Zinger Key Points

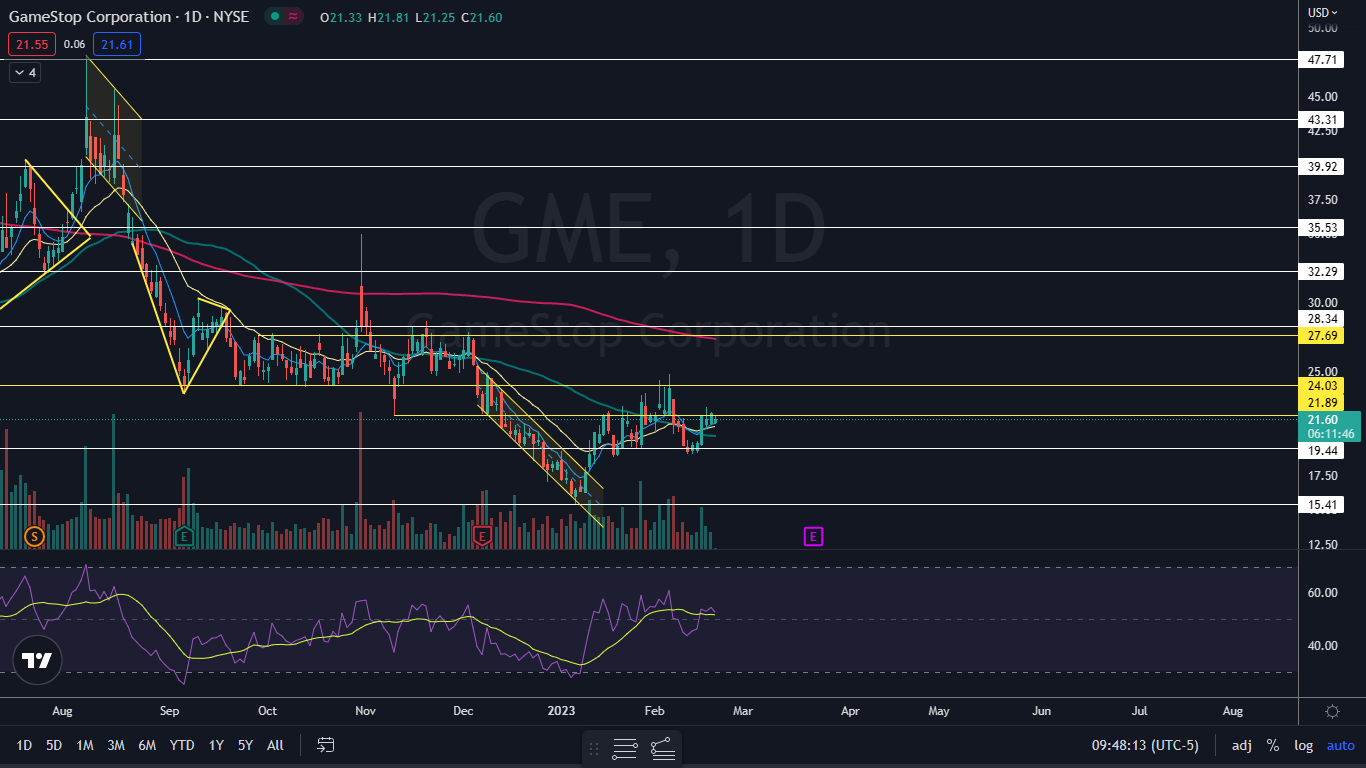

- GameStop is settling into a double inside bar pattern on the daily chart.

- Traders and investors can watch for the stock to break up or down from Friday's mother bar to gauge volume.

- Get two weeks of free access to pro-level trading tools, including news alerts, scanners, and real-time market insights.

GameStop Corporation GME stock was falling Tuesday morning after trending higher in Friday's session.

Friday’s price action appeared to be consolidation, and the stock’s trading range that day took place completely within Thursday’s range, which has settled GameStop into an inside bar patterm.

An inside bar pattern indicates a period of consolidation and is usually followed by a continuation move in the direction of the trend.

An inside bar pattern has more validity on longer time frames (four-hour chart or longer). The pattern has a minimum of two candlesticks and consists of a mother bar (the first candlestick in the pattern) followed by one or more subsequent candles. The subsequent candle(s) must be completely inside the range of the mother bar and each is called an "inside bar."

A double or triple inside bar can be more powerful than a single inside bar. After the break of an inside bar pattern, traders want to watch for high volume for confirmation the pattern was recognized.

- Bullish traders will want to search for inside bar patterns on stocks that are in an uptrend. Some traders may take a position during the inside bar prior to the break, while other aggressive traders will take a position after the break of the pattern.

- For bearish traders, finding an inside bar pattern on a stock that's in a downtrend will be key. Like bullish traders, bears have two options for where to take a position to play the break of the pattern. For bearish traders, the pattern is invalidated if the stock rises above the highest range of the mother candle.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The GameStop Chart: GameStop’s inside bar was formed on lower-than-average volume, which validates the stock's consolidation. The inside bar leans neutral in this case, and traders and investors can watch for the stock to break up or down from Thursday’s mother bar on higher-than-average volume to gauge future direction.

- On Tuesday, GameStop opened slightly lower. Bullish traders will want to see the stock bounce up from Friday’s low-of-day, while bearish traders want to see the stock break down from that area, which will cause GameStop to lose support at the eight-day exponential moving average.

- If GameStop breaks down bearishly from the inside bar pattern, bullish traders can watch for GameSop to form a reversal candlestick near the $19 mark, where GameStop bounced up from a bullish triple bottom pattern on Feb. 15.

- If the stock breaks up from the pattern, the next retracement lower may come near the $25 mark, which GameStop rejected on Feb. 6.

- GameStop has resistance above at $21.89 and $24.03 and support below at $19.44 and $15.41.

Read Next: Meme Stocks Are Back, Short Sellers Beware: The Quick-Hit Playbook For 2023

Read Next: Meme Stocks Are Back, Short Sellers Beware: The Quick-Hit Playbook For 2023

Photo via Shutterstock.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.