Wall Street bulls held their ground to start 2025 despite the DeepSeek artificial intelligence AI news, tariff worries, and beyond.

The bulls are holding the line near the S&P 500 and Nasdaq's 50-day moving averages and the post-Trump election breakout levels. The sideways start to 2025, which helped cool an overheated stock market, came even though earnings results and guidance have been largely positive.

See the Zacks Earnings Calendar to stay ahead of market-making news.

Today's episode of Full Court Finance at Zacks explores two Zacks Rank #1 (Strong Buy) stocks—Arista Networks and Robinhood Markets—that investors might want to buy heading into their earnings releases and hold for long-term growth.

Why This Soaring AI Stock is a Great Buy-and-Hold Investment

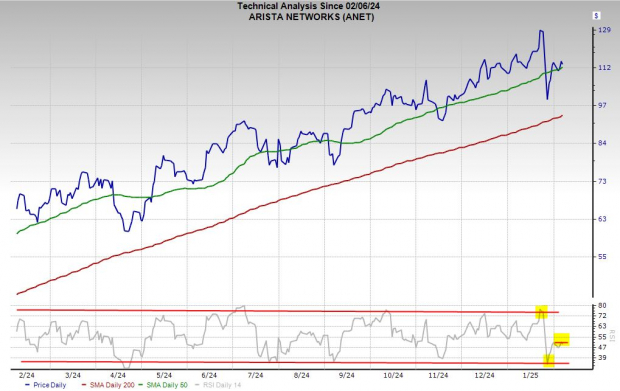

Arista Networks ANET stock has ripped 75% higher in the last 12 months to triple the Zacks Tech sector. ANET's recent outperformance is part of a much stronger run over the last decade.

Arista is back above some key technical levels following its DeepSeek selloff. Yet, ANET trades 10% below its highs heading into its Q4 2024 earnings release on Tuesday, February 18.

Image Source: Zacks Investment Research

Arista Networks is a client-to-cloud networking powerhouse, concentrating on large AI, data center, campus, and routing environments. ANET's networking infrastructure expanded rapidly over the past decade alongside the explosion of cloud computing, big data, and most recently artificial intelligence.

Microsoft MSFT and Meta META are two of Arista's largest clients and both are dedicated to spending billions of dollars on their AI data center expansion despite the DeepSeek news.

ANET grew its revenue from $361 million in 2013 to $5.86 billion in 2023, posting 37% average sales growth in the trailing three years. Arista Networks is projected to boost its sales by 19% in FY24 and 18% in 2025 to $8.18 billion.

Image Source: Zacks Investment Research

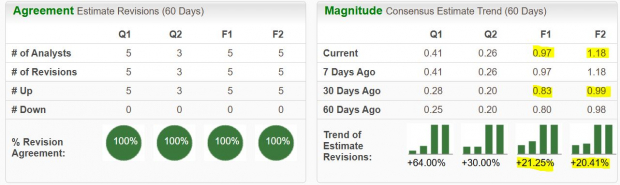

The networking infrastructure firm is projected to grow its adjusted earnings by 26% in 2024 and 10% in FY25, following 52% EPS expansion in FY23. Arista's earnings revisions have continued to climb over the last year, and its Most Accurate FY25 estimate came 9% above consensus.

ANET's upbeat EPS outlook earns it a Zacks Rank #1 (Strong Buy) and it's topped our estimate by an average of 15% in the trailing four quarters.

Arista has an impressive balance sheet, with $7.4 billion in cash and equivalents and nearly $13 billion in assets against $3.6 billion in total liabilities and zero debt.

ANET's valuation could hold the stock back. ANET trades at 52X forward earnings, compared to Tech's 26X.

But Wall Street has gladly paid a big premium for ANET for a decade as they celebrate its growth in a critical industry.

Image Source: Zacks Investment Research

ANET stock skyrocketed roughly 2,800% in the past 10 years, leaving Meta's 840% and Microsoft's 850% runs in the dust and blowing away Tech's 320%. This includes a 240% surge in the last two years and a 45% jump in the last six months.

ANET tumbled on the back of the DeepSeek news, but buyers pushed it right back above its 50-day. The recent selloff and the comeback took it from heavily overbought RSI levels to neutral.

This Stock Might Be Ready for a Breakout After Climbing 385% in the Last Year

Robinhood Markets HOOD has been a Wall Street star over the last year, soaring 385%, including an 80% surge in the past three months. The free stock-trading app transformed into a true competitor to Fidelity and other online broker giants.

Robinhood looks ready to possibly surpass its 2021 peaks before or after it reports its Q4 results on Wednesday, February 12.

Image Source: Zacks Investment Research

Robinhood helped change the entire online broker industry when it rolled out commission-free stock trading, which is now standard across many digital brokers including Fidelity. Robinhood has transformed from a popular pandemic-era trading app into a legitimate rival to Fidelity, catering to a large swath of investors and sophisticated traders with a growing portfolio.

Robinhood has rolled out retirement accounts, crypto trading, futures, and more. HOOD in October introduced Robinhood Legend, a browser-based desktop trading platform built for active traders.

Robinhood is expanding into the robo-advisor and wealth management businesses. HOOD in November agreed to buy TradePMR, a custodial and portfolio management platform for Registered Investment Advisors (RIAs).

Wall Street is also glad Robinhood finalized its SEC settlement in January.

Image Source: Zacks Investment Research

Robinhood grew its monthly active users by 7% YoY in Q3 to 11.0 million, with average revenue per user 31% higher to $105. HOOD's Assets Under Custody jumped 76% YoY to $152.2 billion, "driven by continued Net Deposits and higher equity and cryptocurrency valuations."

HOOD is projected to swing from an adjusted loss of -$0.61 a share last year to +$0.97 a share in 2024 and then add 22% to the bottom line next year.

Robinhood's earnings outlook has surged over the last year, including 20% jumps for FY24 and FY25 in the last few months. HOOD's upward earnings revisions land it a Zacks Rank #1 (Strong Buy).

Meanwhile, its revenue is expected to pop 54% in FY24 and 23% higher in FY25 to hit $3.53 billion vs. $1.9 billion in 2023.

Image Source: Zacks Investment Research

Robinhood shares have skyrocketed 385% in the last year and 210% the last six months. HOOD might face some resistance at its post-IPO highs in 2021 (outside of a massive short-term spike). HOOD stock dipped on Thursday and it could test its 21-day or 50-day moving averages depending on its guidance.

Robinhood's valuation is improving, trading at a 50% discount to its 12-month highs at 44.9X forward 12-month earnings. Its PEG ratio, which accounts for its EPS growth outlook, sits at 0.7 vs. the Finance sector's 1.3 and Tech's 1.7.

Free Today: Profiting from The Future's Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we're working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world's nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation MSFT: Free Stock Analysis Report

Arista Networks, Inc. ANET: Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD): Free Stock Analysis Report

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.