Zinger Key Points

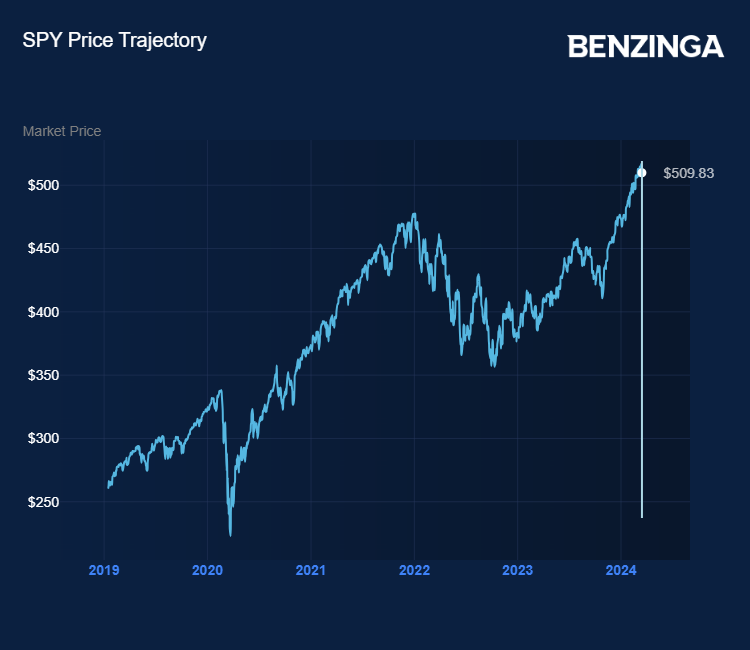

- The global stock markets began to nosedive in late-February 2020 following the onset of the COVID-19 pandemic.

- The market staged a V-shaped recovery and resumed its uptrend that lasted until the end of 2021.

- Find out which stock just claimed the top spot in the new Benzinga Rankings. Updated daily— discover the market’s highest-rated stocks now.

The S&P 500 currently trades just shy of its all-time highs, indicating investor optimism about the economy’s future direction. This is a reversal of fortunes from four years ago, when the equity market plummeted shortly after the COVID-19 pandemic.

The 2020 Market Crash: The U.S. equity market was on a broader uptrend after it bottomed in March 2009.

After an 11-year run, the market experienced a significant downturn in early 2020 due to the onset of the pandemic, which inflicted heavy tolls on human lives and disrupted global operations.

The global stock markets began to nosedive in late-February 2020, with the selling intensifying over the following weeks. On March 16, 2020, the S&P 500 closed at a multi-year low of 2,386.13, experiencing a drop of 12%, the biggest during the pandemic downturn. Market watchers called the day “Black Monday II,” as the previous Monday, when the broader gauge fell about 8%, had been called “Black Monday I.”

On March 16, stocks across sectors sold off, with Apple, which was then the top market-cap company, shedding over 12% on a single day.

See Also: Best ETFs To Buy Right Now

V-Shaped Recovery: Global central banks and governments collaborated in a concerted effort to swiftly reverse the downturn of markets, including that in the U.S. With the S&P 500 Index embarking on an upward trajectory, supported by stimulus measures, the U.S. economy began to emerge from the recession.

The rally continued through the end of 2021 and the uptrend was broken in 2022, as stimulatory measures put in place stoked inflationary pressure. The Federal Reserve was left with the unenviable task of raising the Fed funds rate. As the central bank was quick and aggressive with its rate hikes, consumer confidence took a hit and tough credit conditions pressured businesses.

The market saw a turnaround starting in 2023, benefiting from the economy’s resilience in a higher-rate environment. There has been no looking back ever since.

Returns From SPY: The SPDR S&P 500 ETF Trust SPY, which is an exchange-traded fund that tracks the performance of the S&P 500 Index, ended March 16 at $224.53. A hypothetical $1,000 invested in SPY at its depressed price in 2020 would have fetched 4.5 units of the ETF. The same units would be currently worth $2,271, a return of 127% over a four-year period.

Source: Benzinga

The SPY ended Friday’s session down 0.69% at $509.83, according to Benzinga Pro data.

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.