Zinger Key Points

- Despite an earnings miss reported on Feb. 7, the stock is gaining on investor confidence as CEO David Gibbs sees 2024 as a milestone year.

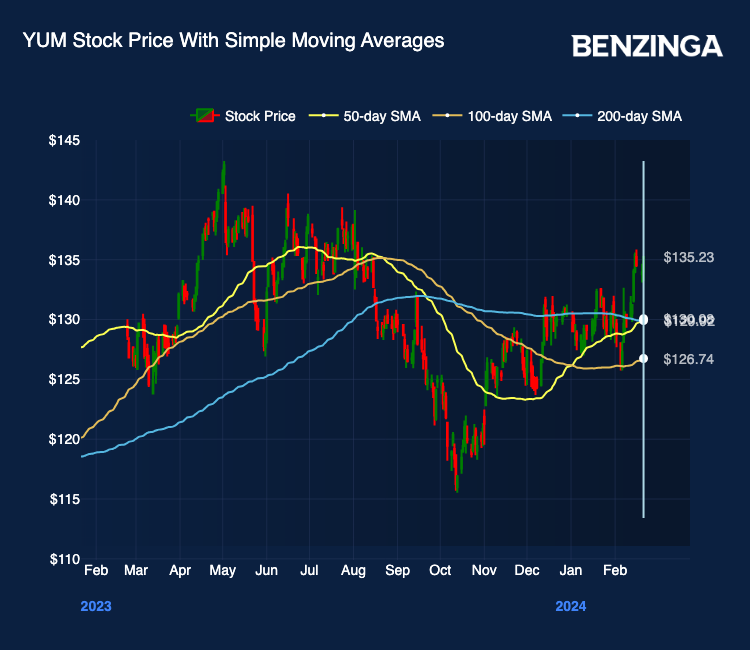

- The stock just made a Golden Cross suggesting a potential shift in trend from a bearish to a bullish direction.

- Get access to your new suite of high-powered trading tools, including real-time stock ratings, insider trades, and government trading signals.

Despite an earnings miss reported on Feb. 7, YUM! Brands YUM — the owner of KFC (Kentucky Fried Chicken), Pizza Hut, Taco Bell, and The Habit Burger Grill — is gaining investor confidence.

The fast-food conglomerate is known for operating several well-known restaurant chains. Its stock has been more or less range-bound between $120-$140 over the past year.

Year-to-date, Yum stock is up 3.5%.

“Looking to 2024, this will be a year of major milestones as we cross 30,000 restaurants at KFC, 20,000 at Pizza Hut and well over 60,000 globally for Yum!” said CEO David Gibbs with the earnings announcement.

Golden Cross Suggests Shift In Trend To Bullish

Investor optimism around Yum’s prospects for 2024 has also led the stock to make a Golden Cross on the price chart. The 50-day simple moving average (SMA) (yellow line above) has crossed over the 200-day SMA, signaling bullish sentiments setting in.

The Golden Cross suggests a potential shift in trend from a bearish to a bullish direction. It indicates that the average price over the short term is starting to outpace the average price over the long term, which could signify a strengthening in the asset’s price momentum.

Traders often use the Golden Cross as a buy signal, interpreting it as a sign that the underlying asset’s price may continue to rise. However, like any technical indicator, investors need to consider other factors and use additional analysis to make well-informed decisions.

Wall Street analysts who reviewed the stock have a consensus Overweight rating on the stock with a price target of $144.35. Analysts who reviewed the stock over January-February have largely maintained their ratings. Price targets from recent reviews range between $133 to $166 a share.

YUM Price Action: YUM stock was trading at $135.95 at the time of publication.

Now Read: Nvidia Market Cap Nears $2 Trillion – Why ‘Tech Giant’ Has Become An Understatement

Image: Wikimedia

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.