Zinger Key Points

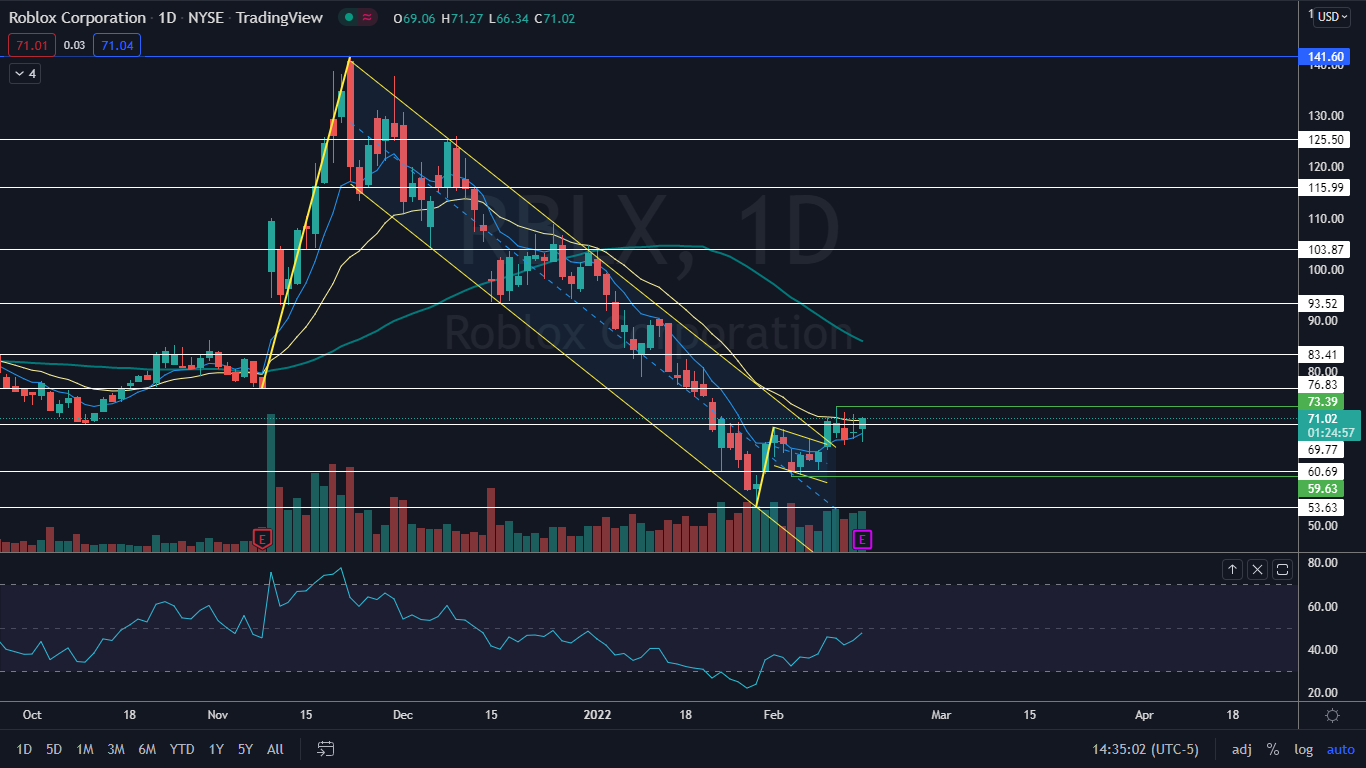

- On Feb. 9, Roblox broke up bullishly from a bull flag pattern and has been consolidating in a horizontal pattern.

- Roblox’s higher-than-average volume on Tuesday indicates a high level of trader and investor interest has returned to the stock.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

Roblox Corporation RBLX is set to print its fourth-quarter and full year financial results after the markets close on Tuesday. Analysts expect Roblox to report earnings per share of 14 cents on revenue of $763.29 million for the quarter ending Dec. 31.

Ahead of the earnings print, BofA Securities reinstated its Buy rating on Roblox and announced an $84 price target.

When Roblox printed its third-quarter earnings print on Nov. 8, the stock gapped up almost 30% the next trading day and over the nine days that followed soared an additional 42% higher to reach a Nov. 22 all-time high of 141.60.

For that quarter, Roblox reported revenue of $509.3 million, up 102% year-over-year. Bookings in the third quarter were $637.8 million, which represented a 28% year-over-year increase. Roblox also increased its daily active users by 31% to 47.3 million.

Since reaching its all-time high, the stock has been heavily beaten down, plummeting over 62% to reach an all-time low of a $53.63 on Jan. 28 before reversing course to the upside.

From a technical perspective, Roblox looks set to fly higher over the coming days and weeks, but holding a position in a stock over earnings can be akin to gambling because stocks can rise following an earnings beat and fall after reporting a miss.

See Also: How to Buy Roblox Stock Right Now

The Roblox Chart: On Feb. 9, Roblox broke up bullishly from both a bull flag pattern and a long-term falling channel formation on the daily chart, which Benzinga called out on Feb. 2. Since breaking up from both patterns, the stock has been consolidating in a horizontal pattern.

On Tuesday, Roblox was attempting to break up bullish from a double inside bar pattern, with the mother bar formed on Friday and the double inside bars created on Monday and Tuesday. The pattern leans bullish because Roblox was trading higher before forming the inside bars.

Roblox’s higher-than-average volume on Tuesday indicates a high level of trader and investor interest has returned to the stock. By midafternoon over 26 million shares of the stock had exchanged hands compared to the 10-day average of 23.51 million.

Roblox is trading above the eight-day exponential moving average (EMA) and in line with the 21-day EMA. Bullish traders will want to see Roblox regain the 21-day EMA as support and hold above the level for a period of time, which will cause the eight-day EMA to bullishly cross above the 21-day.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

- Bulls want to see a bullish reaction to Roblox’s earnings print and for sustained big bullish volume to come in and push the stock up over the Feb. 10 high of $73.39, which would confirm the uptrend is still intact.

- Bears want to see a bearish reaction to the earnings print, prompting big bearish volume to come in and dropping Roblox down below the Feb. 3 low-of-day at the $59.63 mark. Below the level, the only support in the form of price history is at the all-time low.

Photo: Courtesy of roblox.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.