Zinger Key Points

- UBOT is a double leveraged fund that tracks s a variety of stocks in the robotics, AI and automation sector.

- The ETF is trading in an uptrend but may be due for a pullback.

- Next: Get access to a new market-moving chart every day featuring a stock flashing clear technical signals. See today's pick now.

Direxion Daily Robotics, Artificial Intelligence & Automation Index Bull 2X Shares UBOT was trading over 3% higher on Friday after closing Thursday’s session up 3.92%.

AI and tech stocks have experienced a strong rally recently as automation becomes more advanced and integrated into people’s daily lives.

UBOT is a double-leveraged fund that offers 2x daily leverage to bullish movements across a variety of stocks in the robotics, AI and automation sector.

The ETF tracks a number of stocks through its holdings, with companies such as NVIDIA Corporation NVDA weighted at 8.91%, Intuitive Surgical, Inc ISRG weighted at 8.34% and a number of other foreign-listed companies within the sector.

It should be noted that leveraged ETFs are meant to be used as a trading vehicle as opposed to long-term investments by experienced traders. Leveraged ETFs should never be used by an investor with a buy-and-hold strategy or those who have low-risk appetites.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

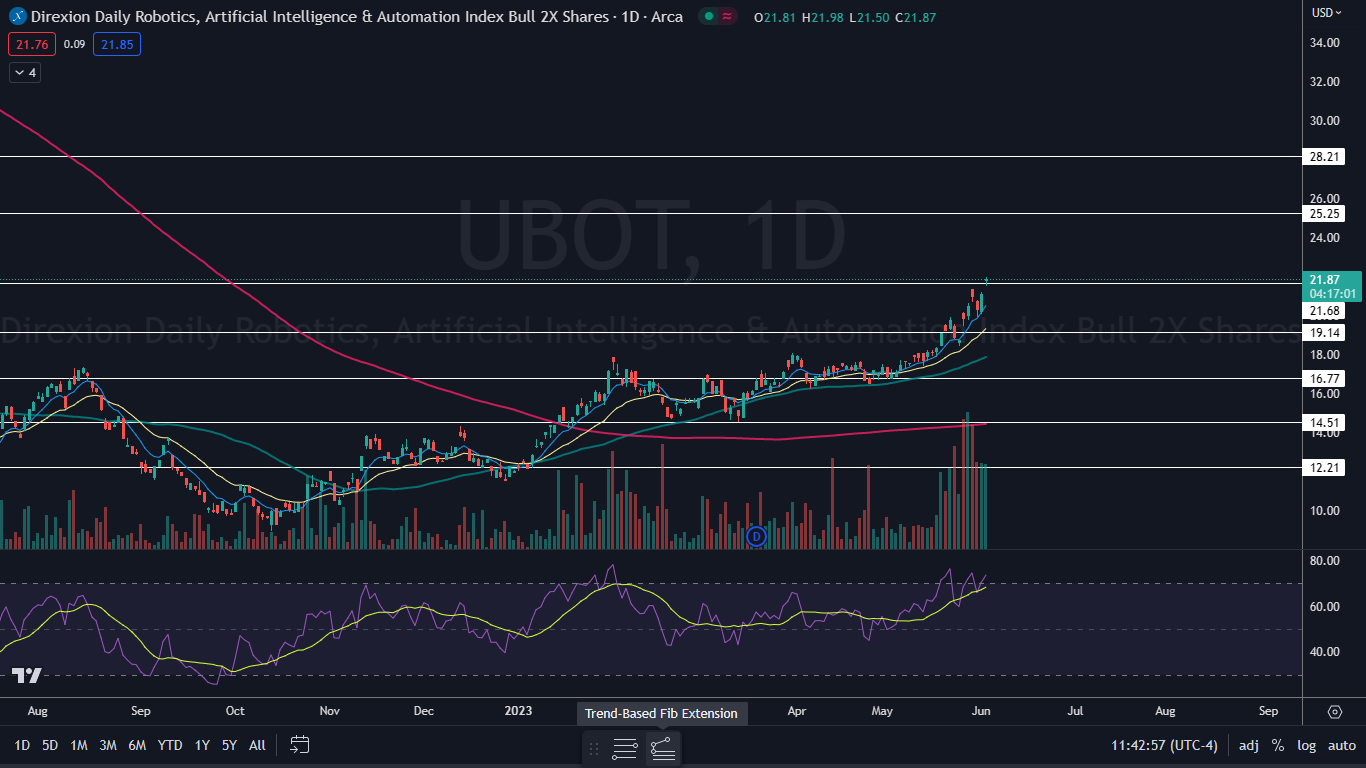

The UBOT Chart: UBOT gapped up to open Friday’s trading session and was trading near its opening price. The trading action had the ETF looking to print a doji candlestick, which could indicate the local top has occurred and UBOT will retrace on Monday.

- The ETF has been trading in a fairly consistent uptrend since March 15, making a series of higher highs and higher lows. UBOT’s most recent higher low within the pattern was formed on Wednesday at $19.93 and the most recent confirmed higher high was printed at the $21.38 mark the day prior.

- A pullback, at least for the ETF to print another higher low is likely to come over the next few trading days because UBOT’s relative strength index (RSI) is measuring in at about 73%. When a stock or ETF’s RSI reaches or exceeds the 70% mark, it becomes overbought, which can be a sell signal for technical traders.

- UBOT has resistance above at $25.25 and $28.21 and support below at $21.68 and $19.14.

Read Next: Which Stocks Are Responding To The Strong Jobs Report? 10 Top Movers

Read Next: Which Stocks Are Responding To The Strong Jobs Report? 10 Top Movers

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.