Retail investors can gain exposure to the oil markets by using ETFs. One of them is the SPDR S&P Oil & Gas Exploration & Production ETF XOP.

The ETF follows the price of oil closely and that’s a good thing because oil may be about to rally.

The ETF has dropped to $75.50. This important level was resistance in July. Levels that were resistance can convert into support and that could happen here.

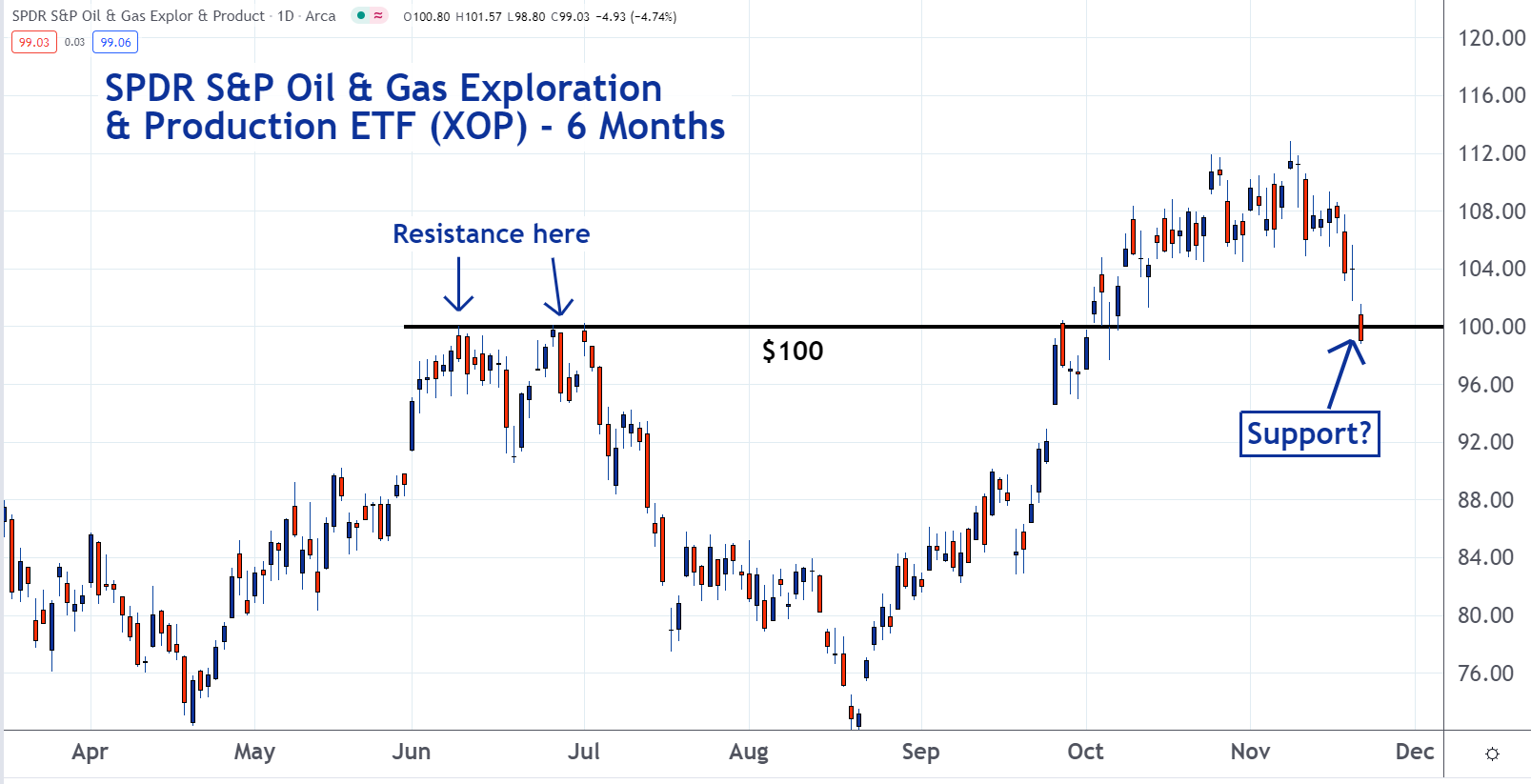

Back in July, XOP ran into resistance around $100 and this level appears to have turned into support. A new uptrend may be about to form in this ETF. If oil rebounds, XOP will follow.

To learn more about reading charts check out the new Benzinga Trading School.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.