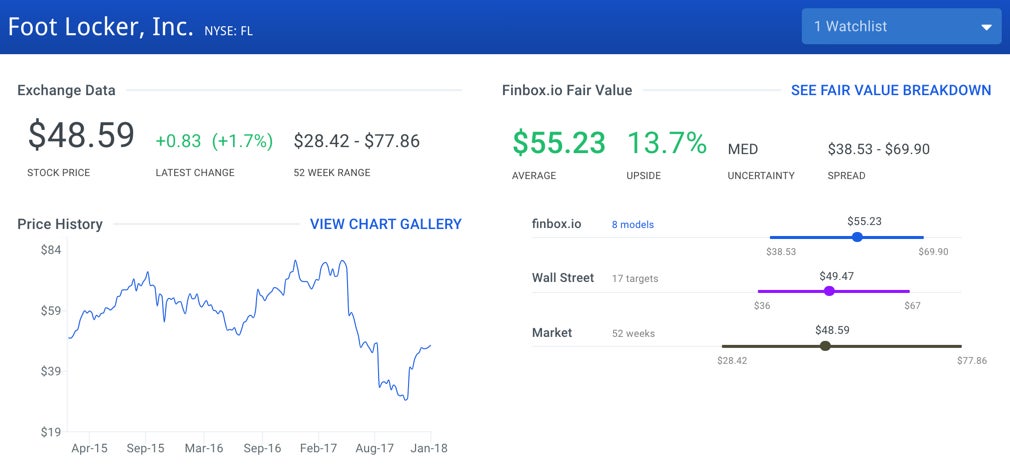

Top 10 Value Stocks In The S&P 500: Foot Locker

Foot Locker Inc FL operates as an athletic shoe and apparel retailer. The company operates in two segments, Athletic Stores and Direct-to-Customers. The Athletic Stores segment retails athletic footwear, apparel, accessories, and equipment under Foot Locker, Kids Foot Locker, Lady Foot Locker, Champs Sports, Footaction, Runners Point, Sidestep, and SIX:02. As of November 17, 2017, this segment operated 3,349 stores worldwide. The Direct-to-Customers segment sells athletic footwear, apparel, equipment, and team licensed merchandise for high school and other athletes through Internet and mobile sites, and catalogs. This segment operates sites such as eastbay.com and final-score.com. Foot Locker, Inc. was founded in 1879 and is headquartered in New York, New York.

Sell-side research analysts often compare the company to a peer group that includes Under Armour Inc UAA, Dick's Sporting Goods Inc DKS, L Brands Inc LB and Burlington Stores Inc BURL. Foot Locker's LTM EBITDA multiple of 4.8x is below all comparable public companies: UAA (16.6x), DKS (5.7x), LB (8.4x) and BURL (14.8x). Similarly, the company's LTM P/E multiple of 10.5x is below UAA (40.5x), DKS (11.8x), LB (14.6x) and BURL (31.1x).

Source: finbox.io

Shares of Foot Locker are down -29.3% over the last year and finbox.io's fair value estimate of $55.23 per share calculated from eight cash flow models imply 13.7% upside.

Top 10 Value Stocks In The S&P 500: Hologic

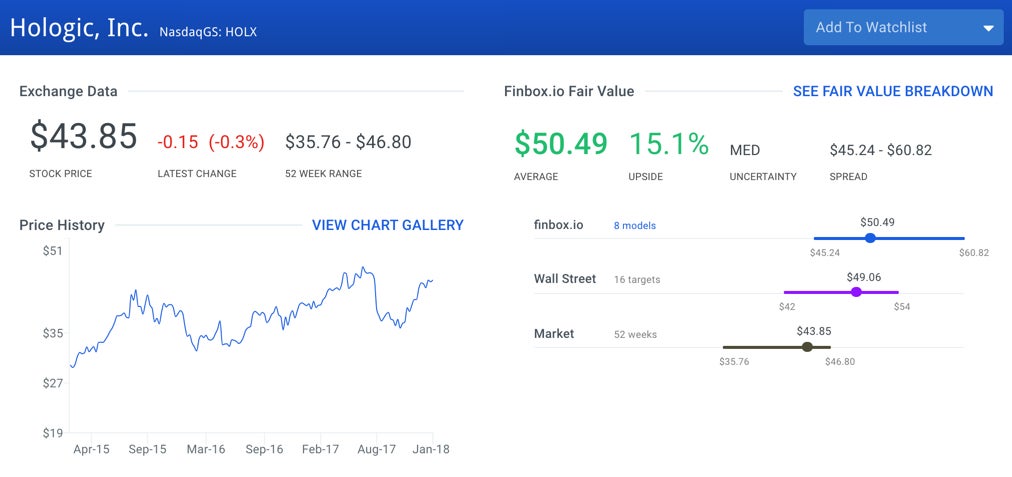

Hologic, Inc. HOLX manufactures diagnostics products, medical imaging systems, and surgical products for women worldwide. The company operates through five segments: Diagnostics, Breast Health, Medical Aesthetics, GYN Surgical, and Skeletal Health. The company sells its products through direct sales and service forces, and a network of independent distributors and sales representatives. Hologic was founded in 1985 and is headquartered in Marlborough, Massachusetts.

On a comparable company basis, selected benchmark companies include Edwards Lifesciences Corp EW, Stryker Corporation SYK, Zimmer Biomet Holdings Inc ZBH and Boston Scientific BSX. Hologic's LTM EBITDA multiple of 8.2x is below EW (21.2x), SYK (22.0x), ZBH (16.2x) and BSX (22.2x). The company's P/E multiple is also below the entire peer group.

Source: finbox.io

Hologic's stock currently trades at $43.85 per share as of Thursday January 18, up 10.1% over the last year. Finbox.io's eight valuation analyses suggest that shares could increase 15.1% going forward.

Top 10 Value Stocks In The S&P 500: Campbell Soup

Campbell Soup Company CPB manufactures and markets food and beverage products. It operates through three segments: Americas Simple Meals and Beverages; Global Biscuits and Snacks; and Campbell Fresh. The Americas Simple Meals and Beverages segment engages in the retail of Campbell’s condensed and ready-to-serve soups. The Global Biscuits and Snacks segment provides Pepperidge Farm cookies, crackers, and bakery. The Campbell Fresh segment offers Bolthouse Farms fresh carrots, refrigerated beverages, and refrigerated salad dressings. Campbell Soup was founded in 1869 and is headquartered in Camden, New Jersey.

The company's valuation multiples implied by the market currently trade below all selected comparable companies ConAgra Brands CAG, Hershey Co HSY, Kellogg Company K and J.M. Smucker CO SJM.

Source: finbox.io

Shares of the company are trading -22.5% lower year over year. But the stock price could end up trading 14.4% higher in 2018 based on Campbell Soup's future cash flow projections.

Top 10 Value Stocks In The S&P 500: Molson Coors Brewing

Molson Coors Brewing Co TAP manufactures and sells beer and other beverage products in the United States, Canada, Europe, and internationally. It sells various products under the Coors Light, Miller Lite, Blue Moon, Leinenkugel, Keystone, Icehouse, Mickey’s and Milwaukee’s Best brands. The Company was founded in 1786 and is headquartered in Denver, Colorado.

Analysts covering the stock often compare Molson Coors Brewing to a peer group that includes Constellation Brands, Inc. STZ, Dr Pepper Snapple Group Inc. DPS, The Coca-Cola Co KO and Boston Beer Company Inc SAM. The company's LTM EBITDA multiple of 6.2x is below all of its selected comparable public companies: STZ.B (17.9x), DPS (14.1x), KO (22.3x) and SAM (11.5x). Its LTM P/E multiple of 8.0x is also well below this same peer group: STZ.B (23.3x), DPS (23.5x), KO (43.9x) and SAM (24.2x).

Source: finbox.io

Molson Coors Brewing's stock currently trades at $83.25 per share as of Thursday January 18, down -12.2% over the last year. On a fundamental basis, the company's stock is trading at a 12.2% discount to finbox.io's intrinsic value estimate.

Top 10 Value Stocks In The S&P 500

In conclusion, the table below ranks all 10 stocks by their upside.

| Ticker | Name | Upside (finbox.io) |

|---|---|---|

| NWL | Newell Brands | 28.4% |

| GILD | Gilead Sciences | 23.4% |

| PCG | PG&E Corporation | 21.0% |

| HBI | Hanesbrands | 20.8% |

| SIG | Signet Jewelers | 19.6% |

| LB | L Brands | 15.9% |

| HOLX | Hologic | 15.1% |

| CPB | Campbell Soup | 14.4% |

| FL | Foot Locker | 13.7% |

| TAP | Molson Coors Brewing | 12.2% |

Many investors prefer buying growth stocks because it's more exciting to have ownership stakes in companies like Amazon and Facebook. However, long-term value investors should take a closer look at the names above if you're looking for quality companies with nice upside potential.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.