Zinger Key Points

- An uptrend occurs when a stock makes a series of higher highs and higher lows.

- Bullish traders can find a solid entry point when a stock prints a reversal candlestick above the most recent higher low.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% (discount ends Wednesday!)

BlackBerry Ltd BB, Moderna Inc MRNA and Palantir Technologies Inc PLTR have been showing strength in comparison to the general market recently and are all trading in uptrends.

An uptrend occurs when a stock consistently makes a series of higher highs and higher lows on the chart.

The higher highs indicate the bulls are in control while the intermittent higher lows indicate consolidation periods.

Traders can use moving averages to help identify an uptrend, with rising lower time frame moving averages (such as the eight-day or 21-day exponential moving averages) indicating the stock is in a steep shorter-term uptrend.

Rising longer-term moving averages (such as the 200-day simple moving average) indicate a long-term uptrend.

A stock often signals when the higher high is in by printing a reversal candlestick such as a doji, bearish engulfing or hanging man candlestick. Likewise, the higher low could be signaled when a doji, morning star or hammer candlestick is printed. Moreover, the higher highs and higher lows often take place at resistance and support levels.

In an uptrend the "trend is your friend" until it’s not and there are ways for both bullish and bearish traders to participate in the stock:

- Bullish traders who are already holding a position in a stock can feel confident the uptrend will continue unless the stock makes a lower low. Traders looking to take a position in stock trading in an uptrend can usually find the safest entry on the higher low.

- Bearish traders can enter the trade on the higher high and exit on the pullback. These traders can also enter when the uptrend breaks and the stock makes a lower low indicating a reversal into a downtrend may be in the cards.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

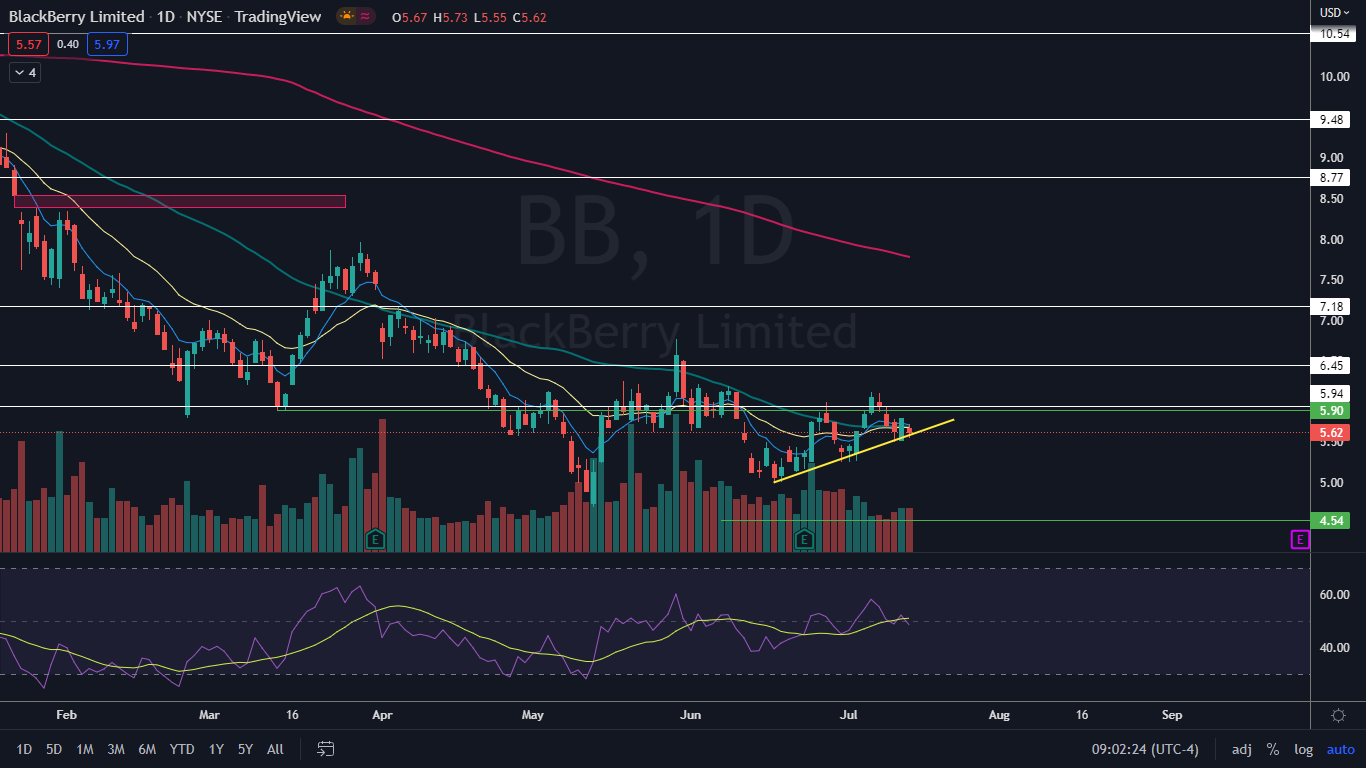

The BlackBerry Chart: BlackBerry reversed course into an uptrend on June 16 and has since printed a consistent series of higher highs and higher lows, with the most recent higher low formed on Wednesday at $5.51 and the most recent higher high printed at the $6.45 level on July 7.

On Thursday, BlackBerry printed an inside bar pattern and traders can watch to see which way the stock breaks from Wednesday’s mother bar to gauge whether the uptrend will continue or if it will be negated.

See Also: Moderna's COVID-19 Vaccine Scores Canadian Approval For Kids Below 5 Years

The Moderna Chart: Moderna has been trading in a strong uptrend since June 14, when the stock printed a double bottom pattern at $115.16. Moderna’s most recent higher high was printed on June 8 at $180.73 and the most recent higher low was formed at the $135.52 level on June 30.

The Moderna Chart: Moderna has been trading in a strong uptrend since June 14, when the stock printed a double bottom pattern at $115.16. Moderna’s most recent higher high was printed on June 8 at $180.73 and the most recent higher low was formed at the $135.52 level on June 30.

On Thursday, Moderna declined more than 6% lower but wicked up slightly from the 21-day exponential moving average. Traders will want to watch Friday’s price action to see if Thursday’s low-of-day serves as the next higher low within the uptrend.

The Palantir Chart: Palantir reversed course into an uptrend on June 13 and the most recent higher high was printed at the $10.38 mark on July 8 and the most recent confirmed higher low was formed on June 30 at $8.72. On Thursday, Palantir came close to negating the uptrend but closed the trading session just above the June 30 low.

The Palantir Chart: Palantir reversed course into an uptrend on June 13 and the most recent higher high was printed at the $10.38 mark on July 8 and the most recent confirmed higher low was formed on June 30 at $8.72. On Thursday, Palantir came close to negating the uptrend but closed the trading session just above the June 30 low.

Traders and investors will want to see Palantir either rise up above Thursday’s high-of-day on Friday or for the stock to print an inside bar to consolidate Thursday’s drop. If Palantir falls below Thursday’s low-of-day on Friday, the uptrend will be negated.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.