Zinger Key Points

- Tesla is trading in an uptrend, making a series of higher highs and higher lows.

- If the stock breaks down from the trend, it may find support at the 50-day SMA.

- Every week, our Whisper Index uncovers five overlooked stocks with big breakout potential. Get the latest picks today before they gain traction.

Tesla, Inc TSLA was trading slightly lower in the premarket on Monday, in contrast to the S&P 500, which was looking to open slightly higher after UBS Group AG UBS and Credit Suisse AG CS agreed to an acquisition.

Credit Suisse’s failure last week was the latest hit to the financial sector, which has been suffering amid the current global economic downturn brought on by stubborn inflation and rising interest rates.

On Tuesday and Wednesday, the Federal Reserve will meet to discuss the economic data that has been printed since it last met. At 2 p.m. on Wednesday, the central bank will announce whether it will continue to hike interest rates and if so, by how much.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

If the central bank decides to hold its federal fund rate between 4.5% to 4.75%, the market could rally. Tesla bull Gary Black predicts the EV stock will remain range bound into early April, however, when the company is expected to print its first-quarter delivery numbers, which could be the catalyst for Tesla’s next big move.

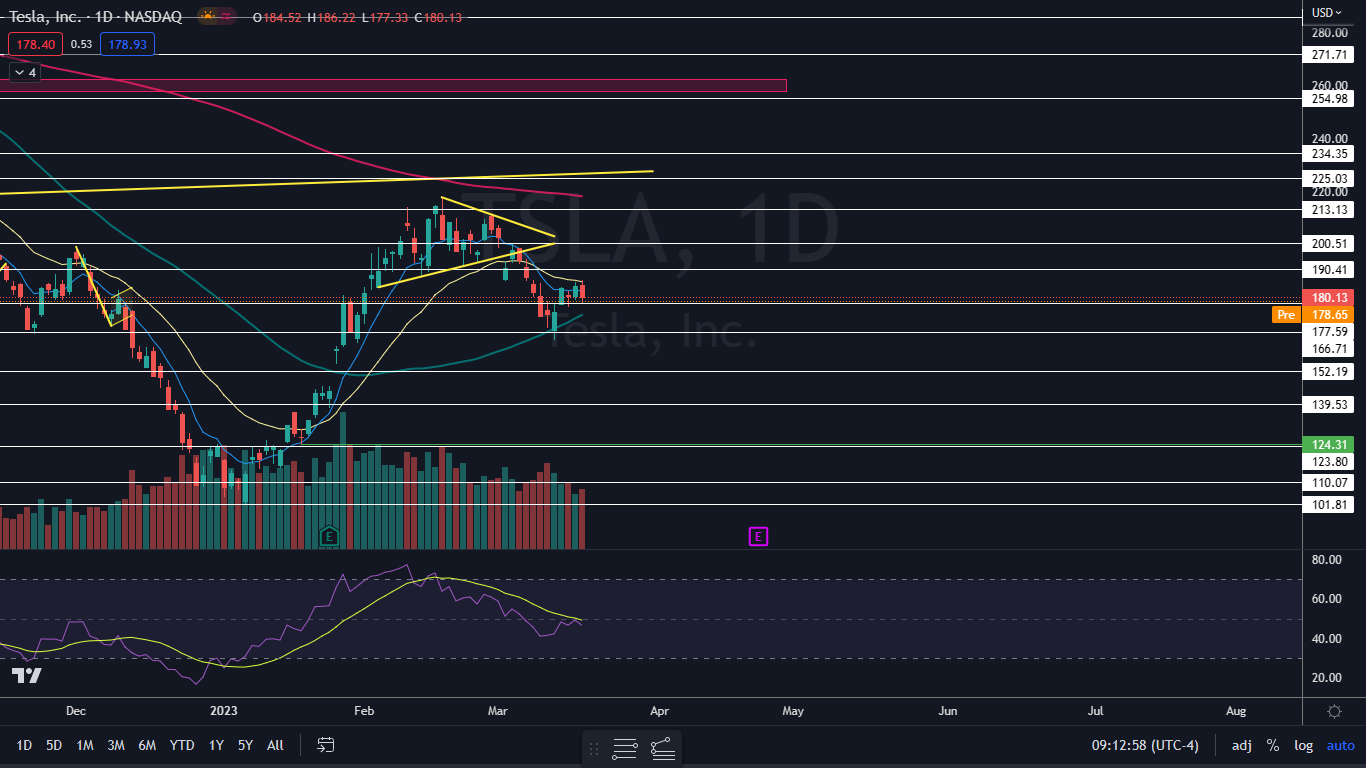

From a technical standpoint, Tesla looks set to trade higher over the near term because the stock is trading in an uptrend.

The Tesla Chart: Tesla confirmed a new uptrend on Thursday, by printing a higher high at the $185.81 mark. The stock's lower high, which negated its downtrend, was formed on Wednesday at $176.03.

- On Friday, Tesla traded mostly sideways in consolidation. The stock has seen decreasing volume since March 10, which suggests Tesla is running out of both buyers and sellers, indicating a larger move could be on the horizon.

- If Tesla breaks down under $176, the stock will negate its uptrend, although a downtrend won’t be confirmed unless Tesla prints a lower high. If that happens, Tesla may find support at the 50-day simple moving average, which is trending at about $173.

- If dip buyers come in on Monday and push Tesla up above Friday’s high-of-day, the stock will regain the eight-day and 21-day exponential moving averages, which would give bullish traders more confidence going forward.

- Tesla has resistance above at $190.41 and $200.51 and support below at $177.59 and $166.71.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Next:

Next: