Zinger Key Points

- The energy sector recently rebounded on the back of strong oil price gains.

- Despite a stellar 2022, energy stocks continues to screen cheap valuations and solid balance sheets.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get Matt’s next trade alert free.

Following a record-breaking 2022, investors are wondering whether energy stocks still have untapped potential for long-term returns.

Oil prices have risen sharply in the last week, with WTI crude recording a 6% weekly gain and rising far above $70 per barrel on the back of lower-than-expected U.S. inventories and remarks from OPEC+ to maintain a tight supply throughout the year.

Commodities gains sent energy stocks higher, with the Energy Select Sector SPDR ETF XLE outperforming other equity sectors.

Occidental Petroleum OXY, up 4% on the week, and Valero Energy Corp. VLO, up 3% on the week, are two of the top performers in the energy sector during the past week.

The sector's giants, including Exxon Mobil Corp XOM and Chevron Corp CVX, have gained 10% and 6%, respectively, since the March lows.

Read more: Warren Buffett's Berkshire Hathaway Boosts Stake In Occidental Yet Again — Spends $1B This Month

The Reasons Why The Energy Sector Is a Good Pick for the Long Run

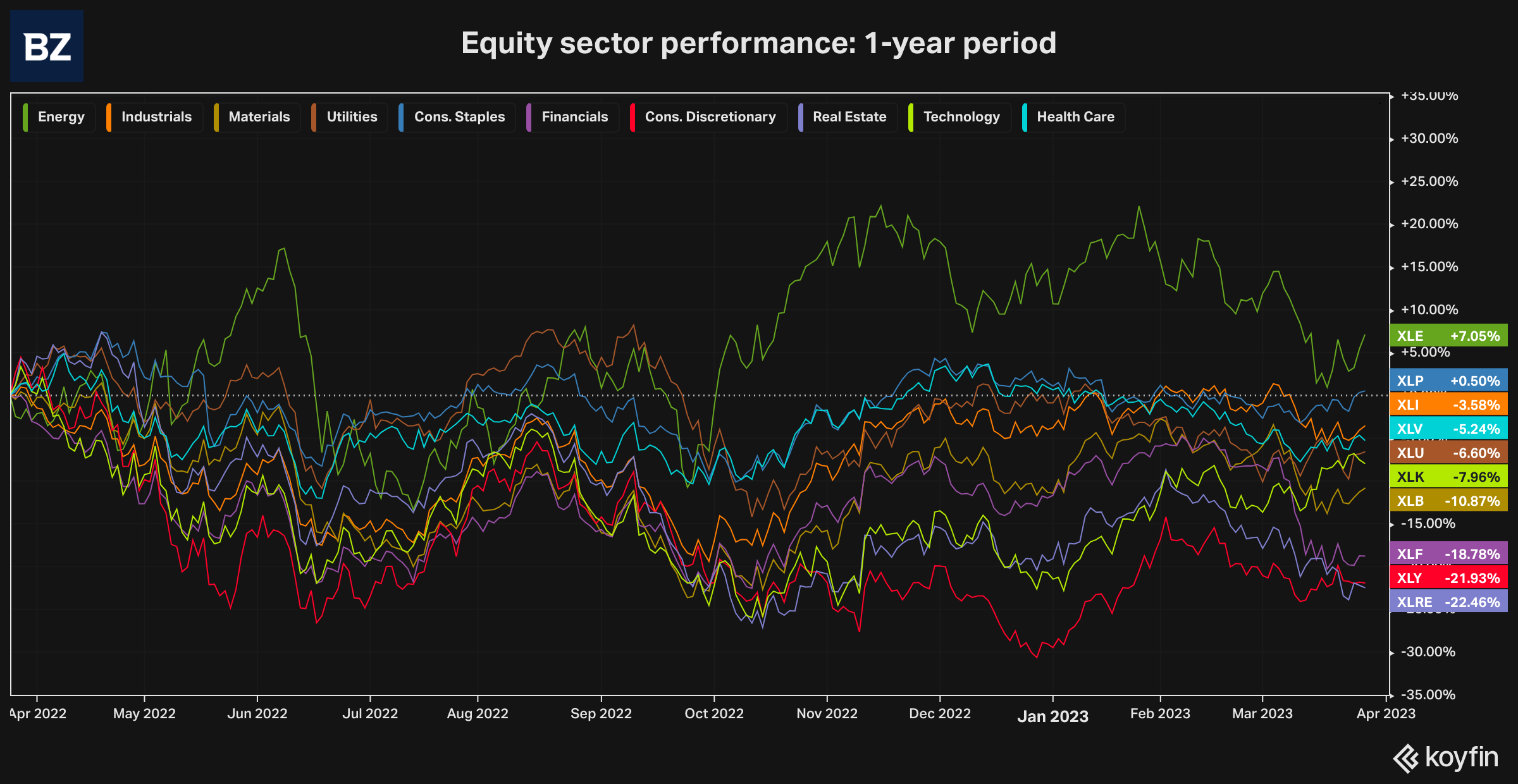

The energy sector (XLE) continues to screen the best sectoral performance in a one-year span, with a 7% gain.

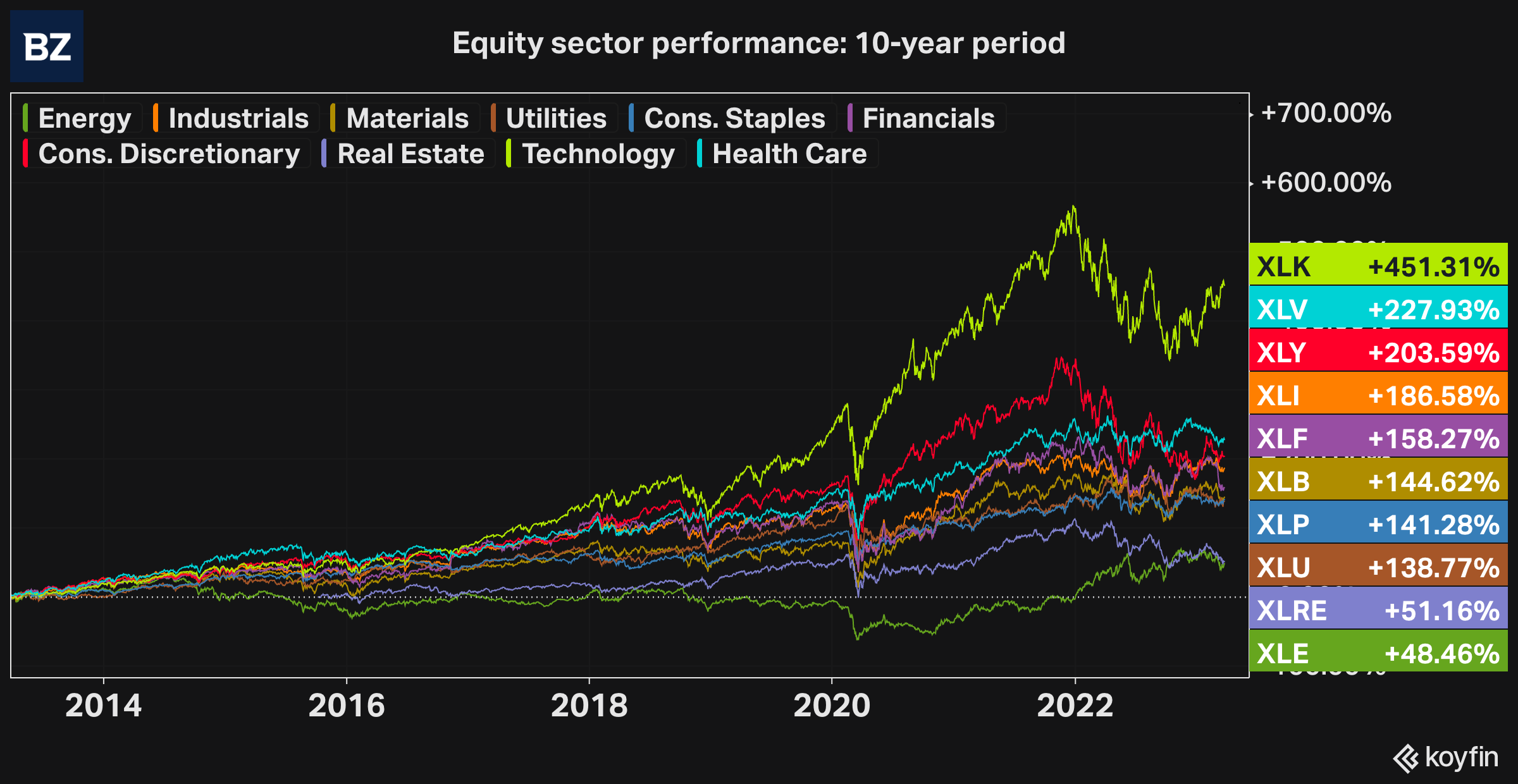

However, looking back at the past decade, the energy sector stands out as the poorest performer, trailing the technology sector by a staggering 353%.

Despite recent gains, the sector's considerable long-term underperformance makes it particularly attractive to long-term value investors.

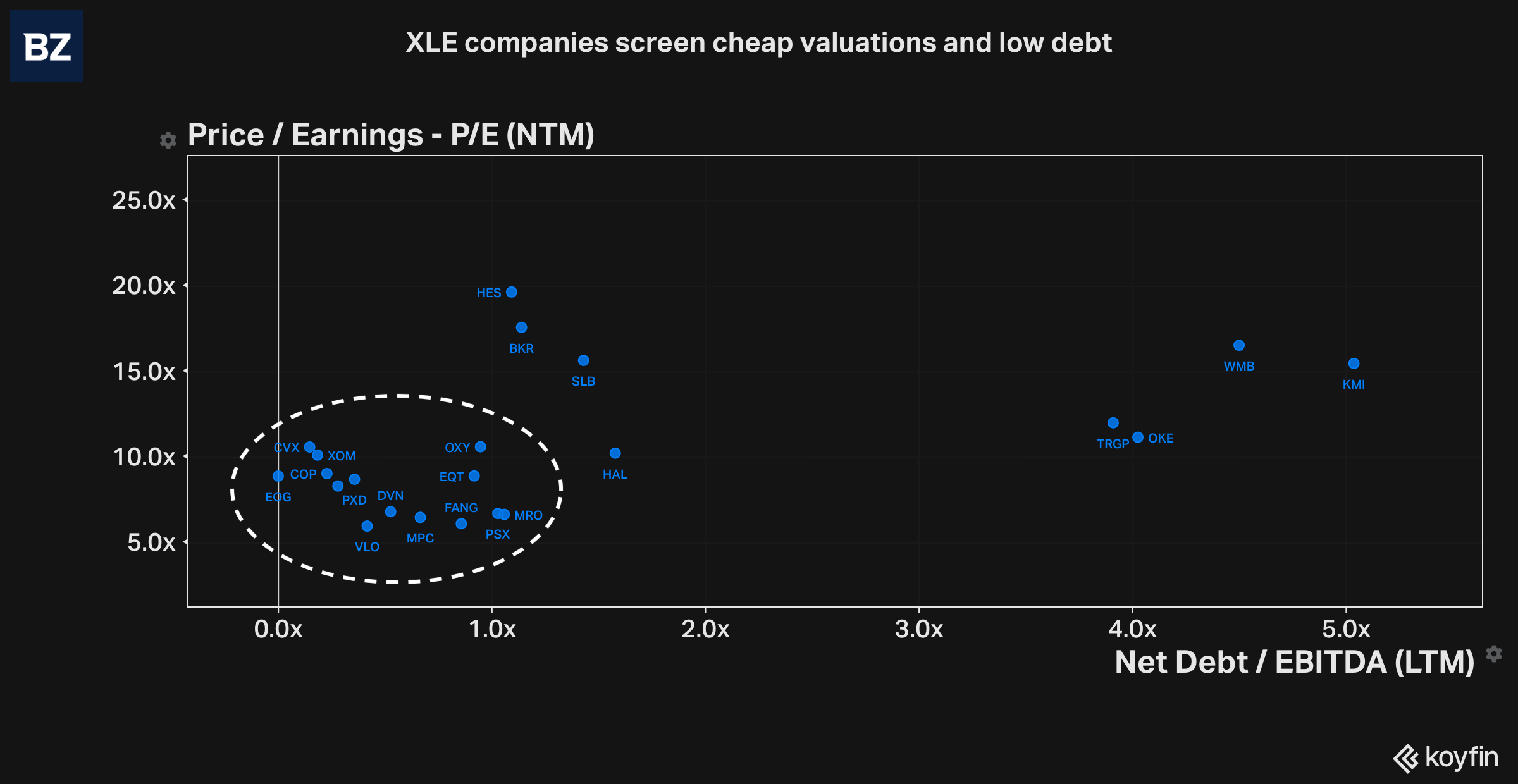

Currently, the majority of XLE holdings are exhibiting cheap valuations, based on the forward ratio and solid balance sheet fundamentals, as measured by the net debt/EBITDA ratio.

XLE Key Metrics:

- YTD Total Return: -6.7%

- 1-year Total Return: 7.05%

- 5-year Total Return: 54.11%

- 10-year Total Return: 48.46%

- Dividend yield: 3.48%

- P/E Ratio (Next Twelve Months): 7.44

Read next: Natural Gas Prices Hit 30-Month Low, But Cheniere Energy Is Trading Higher

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.