Zinger Key Points

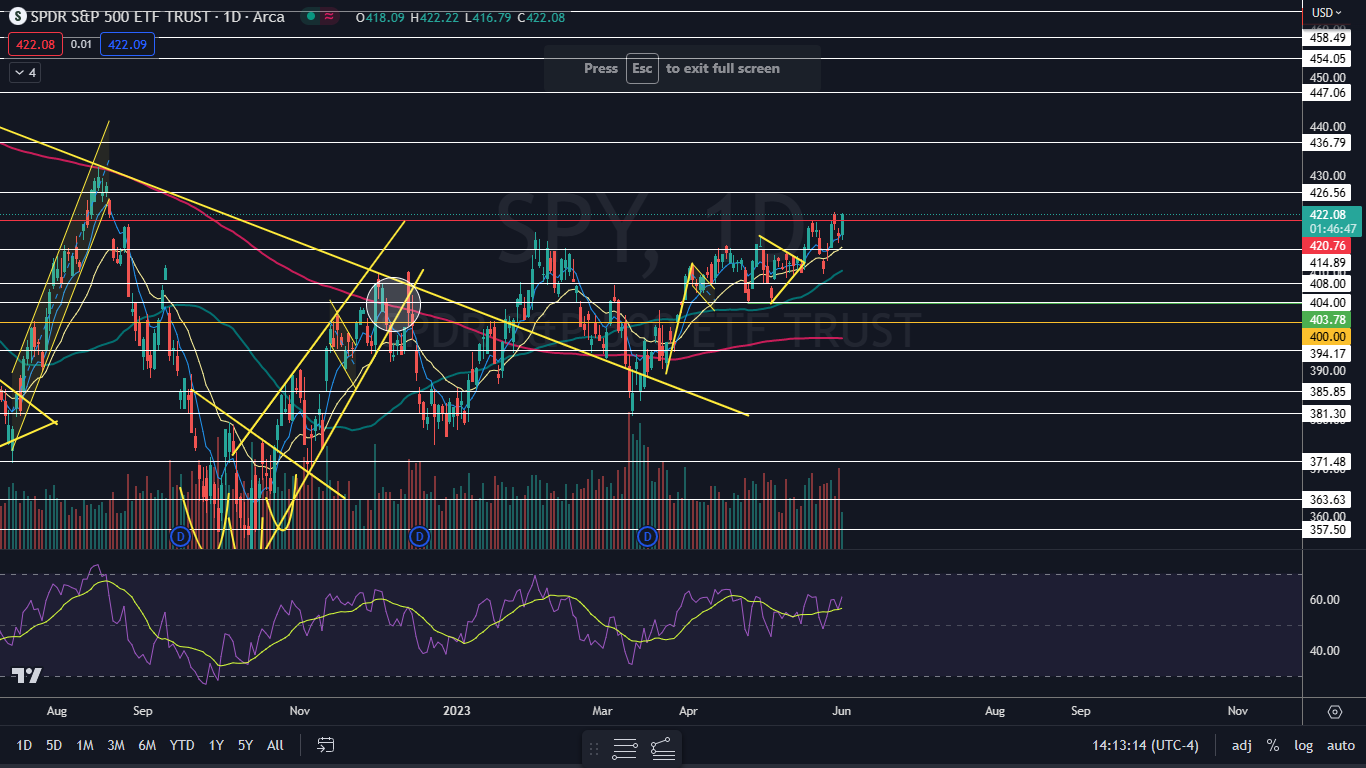

- The SPY is trading in an uptrend, attempting to form a higher high.

- The ETF burst up through heavy resistance near $421 on Thursday.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

The SPDR S&P 500 SPY was pushing up over 0.8% higher on Thursday, breaking through heavy resistance near the $421 level, which Benzinga pointed out was a key area for the bulls on Wednesday.

The move higher was propelled by news the U.S. House of Representatives passed the debt ceiling agreement.

Of the members who voted, 314 were in favor of President Joe Biden and House Speaker Kevin McCarthy's borrowing limit deal.

If the SPY continued to trade higher later on Thursday or on Friday and reached above Tuesday’s high-of-day, the current uptrend will be confirmed as intact. An uptrend occurs when a stock consistently makes a series of higher highs and higher lows on the chart.

The higher highs indicate the bulls are in control, while the intermittent higher lows indicate consolidation periods.

Traders can use moving averages to help identify an uptrend, with rising lower time frame moving averages (such as the eight-day or 21-day exponential moving averages) indicating the stock is in a steep shorter-term uptrend.

Rising longer-term moving averages (such as the 200-day simple moving average) indicate a long-term uptrend.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The SPY Chart: The SPY began trading in an uptrend on May 4, making a fairly consistent series of higher highs and higher lows. The most recent higher low was formed on Wednesday at $416.22 and the most recent confirmed higher high was printed at the $422.58 mark on Tuesday.

- If the SPY closed the trading session near its high-of-day price, which could indicate higher prices will come again on Friday. The second most likely scenario is that the ETF consolidates and prints and inside bar pattern, that would lean bullish for continuation next week.

- For short term bullish traders, the eight-day exponential moving average has been guiding the SPY higher since May 26 and a loss of the area could signal a solid exit point. If the SPY eventually falls under that level and volatility picks up, traders wishing to trade the volatility in the stock market can use MIAX’s SPIKES Volatility products. The products, which are traded on SPIKES Volatility Index SPIKE, track expected volatility in the SPDR S&P 500 over the next 30 days.

- The SPY has resistance above at $426.56 and $436.79 and support below at $420.76 and $414.89.

Read Next: Stock Market Volatility Decreases After House Passes Debt Ceiling Deal: A Technical Analysis

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.