The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Tencent Music Entertainment Group – ADR TME

- On Aug. 13, Tencent Music Entertainment reported a fiscal second-quarter 2024 revenue decline of 1.7% year-over-year to $985.00 million (7.16 billion Chinese yuan), missing the analyst consensus estimate of $996.68 million. Cussion Pang, Executive Chairman of TME, commented, "We are pleased to report another quarter of robust results, driven by the strong performance of our online music services. With over 10 million net subscriber additions in the first half of 2024 and ARPPU expansion, we continue to break new grounds within China's streaming landscape." The company's stock fell around 10% over the past month and has a 52-week low of $5.96.

- RSI Value: 29.61

- TME Price Action: Shares of Tencent Music fell 2.5% to close at $9.51 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest TME news.

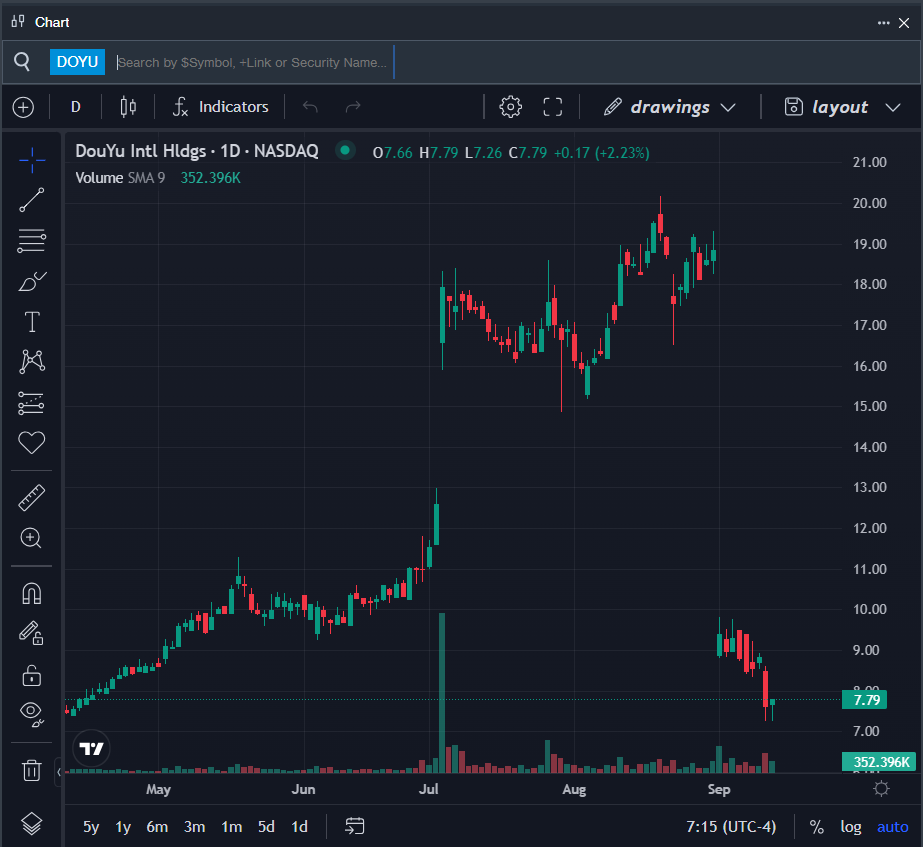

Douyu International Holdings Ltd DOYU

- On Sept. 12, DouYu International reported a fiscal second-quarter revenue decline of 25.9% to $142.01 million year-on-year, missing the analyst consensus estimate of $186.96 million. The company's stock fell around 59% over the past month. It has a 52-week low of $6.29.

- RSI Value: 24.49

- DOYU Price Action: Shares of Douyu International rose 2.2% to close at $7.79 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in DOYU stock.

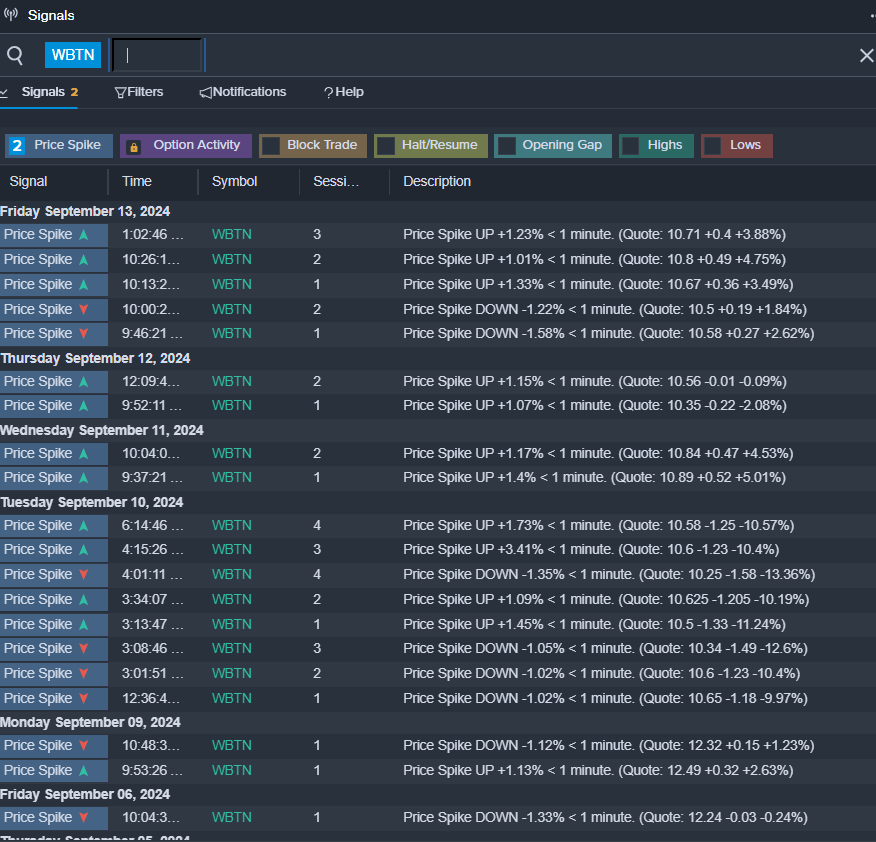

Webtoon Entertainment Inc WBTN

- On Aug. 8, Webtoon Entertainment reported worse-than-expected second-quarter revenue results. Junkoo Kim, Founder and CEO said, “In June, we brought WEBTOON to the public markets, introducing our revolutionary mobile storytelling formats and global IP & creator ecosystem to the investment community. After nearly two decades of innovation as the pioneers of the webcomic format, we’re thrilled to begin the next chapter of our story as we continue to build our business and help our creators earn money and build global fandoms for their work.” The company's shares fell around 15% over the past five days and has a 52-week low of $10.22.

- RSI Value: 28.30

- WBTN Price Action: Shares of Webtoon Entertainment rose 1.1% to close at $10.42 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in WBTN shares.

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.