Zinger Key Points

- The threat of cyber warfare against U.S. and European governments and companies has escalated.

- CrowdStrike and Palantir appear to be settling into two separate bullish patterns on their daily charts.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

CrowdStrike Holdings, Inc CRWD and Palantir Technologies, Inc PLTR shot up on Feb. 24 after gapping down to start that day, after traders and investors woke up to find out Russia had begun its invasion into Ukraine.

The price action since then appears to indicate a reversal to the upside may be in the cards, propelled by both technical indicators on CrowdStrike and Palantir’s charts and the geopolitical events that have thrust cybersecurity stocks into the spotlight.

Although many analysts expected Russia to begin its offense against Ukraine with widespread cyberattacks on Ukraine’s communication infrastructure, Ukraine has remained relatively unscathed on that front.

After the U.S. and its allies began to impose harsh sanctions against Russia for its aggression, however, the threat of cyber warfare against U.S. and European governments and companies has escalated, and U.S. banks and major corporations have begun preparing for Russian retaliation in the form of cyberattacks.

From a technical perspective, CrowdStrike and Palantir appear to be settling into two separate bullish patterns on their daily charts, which could potentially cause the stocks trade significantly higher over the short-term to mid-term timeframe. CrowdStrike may have slightly more upside, however, due to the measured move of its bull flag.

It should be noted, however, that events affecting the general markets, negative or positive reactions to earnings prints and news headlines can quickly invalidate patterns and breakouts. As the saying goes, "the trend is your friend until it isn't" and any trader in a position should have a clear stop set in place and manage their risk versus reward.

See Also: PreMarket Prep Plus: Cybersecurity Stocks In Focus During Ukraine Conflict

In The News: Notable investors have taken bullish positions in CrowdStrike and Palantir this week. On Monday, Market Rebellion co-founder Pete Najarian said he had purchased short-term call options on CrowdStrike.

Former hedge fund manager Puru Saxena said he had bought shares of Palantir and believes the beaten down but sees the potential for high growth over the long term.

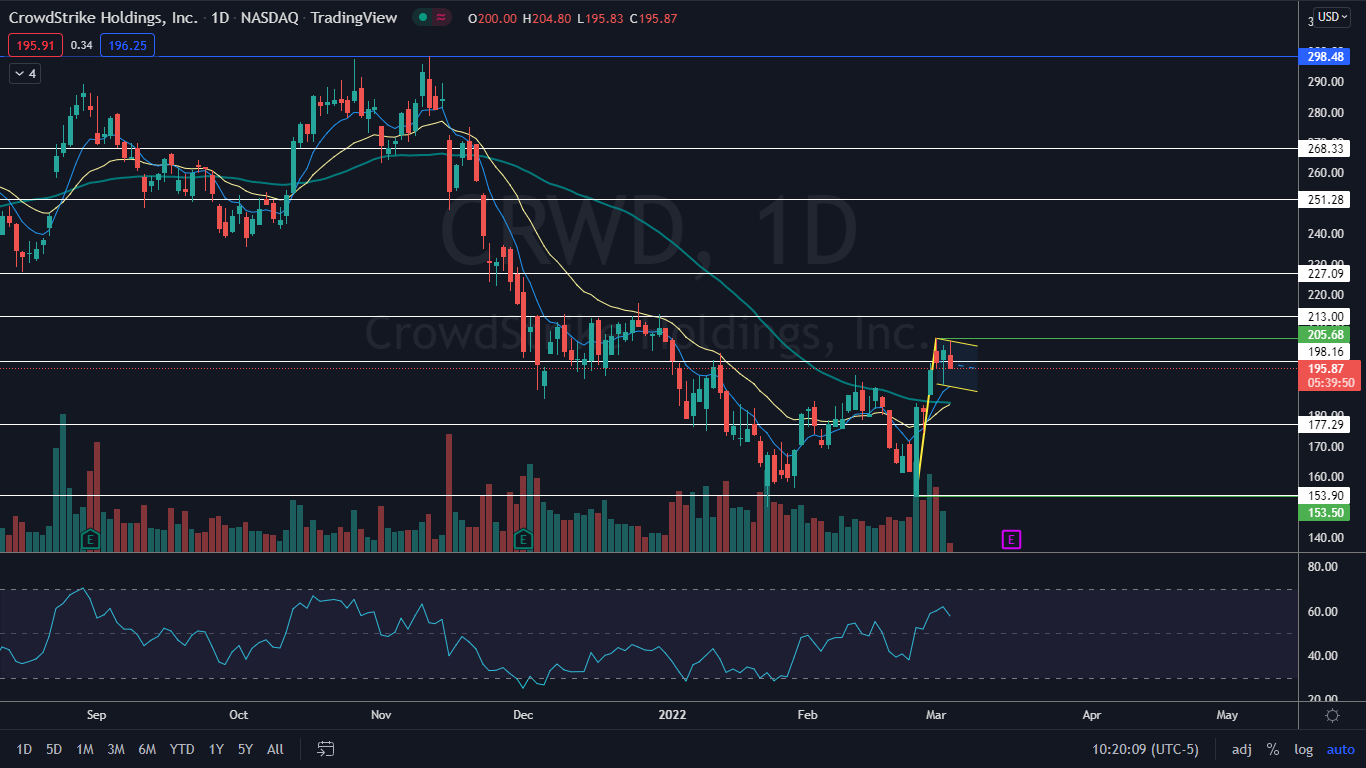

The CrowdStrike Chart: After hitting a bottom at $153.50 on Feb. 25, CrowdStrike reversed course and shot up to $205.68 on March 1. Since that date, CrowdStrike has been consolidating on decreasing volume.

- The rise higher, paired with the consolidation has settled CrowdStrike into a possible bull flag pattern on the daily chart. The measured move, if the pattern is recognized and the stock breaks up bullishly from the flag on higher-than-average volume is about 33%, which indicates CrowdStrike could soar up toward the $253 level.

- CrowdStrike may also be forming an uptrend, although a higher low will need to be confirmed. The higher low may have printed at $190 on Wednesday, and if so, CrowdStrike will need to form a higher high above the $206 level over the coming trading days.

- CrowdStrike has resistance above at $198.16 and $213 and support below at $177.29 and $153.90.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Palantir Chart: Similar to CrowdStrike, Palantir may be forming both a new uptrend as well as a bull flag pattern, with the pole and flag of the formation printing on the same dates.

- The measured move of Palantir’s bull flag is about 27%, which indicates the stock could trade up toward about $14.50 in the future.

- Also like CrowdStrike, Palantir needs to confirm its possible new uptrend with a higher low. The stock may have printed the low on Wednesday and if so, traders can watch for Palantir to rise up above the $12.50 level over the coming days to print a higher high.

- Palantir has resistance above at $13.18 and $14.58 and support below at $10.99 and $9.79.

Photo: Katie Godowski from Pexels

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.