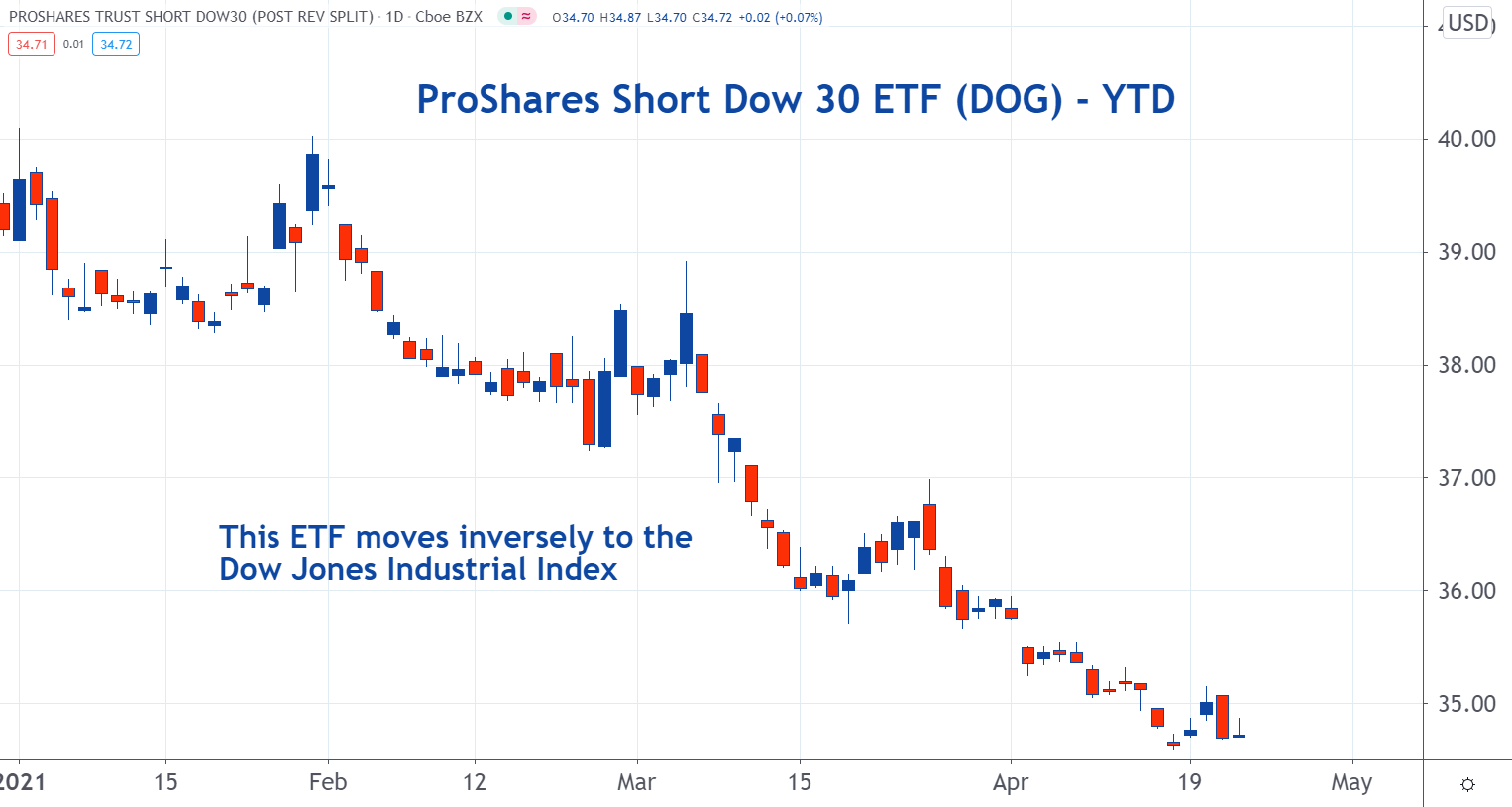

Inverse ETFs move in the opposite direction as the market. They include the ProShares Short Dow 30 ETF DOG, the ProShares Short S&P 500 ETF SH, and the Direxion Daily Small Cap Bear 3X Shares ETF TZA.

Some investors believe the stock market will go lower, but they may not want to use complicated options strategies to protect their portfolios. These investors could consider using inverse ETFs as a way to hedge themselves.

See Also: What Is An ETF?

The most widely cited index in the media is the Dow Jones Industrial Average. This index has been calculated and reported on since 1896. Its members include 30 large and well-known companies.

The ProShares Short Dow 30 ETF moves in the opposite direction of the Dow Jones. If the Dow is down by 1%, this ETF should rise by 1%.

The S&P 500 Index is also commonly cited by the media.

This Index is much more broad-based than the Dow. The Dow is made up of 30 stocks, while the S&P 500 consists of approximately 500 stocks.

The ProShares Short S&P 500 ETF moves in the opposite direction as the S&P 500 Index. If the index falls 5%, this ETF should appreciate by about 5%.

The Direxion Daily Small Cap Bear 3X Shares ETF is much more volatile than DOG and SH. It's structured to move three times inversely to the Russell 2000 Index, an index that consists of roughly 2,000 small-cap companies.

These small-cap stocks tend to be more volatile than the larger company stocks in the other indices. If the Russell 2000 drops by 1%, this ETF will gain about 3%.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.