Zinger Key Points

- SPXS gapped higher to start Thursday's session, moving inversely to the S&P 500.

- SPXS and SPXL offer 3X leverage to play the S&P 500.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

The SPDR S&P 500 SPY gapped down to open Monday’s trading session, when the market ETF ran into a group of buyers who caused the SPY to climb from its low-of-day to erase its earlier loss.

Whether or not the market will continue in its current uptrend or reverse course, remains to be seen. The current trend suggests the SPY is likely to trade higher over the longer term.

However, as big tech earnings season kicks into full gear next week, the SPY could start to melt lower if companies continue to suffer bearish reactions.

Both Netflix and Tesla plunged following their first-quarter results reported on Tuesday and Wednesday, respectively.

Microsoft, Meta Platforms, Alphabet and Visa are just some of the mega-cap companies set to print their financial results this week.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

More experienced traders who wish to play the SPY either bullishly or bearishly may choose to do so through one of two Direxion ETFs. Bullish traders can enter a short-term position in Direxion Daily S&P 500 Bull 3X Shares SPXL and bearish traders can trade the inverse ETF, Direxion Daily S&P 500 Bear 3X Shares SPXS.

The ETFs: SPXL and SPXS are triple leveraged funds that track the movement of the SPY, seeking a return of 300% or –300% on the return of the benchmark index over a single day.

It should be noted that leveraged ETFs are meant to be used as a trading vehicle as opposed to long-term investments.

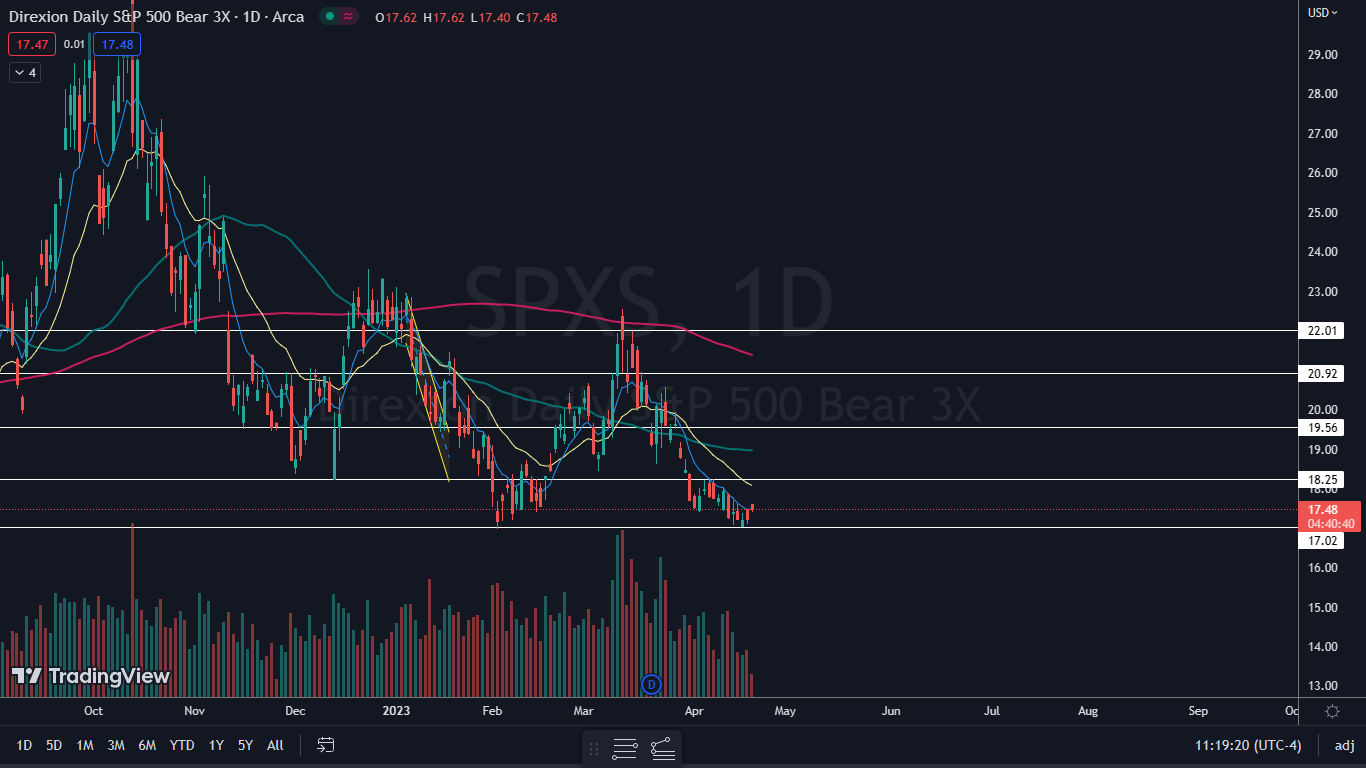

The SPXS Chart: SPXS gapped up slightly to start Thursday’s trading session, but not enough to negate the downtrend the ETF has been trading in since March 13. SPXS then ran into a group of sellers, who caused the ETF to drop to near flat.

- The ETF’s most recent confirmed lower high was printed on April 6 at $18.27 and the most recent lower low was formed at the $17.02 mark on Tuesday. If the ETF continues to trade lower on Friday, traders can watch for SPXS to eventually form a bullish reversal candlestick, such as a doji or hammer candlestick, to indicate the next local low has occurred, and the ETF will bounce higher, which could be a good entry point.

- If SPXS bounced to close Thursday’s trading session near its high-of-day, a continued climb higher could take place on Friday.

- SPXS has resistance above at $18.25 and $19.56 and support below at $17.02 and at the psychologically important $15 mark.

Read Next: Weekly Jobless Claims Rise Again, Reflecting More Labor Market Weakness: What You Need To Know

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.