Zinger Key Points

- CWEB is a 2X leveraged ETF that tracks the China-based Internet sector.

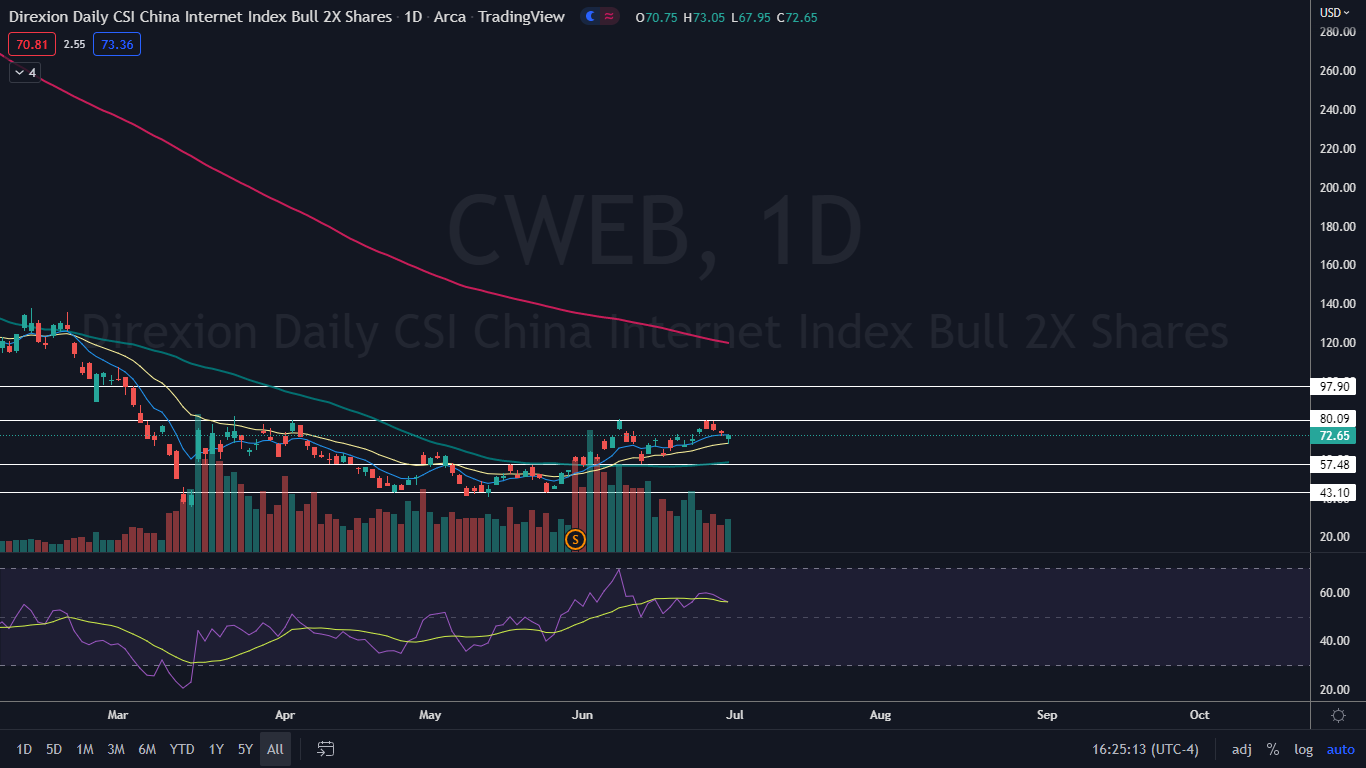

- The ETF has been trading in a strong but gradual uptrend since May 25.

- Wall Street veteran Chris Capre is going live April 9 at 6 PM ET to reveal a short-term strategy that just returned 195%—in the middle of a crashing market.

Direxion Daily CSI China Internet Index Bull 2x Shares CWEB closed down 1.62% on Thursday in consolidation. Consolidation can be determined by looking at volume on a security, which in this case was lower than average.

CWEB reversed into an uptrend on May 25 and has been gradually grinding higher since that date.

The ETF is a double leveraged fund that offers 2x daily exposure to companies whose primary business falls within the internet or internet-related sectors. The ETF tracks a number of China-based Internet companies through its four holdings, with the KraneShares CSI China Internet ETF and the U.S. dollar making up 82.44% of its weighted holdings.

The other two funds making up the remainder of CWEB’s weightings are the Goldman Sachs Trust Financial Square Treasury Instruments Fund Institutional, weighted at 10.48%, and Dreyfus Government Cash Management Funds Institutional, with a 7.08% weighting.

It should be noted that leveraged ETFs are meant to be used as a trading vehicle as opposed to a long-term investment by experienced traders. Leveraged ETFs should never be used by an investor with a buy and hold strategy or those who have low risk appetites.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The CWEB Chart: CWEB formed the most recent higher high of its downtrend on June 27 at $80.09 and the most recent confirmed higher low was printed at the $66.07 mark on June 22.

On Thursday, CWEB printed a hammer candlestick on the daily chart, which could indicate the next higher low is in and the ETF will trade higher on Friday as it continues in its uptrend.

- The declining share price on Thursday took place on lower-than-average volume, which indicates consolidation. Bullish traders want to see lower prices on lower-than-average volume and higher prices on higher-than-average volume, which indicates the bull are in control.

- CWEB is trading slightly below the eight-day exponential moving average (EMA) but with the eight-day EMA trending above the 21-day, which indicates indecision. Bullish traders will want to see CWEB regain the eight-day EMA over the coming days to avoid the indicator crossing below the 21-day.

- CWEB has resistance above at $80.09 and $97.90 and support below at $57.48 and $43.10.

See Also: Alibaba And Other Chinese Stocks Go Jittery As China Tightens Rules On Overseas Data Transfer

See Also: Alibaba And Other Chinese Stocks Go Jittery As China Tightens Rules On Overseas Data Transfer

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.