Zinger Key Points

- Oklo signs a letter of intent to acquire Atomic Alchemy for $25 million in an all-stock transaction.

- The acquisition supports Oklo’s strategy to expand its clean energy and fuel recycling technology into the radioisotope market.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

Oklo Inc. OKLO shares are trading higher. The company on Thursday announced a proposed acquisition to expand into the radioisotope market. Here’s what you need to know.

What Happened: Oklo said it signed a letter of intent to acquire Atomic Alchemy for $25 million in an all-stock transaction.

The potential acquisition would expand Oklo’s presence into the radioisotope market, which is expected to represent a $55.7 billion market by 2026.

The proposed acquisition builds upon the strategic partnership announced between Oklo and Atomic Alchemy earlier this year. The potential deal would integrate radioisotope production into Oklo’s fuel recycling processes, generating materials crucial for applications in medical treatments, diagnostic imaging and industrial uses.

“The proposed acquisition is expected to enable Oklo to significantly broaden its impact, as our fast reactor and fuel recycling technologies allow us to produce radioisotopes as a coproduct,” said Jacob DeWitte, co-founder and CEO of Oklo.

See Also: ASP Isotopes Stock Is Moving Higher Thursday: What’s Going On?

Sam Altman, chairman and board member of Oklo, also commented on the proposed acquisition: “I deeply believe in the importance of abundance and reliable energy for the future, and Oklo’s proposed acquisition of Atomic Alchemy opens the door for nuclear technology to play an even greater role in solving critical energy, medical, and industrial challenges.”

All Oklo shares issued to existing shareholders of Atomic Alchemy in connection with the transaction are expected to be subject to multi-year lock-ups.

Oklo said the proposed transaction is expected to have “minimal immediate impact” on the company’s operating cost structure. It’s also not expected to impact Oklo’s previously announced 2024 guidance.

The news comes a day after Oklo announced plans to partner with two major data center providers to deliver up to 750 MW of power. The company said it will now work with "one of the fastest-growing data center companies" to deploy powerhouses in select sites. The commitments bring Oklo's customer pipeline up to approximately 2,100 MW.

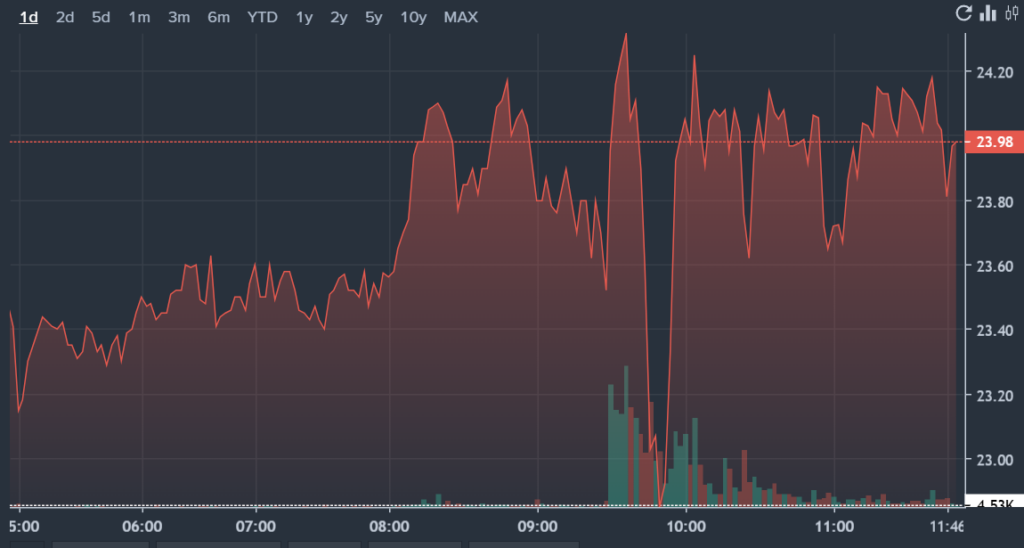

OKLO Price Action: Oklo shares were up 3.16% at $23.81 at the time of writing, according to Benzinga Pro.

Read Next:

Image: Courtesy of Oklo, Inc.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.