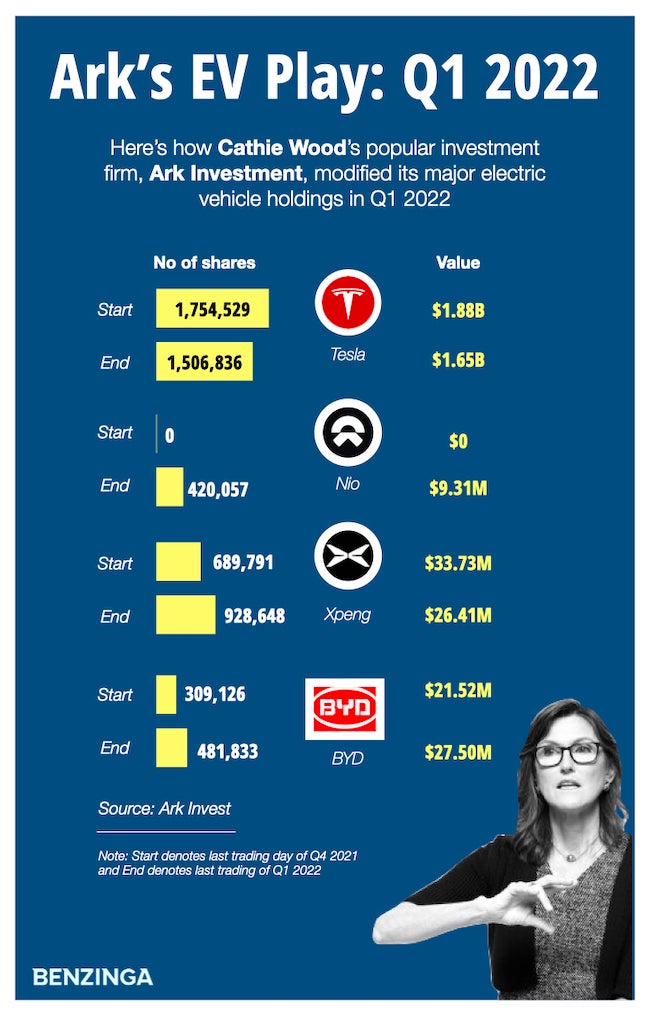

Cathie Wood’s Ark Investment Management upped its electric vehicle game in the first quarter as it initiated a new position in China’s Nio Inc NIO, while raising its exposure to other Chinese rivals and trimming its stake in Elon Musk-led Tesla Inc TSLA.

The popular stock-picking firm piled up more shares in Xpeng Inc XPENG and Warren Buffett-backed BYD Co BYDDY in the three months ended March 31.

Tesla Good Source Of Cash: Ark Invest during the first quarter booked profits in Tesla stock every time it rose.

“We have been selling (Tesla) recently because of how well it has done relative to the rest of the stocks in our portfolio,” Wood said last week in an interview with Bloomberg Radio.

“It has been a good source of cash and we have taken profits and deployed them into other stocks that we feel have been unfairly punished.”

St. Petersburg, Florida-based Ark Invest sold a total of 464,574 Tesla shares and bought 170,107 shares in the first quarter.

The investment firm held 1.5 million shares in Tesla as of March 31, compared with 1.75 million shares at the beginning of the first quarter, as shares gained 1.97% over this period.

In value terms, Ark's position fell to $1.65 billion from $1.88 billion.

Bets on Nio, Xpeng: Wood’s firm first initiated a position in Shanghai-based Nio on March 26, when it scooped up 420,057 shares. It has since not made any fresh trades on the company.

Ark added 342,323 shares in Xpeng, after having started to pile them up in December 2021. The investment firm held 928,648 shares in the Guangzhou-based EV maker at the end of the first quarter.

Wood last week said she has been buying shares in Xpeng and Nio because they are currently “very low-margin” companies.

Xpeng stock declined 45.2% in the first quarter, while Nio’s lost 33.5%.

Building Stake In BYD: Ark Invest in the first quarter bought 214,870 shares in BYD, backed by Berkshire Hathaway Inc (NYSE: BRK-A) (NYSE: BRK-B) Chairman Buffett.

The EV maker recently announced it had stopped producing traditional fossil fuel-powered vehicles.

Ark Invest held 481,833 shares in BYD at the end of the first quarter, from 309,126 earlier, with the stock losing 18% over this period.

Photo courtesy: Ark Investment

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.