Genius Brands International, Inc. GNUS on Monday broke up from a descending trendline called out by Benzinga on Aug. 3 and ran 5% higher. The move north was then followed by consolidation on Tuesday.

Genius Brands has been trading in a steep downtrend since reaching a high of $2.30 on June 9. The animated entertainment company’s stock is relatively volatile and has been the target of a short squeeze at least three separate times over the past 14 months.

In June 2020, long before the epic GameStop Corporation GME saga took place, Genius Brands squeezed 660% higher over the course of just seven trading days. Genius Brands was then targeted alongside GameStop and shot up over 90% on Jan. 27, the day before GameStop completed its parabolic journey to $483.

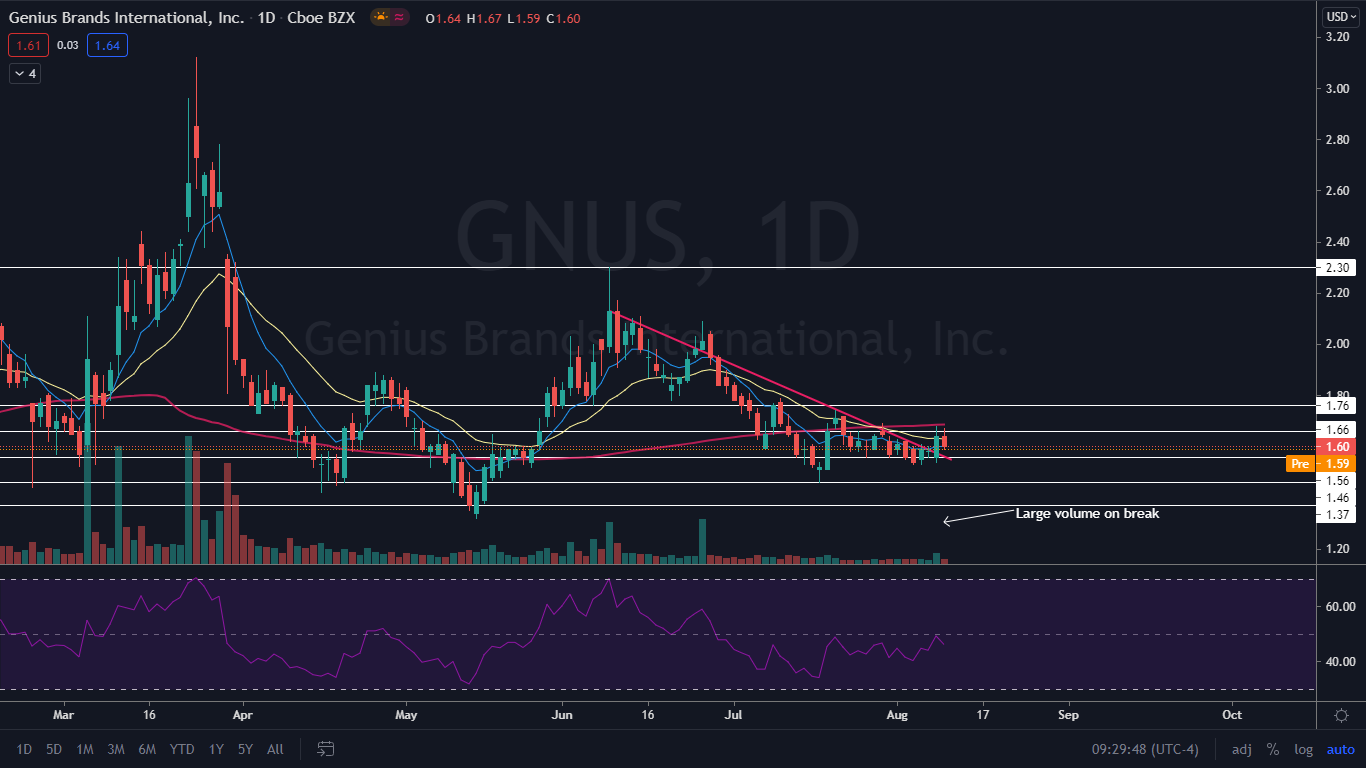

The Genius Brands Chart: When Genius Brands broke from the trendline, that had been holding it down since June 9, it was on above average volume. This indicates that the pattern was recognized. Bulls may want to see a few more candles print on the daily chart to make sure it isn’t a "bull trap" because the stock broke up in a similar way on June 25 before trapping bulls and falling back below the trendline.

When Genius Brands broke up from the trendline, it was able to push through a resistance level at $1.66 but slammed into the 200-day simple moving average (SMA) – rejecting and wicking from it. Where a security is trading in relation to the 200-day SMA provides an indication of overall sentiment. Genius Brands is trading below the SMA, which indicates overall sentiment is bearish.

Genius Brands is trading in line with the eight-day exponential moving average (EMA) but below the 21-day EMA with the eight-day EMA trending below the 21-day, which leans to bearish sentiment for the short term. It's a positive sign for the bulls that the eight-day is currently acting as support and bulls will want to see that continue.

- Bulls also want to see Genius Brand’s stock continue to hold over support at the $1.56 area, which currently aligns with the descending trendline and has also now become support. Although the stock may backtest the level as support, bulls want to see big bullish volume come in and push Genius Brands back up above the 21-day EMA to help propel it over resistance at $1.66. If it can regain the level as support, it has room to move up to $1.76 which would put it clearly over the 200-day SMA.

- Bears want to see Genius Brands fall back below the eight-day EMA and for big bearish volume to push the stock back down below the descending trendline. If Genius Brands were to fall below the level it would also lose support at $1.56, which would make a fall to $1.46 possible. Under $1.46 there is support at the $1.37 level.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.