Zinger Key Points

- Jet.AI's board authorizes a $2 million share repurchase program through 2025.

- Jet.AI withdraws its S-1 registration for a planned offering, aiming to simplify its capital structure.

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

Jet.AI Inc. JTAI shares are trading higher Wednesday after the company’s board approved a $2 million share repurchase program through 2025 and announced the withdrawal of its S-1 registration. Here’s what you need to know.

What To Know: Jet.AI’s board of directors authorized a buyback of up to $2 million. The company has until the end of 2025 to complete the repurchases.

Jet.AI CEO Mike Winston stated that the move will allow Jet.AI to buy back its shares when the company believes they are undervalued.

“Additionally, because we recently succeeded in exchanging our publicly held warrants for stock to simplify the capital structure – we’re glad to pull this previously contemplated warrant heavy transaction, which is no longer necessary given the company’s position,” Winston said.

Jet.AI announced the withdrawal of its S-1 registration statement for a prospective offering that the company was previously pursuing. The company said the terms were no longer advantageous to its strategic goals as it aims to comply with Nasdaq listing requirements before a deadline on Nov. 26.

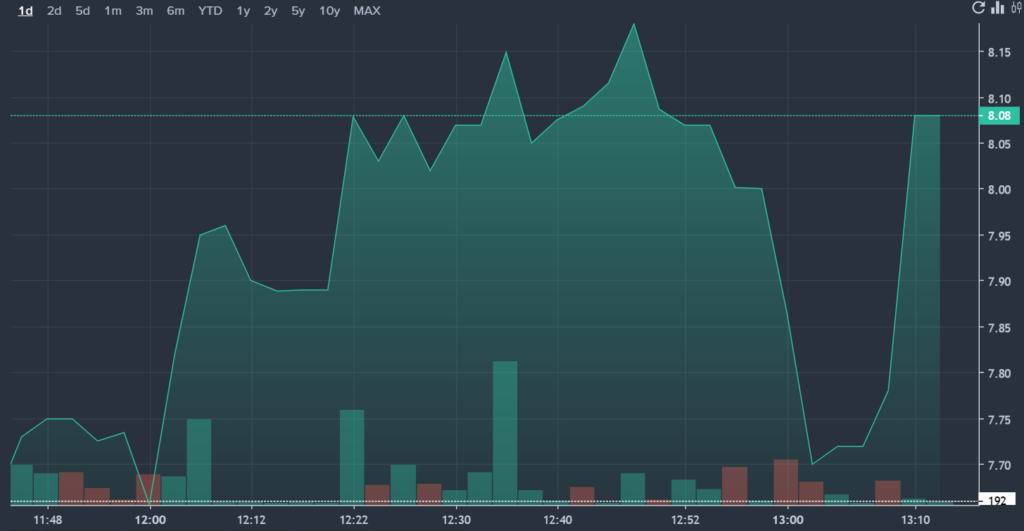

Jet.AI enacted a 1-for-225 reverse stock split this week, which has sparked some volatility in the name. The stock began trading on a split-adjusted basis on Tuesday. The stock split was aimed at regaining compliance with the Nasdaq’s continued listing criteria.

JTAI Price Action: Jet.Ai shares were up 21.9% at $8.09 at the time of writing, according to Benzinga Pro.

Read Next:

Image: Shutterstock/ solarseven.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.