Zinger Key Points

- The Cupertino, California-based company looks to be settling into a few different patterns on both the daily and weekly charts.

- Apple stock is a long way from negating the current downtrend.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Apple Inc. AAPL was sliding almost 4% lower at one point on Thursday, in sympathy with the general markets, which saw the S&P 500 falling almost 2%.

The tech giant holds a 6.2% weighting in the S&P 500, which often causes the stock and the ETF to trade in tandem.

The markets recently enjoyed a short bull cycle within the longer-term bear cycle that officially began on June 13, when the S&P 500 fell below the $3,852 level. The drop put the ETF down a total of over 20% from its Jan. 4, 2022, all-time high of $4,818.62.

For many retail traders, the current bear cycle in the markets is the first they’ve experienced, and most traders naturally have what is known as a “bullish bias,” which makes trading bear cycles more difficult. For that reason, patience is often the key, which can be difficult to practice for traders who enjoyed the massive bull run that followed the COVID-19 crash in March of 2020.

There is money to be made for bullish traders in every bear cycle but sitting on the sidelines more often than not is usually the best way to preserve capital.

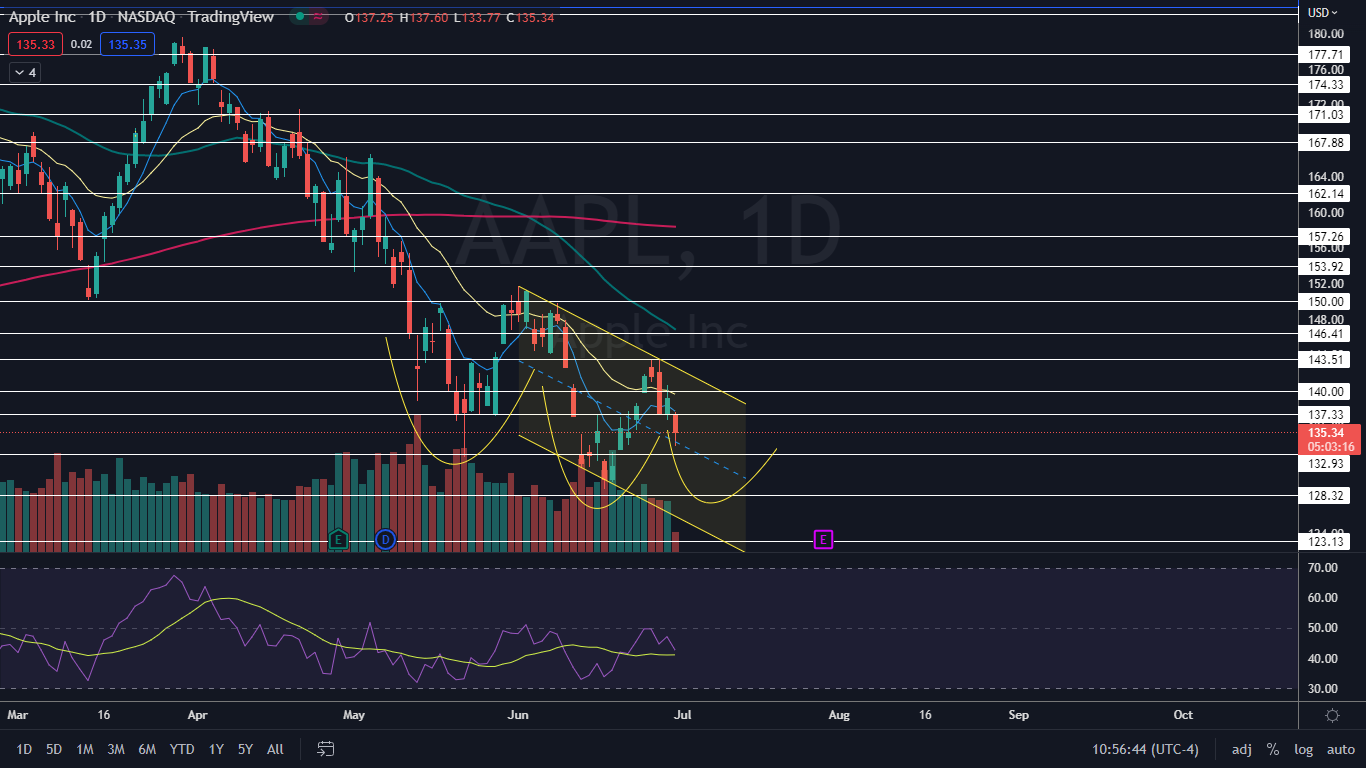

For technical traders, Apple looks to be settling into a few different patterns on both the daily and weekly charts, with the daily chart looking possibly bullish and the weekly appearing bearish.

See Also: Apple Analyst Says This Is Cupertino's Unique Advantage Over Other Tech Giants

Choosing a Timeframe For Charting: When choosing which timeframe to use when charting a stock, technical traders take into consideration the amount of time they plan to hold the stock before selling, with longer timeframes being used for longer-term trades and shorter timeframes used for shorter-term trades.

For example, a trader waiting for a weekly chart pattern to confirm or play out will likely wait for weeks while a trader using a daily chart to analyze potential direction is likely to wait days. Similarly, scalpers and short-term traders, who prefer not to hold stocks overnight will often watch the hourly, 15-minute or even five-minute chart to guide their decisions.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Apple Daily Chart: During the short bull cycle that occurred between June 17 and June 27, Apple negated its previous downtrend but the stock hasn’t yet confirmed an uptrend. For an uptrend to confirm, Apple will need to print a higher low above the most recent lower low of $129.04 over the coming days and then soar up to form a higher high above the June 27 high of $143.49.

- Apple could also be trading within a falling channel on the daily chart, within a downtrend on larger timeframes. A falling channel pattern is considered to be bearish until a stock breaks up bullishly from the upper descending trendline of the formation, which can signal a larger reversal to the upside is in the cards.

- A third pattern that Apple could be settling into is an inverted head-and-shoulder pattern, with the left shoulder formed between May 9 and June 1, the head created between June 2 and June 27 and the right shoulder forming over the days that have followed. If the head-and-shoulders become the dominant pattern, the measured move is about 12%, which suggests Apple could trade up toward $164.

- Apple has resistance above at $137.33 and $140 and support below at $132.93 and $128.32.

The Apple Weekly Chart: On this larger timeframe, Apple is trading in a consistent downtrend, with the most recent lower high printed the week of May 31 at $151.74 and the most recent confirmed lower low formed at the $129.04-mark the week of June 13. If Apple closes this trading week near its low-of-week, the stock could form a bearish engulfing candlestick, which could indicate lower prices will come again next week.

The Apple Weekly Chart: On this larger timeframe, Apple is trading in a consistent downtrend, with the most recent lower high printed the week of May 31 at $151.74 and the most recent confirmed lower low formed at the $129.04-mark the week of June 13. If Apple closes this trading week near its low-of-week, the stock could form a bearish engulfing candlestick, which could indicate lower prices will come again next week.

- If Apple has a bullish day on Thursday and Friday and closes the week with a long lower wick, the stock will print a hammer candlestick. That could indicate a bounce is in the cards over the next week or two, but the stock is a long way from negating the current downtrend.

- The same areas of resistance and support on Apple’s daily chart can be used on the weekly chart.

See Also: Return On $100 In Apple (AAPL) Stock Since First iPhone Launch

See Also: Return On $100 In Apple (AAPL) Stock Since First iPhone Launch

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.