Zinger Key Points

- Tesla’s profits lead the pack, while Rivian relies on partners to keep moving forward.

- Rivian’s rugged appeal is distinct, but Tesla’s dominance in tech keeps it ahead in the EV race.

- How to Spot the Market Bottom: Matt Maley has navigated every major market turn in the last 35 years, and on Wednesday, March 26, at 6 PM ET, he’s revealing how to recognize when the worst is over, the trades to make before the next bull market takes off, and the stocks and sectors that will lead the recovery.

As the electric vehicle landscape charges forward, Tesla Inc TSLA and Rivian Automotive Inc RIVN stand as two of the most-watched U.S. players in the industry.

But while Tesla has a strong profit engine driving its future, Rivian has been burning cash, relying on partners like Volkswagen AG VLKAF to keep up the pace.

Who has the edge in the EV race, and can Rivian's adventurous brand and recent partnerships help it close the gap?

Profitability: Tesla's Cash Vs. Rivian's Burn Rate

Tesla has mastered profitability, showing that EVs can be lucrative even in a competitive market.

Rivian, by contrast, reported a $1.46 billion loss in the second quarter, translating to roughly $33,000 lost on each vehicle sold. Despite initial buzz and a record IPO, Rivian's financials remain challenging, casting doubt on its path to profitability.

Products & Brand Appeal: Tesla's Tech Dominance Vs. Rivian's Adventure Edge

Tesla's streamlined, tech-focused vehicles continue to dominate urban and suburban markets, and the Cybertruck has even Tesla skeptics intrigued.

Read Also: Tesla Engineer Denies Prioritizing ‘Affluent’ Cybertruck Owners For Lightbar Installation

Rivian, with its rugged R1T and R1S models, targets adventure enthusiasts but now faces reliability issues, which may impact its niche reputation.

Upcoming mid-size models like the R2 and R3 could broaden Rivian's appeal if it can stabilize production.

Tesla Stock Vs. Rivian Stock: Bullish Streak Vs. Unsteady Climb

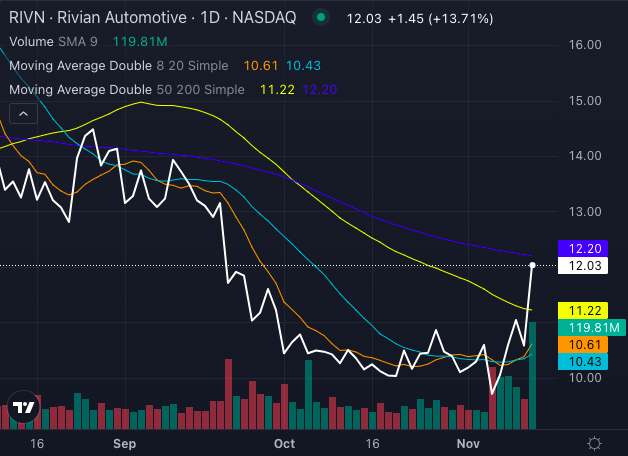

Chart created using Benzinga Pro

Tesla's stock remains bullish, with prices well above major moving averages, signaling strong market confidence.

Chart created using Benzinga Pro

Rivian, despite recent boosts from its Volkswagen deal, struggles to sustain long-term momentum.

While partnerships with giants like Volkswagen hint at future potential, Rivian's stock is volatile, with mixed technical indicators suggesting investors remain cautious.

Read Next:

Rivian vs Tesla. Photos via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.