Zinger Key Points

- After Aswath Damodaran revealed he bought Tesla stock at $180, Redditors discuss whether it is a good buy price for the stock.

- While a few say it is an opportune time, others expressed caution citing various factors. Technical analysis suggests support at $160.

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

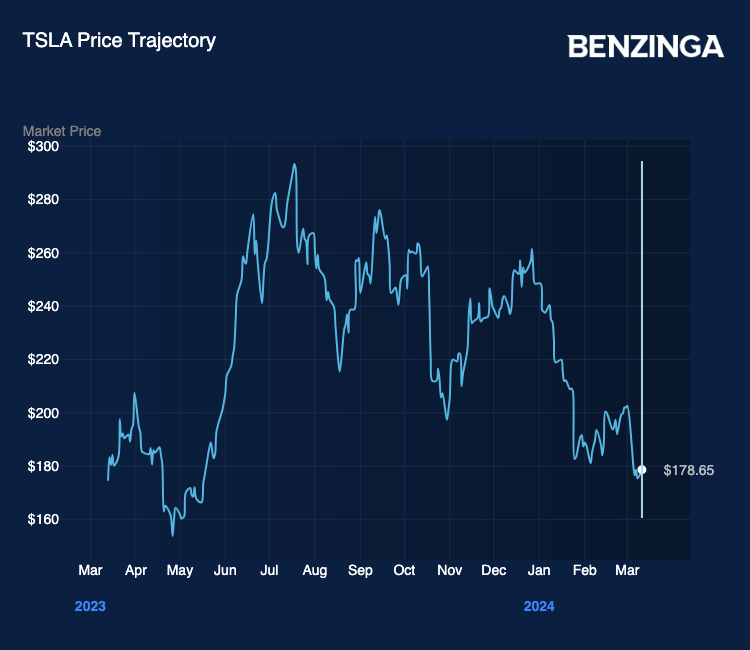

In a video interview, Aswath Damodaran, a renowned figure in the investing world, has disclosed his purchase of Tesla Inc TSLA stock at approximately $180. This revelation has sparked discussion among investors, with Redditors at r/ValueInvesting sharing their thoughts on whether Tesla is a good buy at its current price.

During the interview, Damodaran talked about how the Magnificent Seven stocks saved the market in 2023. He discussed his investment in each of these stocks, highlighting that he bought Tesla stock just a week back at $180 a share.

Shares of Tesla are currently trading just below $180. Here’s what Redditors have to say about Tesla stock’s price right now.

Some Say It Is An Opportune Time

Redditor solodav highlighted that Damodaran, known for his valuation expertise, made the purchase at what seems like an opportune time. Damodaran has a history of buying without requiring a margin of safety, emphasizing his willingness to buy at or below intrinsic value.

Warhawk_1 recalled Damodaran’s previous actions, noting that he bought Tesla when there was a high bankruptcy risk but sold early during the beginning of the bull run when positive gross margins were achieved.

Redditor daynighttrade defended Tesla’s diversified offerings beyond cars, citing the vast charging network and advantages over legacy automakers by avoiding dealer markups. He compared Tesla to Apple, emphasizing the broader perspective.

Also Read: Cathie Wood’s Ark Invest Sees $28 Trillion Opportunity In AI: Tesla, Drones And More

Others Expressed Caution

Some Redditors expressed caution regarding Tesla’s current situation. namron79 pointed out concerns, including the absence of delivery guidance for the year, economic challenges in China, and uncertainties around Model 3 refresh qualifications for tax credits.

Redditor ughthat raised concerns about Tesla’s P/E ratio of 40, increased competition, and regulatory scrutiny. The sentiment leaned towards skepticism, waiting for substantial evidence that Tesla is more than just a car company. “With the current trajectory I think everything above $100 is overvalued,” the Redditor stated.

Teembeau expressed skepticism about purchasing Tesla shares, citing concerns such as its high P/E ratio, a market capitalization surpassing that of the top five automakers combined, and the difficulty of overcoming consumer brand loyalty. CEO Elon Musk‘s conduct and doubts regarding the company’s self-driving technology were also noted. “Everyone knows that self-driving doesn’t work,” the Redditor wrote.

Technical Analysis Suggests Support At $160

ChungWuEggwua suggested that Tesla’s stock could potentially drop to the $160s, finding support based on technical analysis. However, the Redditor highlighted the importance of Tesla proving itself beyond being just a car company.

Investors are encouraged to conduct thorough research, consider various perspectives, and assess their risk tolerance before making investment decisions. As Damodaran’s purchase prompts discussions, it underscores the dynamic nature of investment choices and the importance of individual analysis.

Read Next: Wall Street’s ‘Dean Of Valuation’ Says Nvidia Stock Is ‘Priced To The Point Of Insanity,’ But These 2 Magnificent 7 Stocks Can Be Bought Right Now

Photo: Sheila Fitzgerald/Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.