Camber Energy, Inc CEI and Battalion Oil Corporation BATL were trading down over 6% and 2%, respectively, on Tuesday afternoon in sympathy with the United States Oil Fund, which fell over 6% in the morning before recouping some of the losses to trade down about 4% off Monday’s close.

Stocks in the energy sector have been flying higher amid Russia’s invasion of Ukraine and fear of how sanctions imposed on the Putin-led country will impact the price of oil. Many of the stocks soared so quickly that they became over-extended, making a retracement likely, which has caused the sector to pull back. Ongoing talks between Russian and Ukraine senior officials to end the war are underway, bringing some hope the war will come to an end, resulting in lower energy costs.

Chart-wise, the recent 5-day pullbacks of Camber Energy and Battalion Oil have had different results, with Camber Energy continuing to hold its uptrend on the retracement whereas Battalion negated its rising trend when the stock printed a lower low on Monday.

Both stocks are showing signs on Tuesday that a bounce to the upside is likely in the cards because by midafternoon, Camber Energy was forming a dragonfly doji candlestick and Battalion Oil looked to be printing a hammer candlestick, which both signal a reversal may be on the way.

It should be noted, however, that events affecting the general markets, negative or positive reactions to earnings prints and news headlines can quickly invalidate patterns and breakouts. As the saying goes, "the trend is your friend until it isn't" and any trader in a position should have a clear stop set in place and manage their risk versus reward.

See Also: Here's Why Camber Energy Shares Are Falling

The Camber Energy Chart: On Tuesday, Camber Energy dropped lower to test the 50-day simple moving average, which aligns with a support zone at 70 cents, and bounced up from the level. This indicates longer-term sentiment remains bullish for the stock.

- Camber Energy began trading in an uptrend on Feb. 23 and has made a consistent series of higher highs and higher lows. The most recent higher low was printed on March 4 at 55 cents, and as long as the stock doesn’t retrace below that level over the coming days, the uptrend is likely to stay intact.

- If the dragonfly candlestick is recognized, Camber Energy is likely to trade up on Wednesday, and bullish traders will want to see the stock regain support at the eight-day exponential moving average to feel more confident going forward.

- Camber Energy’s relative strength index, which was overextended on March 7 when the stock hit a high of $1.98, has retraced to a more comfortable 50%, which gives the stock room to bounce.

- Camber Energy has resistance above at 85 cents and $1 and support below at 70 cents and the 50-cent mark.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

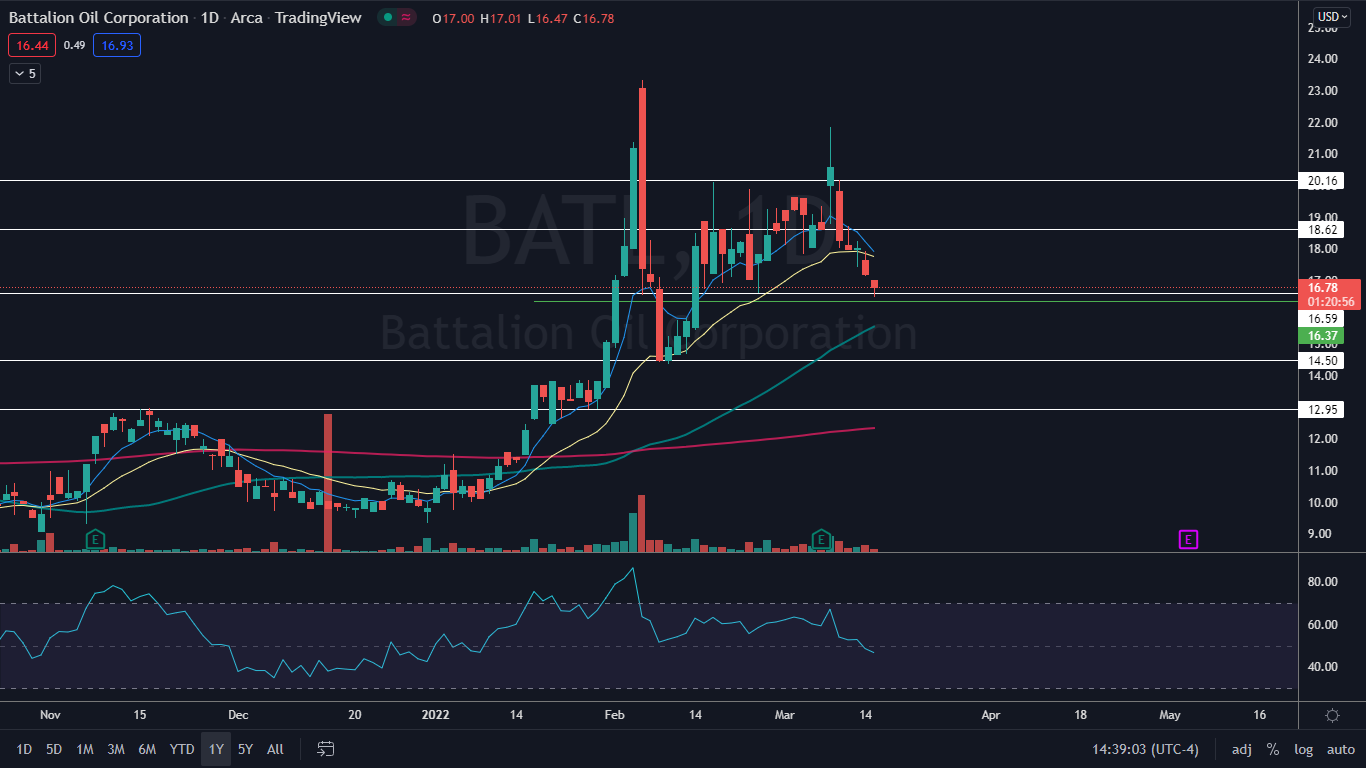

The Battalion Oil Chart: Battalion Oil has been trading in a volatile and inconsistent uptrend since Dec. 31, 2021, but on Monday, when the stock fell below the March 3 higher low at the $17.82 mark, the most current uptrend was negated.

- When Battalion Oil fell slightly below the $16.50 mark on Tuesday, bulls came in and bought the dip, which caused the stock to wick up from the area and print a hammer candlestick. If the pattern is recognized, bulls will want to see the stock pop up above the eight-day and 21-day EMAs that are trending just below the $18 level to avoid causing the eight-day EMA to cross below the 21-day EMA.

- Like Camber Energy, Battalion Oil’s RSI has retraced to the 50% level from the 87% level it hit on March 3.

- Battalion Oil has resistance above at $18.62 and $20.16 and support below at $16.59 and $14.50.

See Also: Good As Gold: Investors Haven't Given Up On The Traditional Safe Haven

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.