Alexandria Real Estate Equities Inc ARE is the largest office real estate investment trust (REIT) in the U.S. by market capitalization and has been one of the best performing office REITs over the past five years. The company was also one of the first in its sector to see its share price recover from the COVID-19 pandemic.

The REIT’s share price rose over 30% in 2021, closing its all-time high of $223.57 on New Year's Eve. This price gain is likely to have left many investors feeling like they missed out on the bulk of the upside for this company, but there are several reasons to believe that this REIT still has plenty of growth left in it.

Real Estate Portfolio: The long-term outlook for office real estate remains uncertain with vacancy rates increasing as companies are shedding unused office space. However, there is a growing demand for office space among certain industries, such as life sciences and technology, which are the industries that make up the bulk of Alexandria Real Estate’s tenants.

70% of the REIT’s annual rental income comes from public and private biotechnology, pharmaceutical and life sciences companies. Another 10% is from mega cap and large cap technology companies.

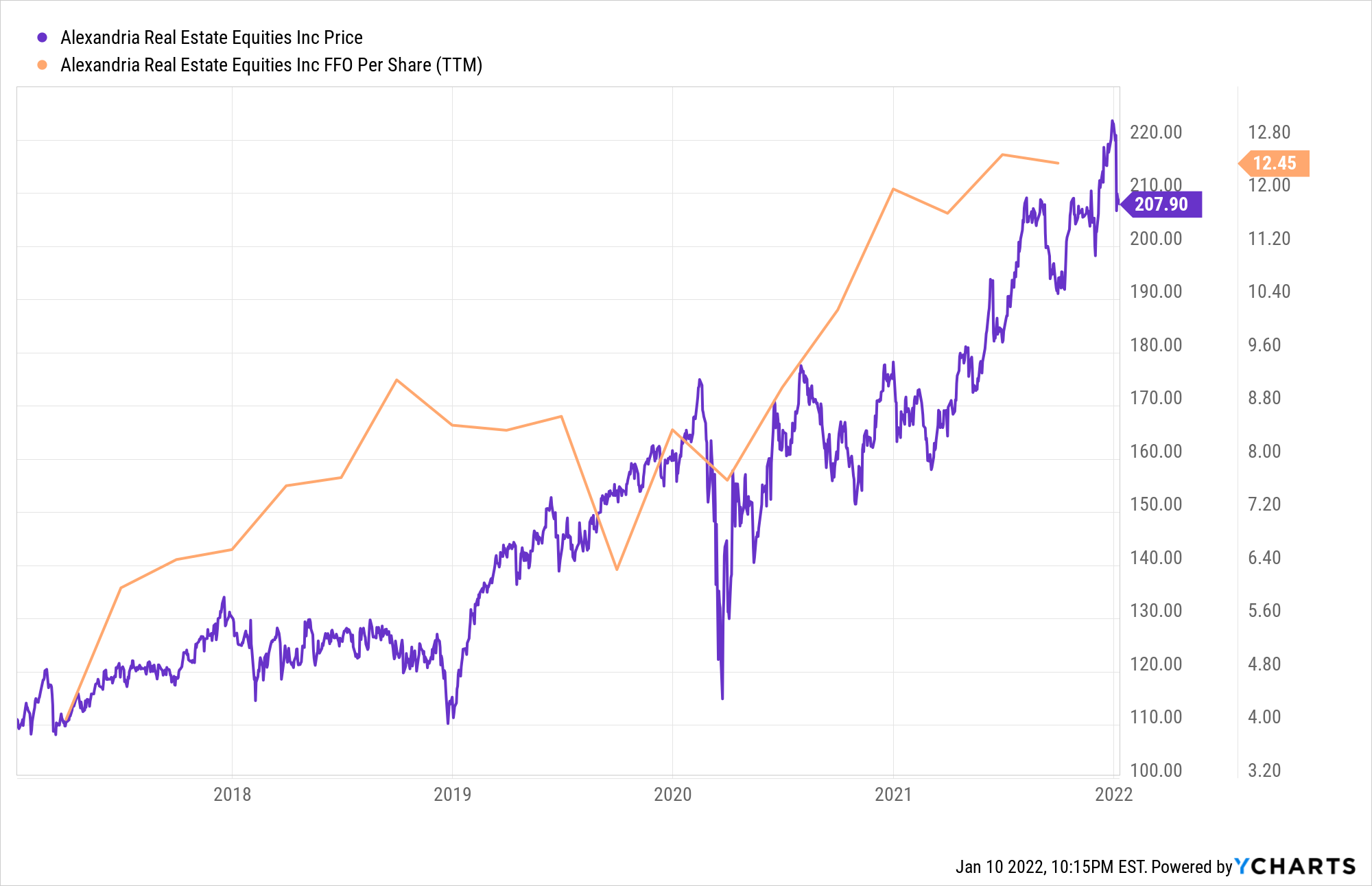

FFO per Share Growth: While the company’s share price has been steadily climbing over the past several years, its funds from operations (FFO) per share has been climbing at an even faster rate. This has created an even more attractive valuation, even priced at above $200 per share.

Source: YCharts

Recent Price Drop: The company’s share price fell roughly 7% last week after it announced a public offering of 7 million shares of common stock. A price drop like this is common after a stock offering is announced considering shares are being diluted.

However, there’s a big difference between a REIT selling shares to cover expenses and keep itself out of trouble versus one raising capital to fund growth, which is what Alexandria Real Estate appears to be doing in this case.

The company currently has 7.7 million square feet of development projects in its pipeline, including Moderna Inc’s MRNA new 462,100 square foot headquarters and core R&D operations. These new developments are expected to add another $615 million in annual rental income to Alexandria Real Estate’s revenue and be accretive to its FFO per share.

The recent price dip may be an opportunity to capture some additional upside from a proven REIT with plenty of growth potential in its future.

Photo: Courtesy of Alexandria Real Estate Equities Inc.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.