Zinger Key Points

- DRIP is a 2X leveraged fund that tracks the energy sector bearishly.

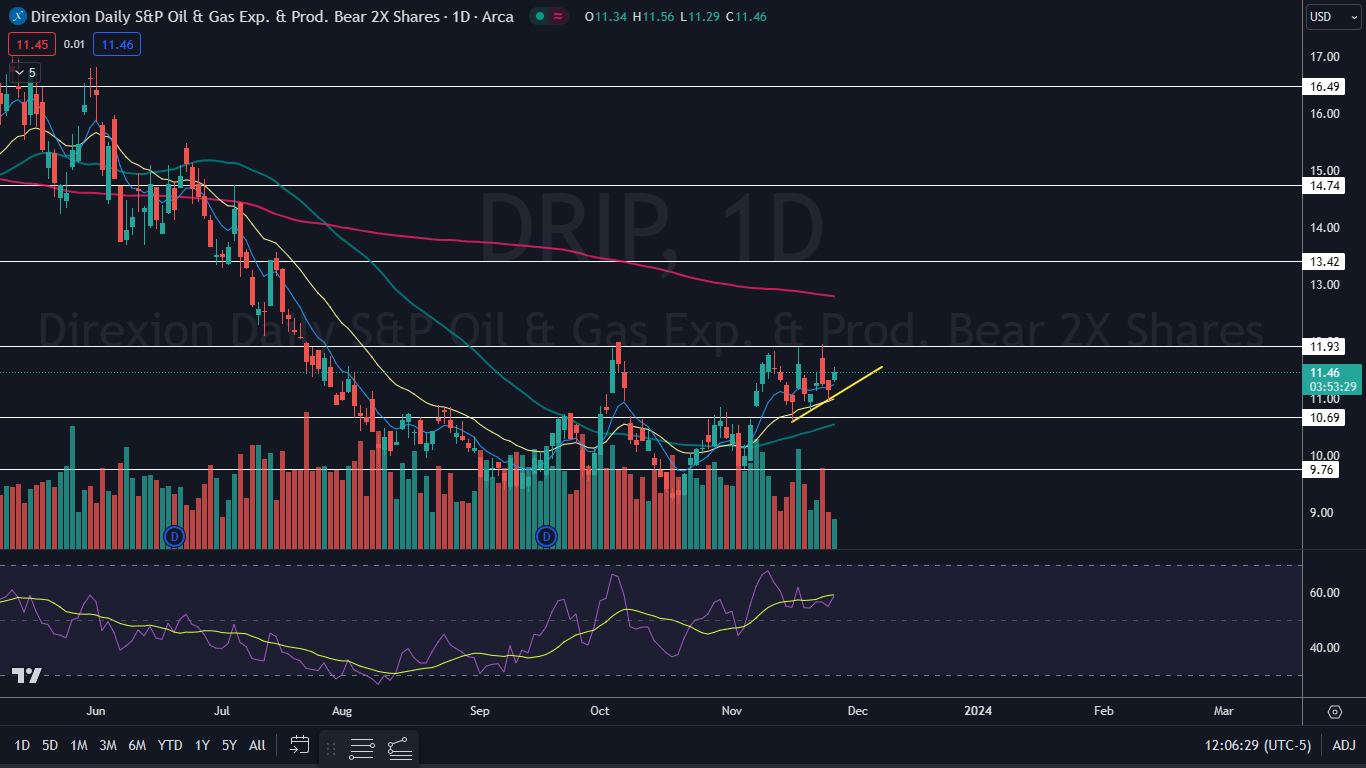

- The ETF is trading in an uptrend, bouncing up from a lower ascending trendline above the 50-day SMA.

- The ‘Trade of the Day’ is now live. Get a high-probability setup with clear entry and exit points right here.

Direxion Daily S&P Oil & Gas Exp & Prod Bear 2X Shares DRIP was rising about 2.5% Monday ahead of Thursday’s OPEC+ oil policy meeting, which was originally scheduled to take place on Sunday.

Traders and investors appear to be expecting that even if cuts are announced, little will change because the current supply is high.

On Nov. 20, Stifel analyst Derrick Whitfield maintained a Buy rating on Marathon Oil Corporation Corp MRO and dropped a price target from $40 to $39. On Nov. 14, Mizuho analyst Nitin Kumar maintained a Buy rating on Exxon Mobil Corp XOM and lowered the price target from $139 to $133.

DRIP is an inverse double-leveraged fund designed to track companies held in the S&P Oil & Gas Exploration & Production Select Industry Index by 200%.

A few of the most popular companies held in the ETF are Exxon, which is weighted at 2.54% within the ETF; Occidental Petroleum Corporation OXY, weighted at 2.48%; and Marathon Oil, weighted at 1.45%.

It should be noted that leveraged ETFs are meant to be used as a trading vehicle as opposed to long-term investments.

For traders looking to play the oil and gas sector bullishly, Direxion offers the Direxion Daily S&P Oil & Gas Exp & Prod Bull 2X Shares GUSH.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The DRIP Chart: DRIP has been trading in an uptrend since Nov. 3, making a series of higher highs and higher lows. The most recent higher high was formed on Nov. 22 at $11.95 and the most recent higher low was printed at the $10.96 mark on Friday.

- On Monday, DRIP was rising slightly on lower-than-average volume, which indicates weakness from the bulls. If DRIP falls on Tuesday due to that weakness, Monday’s high-of-day will serve as a lower high, which will negate the uptrend.

- Bullish traders want to see DRIP continue to trend higher above a lower ascending trend line, which the ETF has been bouncing up from since Nov. 16. If that happens, DRIP will eventually break through heavy resistance near the $12 mark.

- Bears want to see big bearish volume come in and knock DRIP down under the 50-day simple moving average, which could accelerate downside pressure.

- DRIP has resistance above at $11.93 and at $13.42 and support below at $10.69 and at $9.76.

Read Next: Oil Majors: Are BP And Chevron Attractively Valued After Share Price Tumbles?

Read Next: Oil Majors: Are BP And Chevron Attractively Valued After Share Price Tumbles?

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.