Zinger Key Points

- Analysts expect Amazon to report EPS of 17 cents on revenues of $145.45 billion.

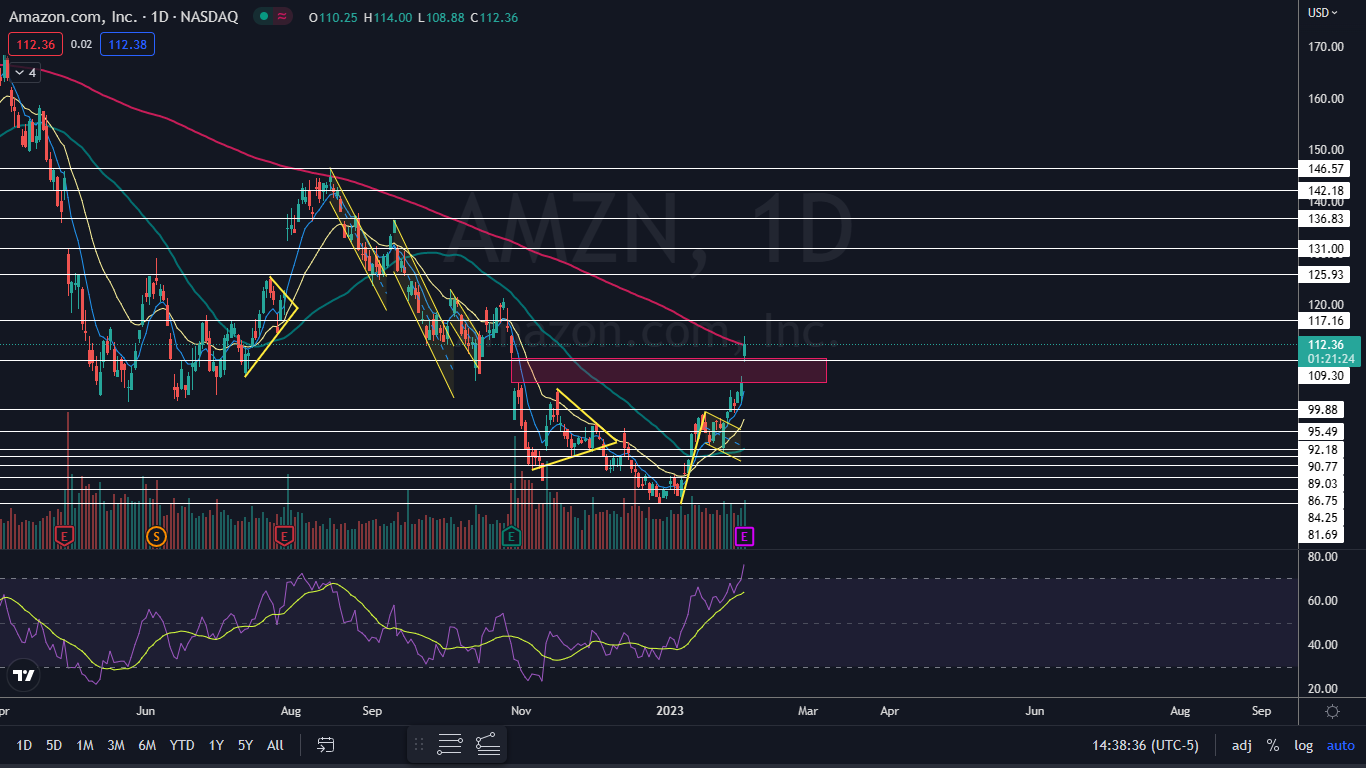

- The stock is trading in a strong uptrend, attempting to regain the 200-day SMA as support.

- Every week, our Whisper Index uncovers five overlooked stocks with big breakout potential. Get the latest picks today before they gain traction.

Amazon.com, Inc AMZN is set to print fourth-quarter financial results after the market close Thursday. The stock is surging over 8% heading into the event.

When the e-commerce and streaming giant printed its third-quarter results on Oct. 27, the stock gapped down over 9% the following day. Amazon then plunged into a downtrend, losing over 16% to reach a $81.69 low on Dec. 28 before reversing into an uptrend.

For the third quarter, Amazon reported earnings of 28 cents per share on revenue of $127.1 billion. The company beat the consensus estimate of EPS of 22 cents but missed on the $127.84-billion revenue estimate.

For the fourth quarter, analysts expect Amazon to report EPS of 17 cents on revenues of $145.45 billion.

See Also: More Amazon Warehouses Come Under Regulator Scanner Over Worker Safety

On Jan. 30, Credit Suisse analyst Stephen Ju maintained an Outperform rating on Amazon and raised the price target from $142 to $171. In contrast, Barclays analyst Ross Sandler maintained an Overweight rating and lowered the price target from $140 to $130.

From a technical analysis standpoint, Amazon’s stock looks neutral heading into the event, trading on the 200-day simple moving average as support but in need of a pullback. It should be noted that holding stocks or options over an earnings print is akin to gambling because stocks can react bullishly to an earnings miss and bearishly to an earnings beat.

Options traders, particularly those who are holding close dated calls or puts, take on extra risk because the institutions writing the options increase premiums to account for implied volatility.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Amazon Chart: Amazon temporarily burst up through the 200-day simple moving average on Thursday. Heading into earnings, the stock was sitting on top of the area. If Amazon receives a bullish reaction to its earnings print, the stock is likely to regain the area as support, which will give bullish traders more confidence going forward.

- On Wednesday, Amazon partly filled a gap that was left behind on Oct. 28 between $104.87 and $109.77. Amazon is now trading above that area, and if the stock suffers a bearish reaction to its earnings print, may fall to completely fill the gap on Friday.

- Amazon’s relative strength index (RSI) is measuring in at about 76%, which puts the stock well into overbought territory. Even if Amazon surges higher Friday, a pullback is likely in the cards for next week to bring the RSI level down to a more comfortable level.

- Amazon is trading in an uptrend, making a consistent series of higher highs and higher lows. The stock’s most recent higher low was formed on Monday at $99.01 and the most recent confirmed higher high was printed at the $103.49 mark on Jan. 27.

- Amazon has resistance above at $117.16 and $125.93 and support below at $109.30 and $99.88.

Read Next: Amazon's Drone Delivery Service Off To A Slow Start

Read Next: Amazon's Drone Delivery Service Off To A Slow Start

Photo via Shutterstock.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.