Zinger Key Points

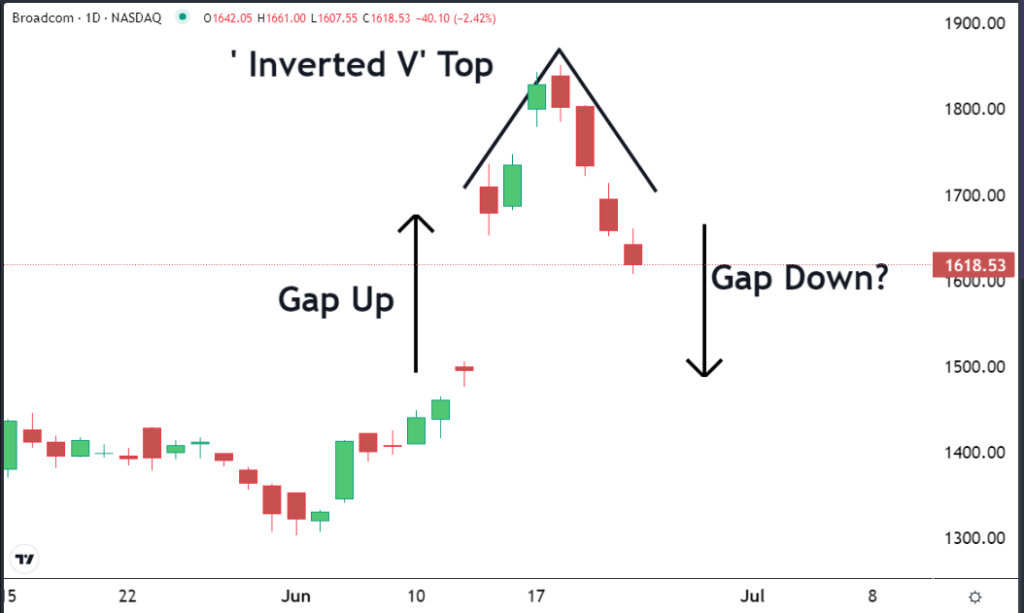

- Broadcom has formed a reversal pattern on the chart.

- The shares may be about to head lower.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

Shares of Broadcom Inc. AVGO have reversed, and they also could be about to refill a gap. This means the stock may make a meaningful move lower.

This is why the trading team has identified Broadcom as our ‘Stock of the Day'.

When the leadership of a market is changing from bears to bulls or bulls to bears, the price action can show up on a chart as a reversal pattern. If the reversal takes place in one day, the action may appear as a ‘bearish engulfing pattern'.

This happened with Nvidia NVDA last week.

If the change is slow and takes place over an extended, a ‘rounded bottom' or ‘rounded top' may form on the chart. If the change takes place over a few time-periods, it can appear as a ‘V bottom' or an ‘inverted V' top.

As you can see on the chart, Broadcom just completed an inverted ‘V top’ pattern. The green team (bulls) took over the market in early June and pushed the price higher. But last week the red team (bears) gained control and have been pushing the price lower ever since.

Now the shares may be about to refill a gap. This means the move lower may accelerate.

One reason why support forms in markets is seller's remorse. Sometimes, people regret selling if the market moves higher after they do. And sometimes they decide that they will buy their shares back if they can get them for the same price they were sold for.

A stock can close at one price and open the next day at a substantially higher price. That was the case recently with AVGO. The shares closed on Wednesday, June 12 around $1,495. The next morning, they opened close to $1,710.

Because there was no trading at the prices in between the open and the close, it appears on the chart as a blank space or a gap. And because there was no trading within these levels, there were no traders or investors who sold who have become remorseful and will be trying to buy their shares back.

That means that there may not be a lot of buy interest in between these two prices. So, if the shares reverse and move back into this range going in the opposite direction, people who want to sell may have a difficult time finding others to buy their shares.

As a result, they will need to be aggressive and offer their shares at a discount. This could result in a rapid selloff that ‘refills' the gap. Within a few days, Broadcom may end up right back where they started from when they gapped up.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.