Zinger Key Points

- As Amazon is set to join the DJIA on Feb. 16, investors fear whether it would meet the same fate as Apple, Microsoft & Intel's stocks

- The technical setup for Amazon stock, however, appears bullish with aggressive buying and passive selling behavior among market participants

- Get access to your new suite of high-powered trading tools, including real-time stock ratings, insider trades, and government trading signals.

Amazon.com Inc AMZN stock is trading higher on the news that the company is set to join the Dow Jones Industrial Average (DJIA) on Feb. 26.

During CNBC’s Last Call, host Brian Sullivan suggested that Amazon’s inclusion in the DJIA might not necessarily be advantageous for the Seattle e-commerce giant.

Look at other major stocks like Microsoft Inc MSFT and Apple Inc AAPL, Sullivan says. Microsoft joined the DJIA in November 1999, and Applie joined in March 2015. Both companies initially suffered from stagnant stock performances for several years before a significant increase.

Intel INTC stock also faced the same trajectory upon Dow inclusion in November 1999.

Investors are now concerned whether Amazon might experience a similar pattern of slow growth.

Let’s look at the technical setup of the stock ahead of its inclusion.

Amazon Stock’s Technical Setup Ahead Of Dow Inclusion

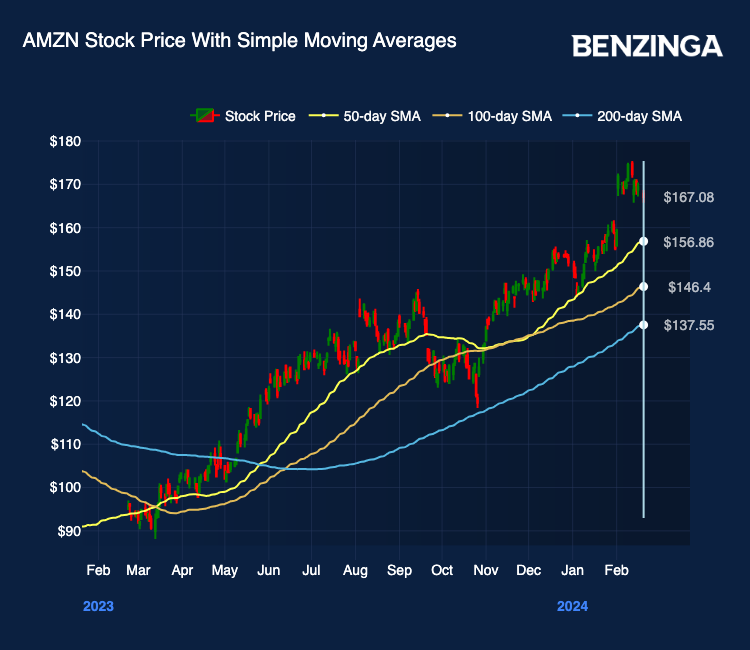

The technical analysis of Amazon stock suggests a favorable outlook. The stock has been on an upward trajectory within a rising trend channel in the medium long term, reflecting increasing optimism among investors. The absence of resistance in the price chart indicates the potential for further upward movement.

Examining the moving averages, the stock’s 50-day simple moving average (SMA) at $156.86, compared to the current share price of $167.08, signals a technical “Buy.” Additionally, the 200-day SMA at $137.55 further reinforce the Buy signal, providing confidence in the stock’s positive momentum.

Positive volume balance, as indicated by the upward trajectory of the on-balance volume indicator in the chart above, underscores the stock’s strength in buying volume, with aggressive buying and passive selling behavior among market participants.

Overall, the technical analysis suggests a favorable outlook for Amazon stock, supported by various indicators.

Currently trading near its 52-week high, Amazon’s performance aligns with the broader market represented by the S&P 500 Index, which is also trading near new highs. The slight pullback after the strong upward movement opens up a potential entry point. The ongoing pullback creates an opportune moment for entry.

However, given the trajectory faced by other tech stocks such as Apple, Microsoft and Intel upon Dow inclusion, those buying-the-dip may want to exercise caution.

Read Next: Amazon Stock Is Moving Higher Wednesday: What’s Going On?

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.