Zinger Key Points

- Analysts expect the company to report EPS of $1.20 on revenues of $7.39 billion.

- PayPal negated its uptrend on Thursday by printing a lower low.

- The new Benzinga Rankings show you exactly how stocks stack up—scoring them across five key factors that matter most to investors. Every day, one stock rises to the top. Which one is leading today?

PayPal Holdings, Inc PYPL is set to print its fourth-quarter financial results after the markets close on Thursday.

Analysts expect the company to report EPS of $1.20 on revenues of $7.39 billion for the quarter ending Dec. 30.

Ahead of the earnings print, Mizuho analyst Dan Dolev maintained a Buy rating on PayPal and cut the price target by $5, from $105 to $100. The new price target suggests 23% upside for the stock.

When PayPal printed its third-quarter earnings report on Nov. 3, the stock plunged almost 7% at one point the following day but ran into a group of buyers who caused the stock to close down just 1.62% on the day.

For that quarter, PayPal reported earnings per share of $1.08, beating a Street estimate of 96 cents per share. The company also posted a top line beat, reporting revenues of $6.85 billion compared to the $6.82-billion consensus estimate.

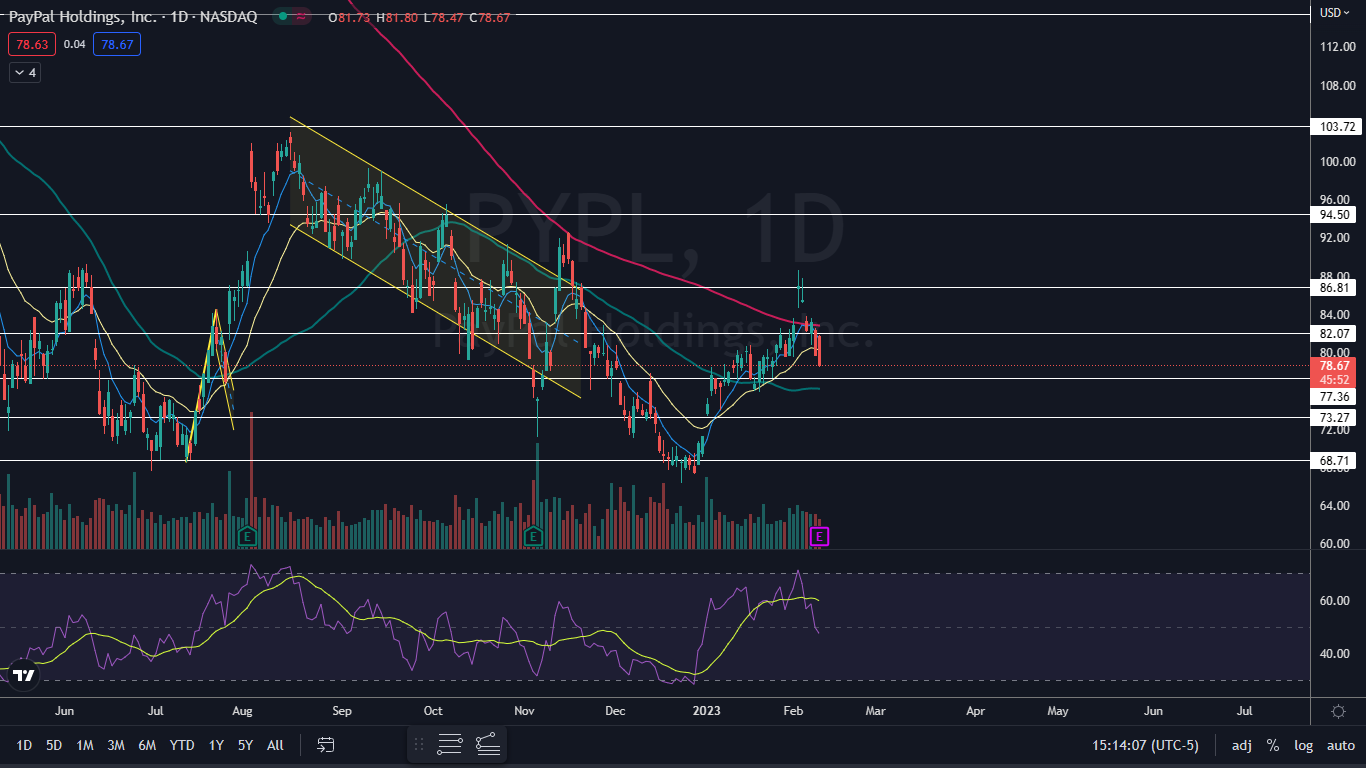

From a technical perspective, PayPal looks set to trade lower due to a downtrend that has developed on the stock’s chart. Of course, holding a position in a stock over earnings can be akin to gambling, as stocks can rise following an earnings miss and fall after reporting a beat.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The PayPal Chart: PayPal reversed into an uptrend on Dec. 22, making a series of higher highs and higher lows. On Thursday, the stock negated that uptrend by falling under the most recent higher low of $79.54, which was printed on Jan. 30.

- On Feb. 2 and Feb. 3, PayPal temporarily regained support at the 200-day simple moving average (SMA), which proved to be a bull trap because on Monday, PayPal gapped down and fell back under that area intraday. If PayPal pops higher following a bullish reaction to its earnings print, the stock may find resistance at the 200-day SMA.

- If PayPal continues to trade lower following the earnings print, the stock may find support at the 50-day SMA, which is trending near the $76 mark. If PayPal loses that area as support, a steep downtrend could occur.

- PayPal has resistance above at $82.07 and $86.81 and support below at $77.36 and $73.27.

Read Next: Affirm Earnings Came In Cold: What Do Analysts Think About The Stock Now?

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.