Zinger Key Points

- Traders and investors are watching to see if First Republic becomes the next bank to fail.

- Bullish traders want to see the divergence on the stock's chart play out, while bearish traders want the downtrend to continue.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get Matt’s next trade alert free.

First Republic Bank FRC opened about 30% higher on Tuesday, near the middle of Monday’s trading range.

The stock has been wildly volatile recently amid uncertainty over whether the bank will survive the crisis of net deposit outflows that caused the recent failure of SVB Financial Group's SIVB Silicon Valley Bank.

The health of the financial sector has become a hot topic of discussion and many traders and investors are anxious to see if the Federal Reserve will continue to apply pressure on the economy by raising rates on Wednesday.

On Monday, news hit that JPMorgan Chase & Co. JPM CEO Jamie Dimon is in talks with several other big bank leaders to help solve First Republic’s outflow crisis, according to a report. Withdrawals at First Republic have exceeded $70 billion since Silicon Valley failed.

Whether or not larger banks are able to save First Republic from collapsing is yet to be seen, and from a technical analysis perspective, the stock is sending mixed signals, making it difficult to determine future direction.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

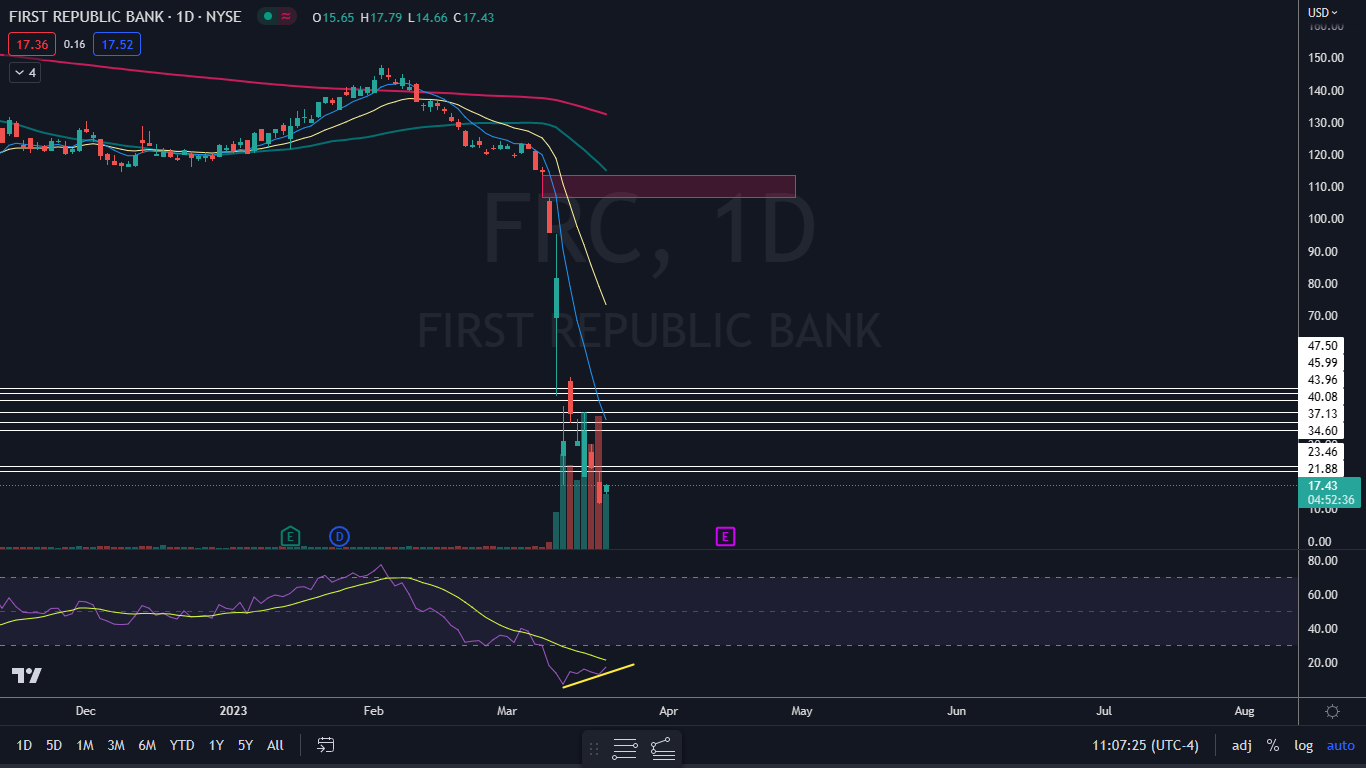

The First Republic Chart: From a bearish perspective, First Republic is trading in a confirmed downtrend and is making a series of lower highs and higher lows. The bank’s most recent lower high was formed on March 16 at $40 and the most recent lower low was printed at the $11.52 mark on Monday.

- On Tuesday, First Republic was forming an inside bar pattern, with all the price action taking place within Monday’s trading range. The pattern leans bearish in this case because First Republic is in a downtrend, but traders and investors can watch for the stock to break up or down from Monday’s range to gauge the future direction.

- From a bullish perspective, First Republic has developed a bullish divergence on the daily chart. A bullish divergence occurs when a stock makes a series of lower lows while its relative strength index makes a series of higher lows. The divergence indicates bullish momentum is returning to First Republic, which could signal a longer-term reversal.

- Conservative bulls and bears want to see First Republic’s volume continue to decline over the next few days to indicate consolidation. If that happens, a subsequent influx in volume, paired with a big move in either direction, will give traders more clarity.

- First Republic has resistance above at $21.88 and $23.46. The only support below is the psychologically important $15 and $10 levels.

Read Next: First Republic Bank Stock Bounces Back: What's Going On?

Read Next: First Republic Bank Stock Bounces Back: What's Going On?

Photo: Maurice NORBERT via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.