Zinger Key Points

- Market memory refers to how some support and resistance levels can stay intact for a long time.

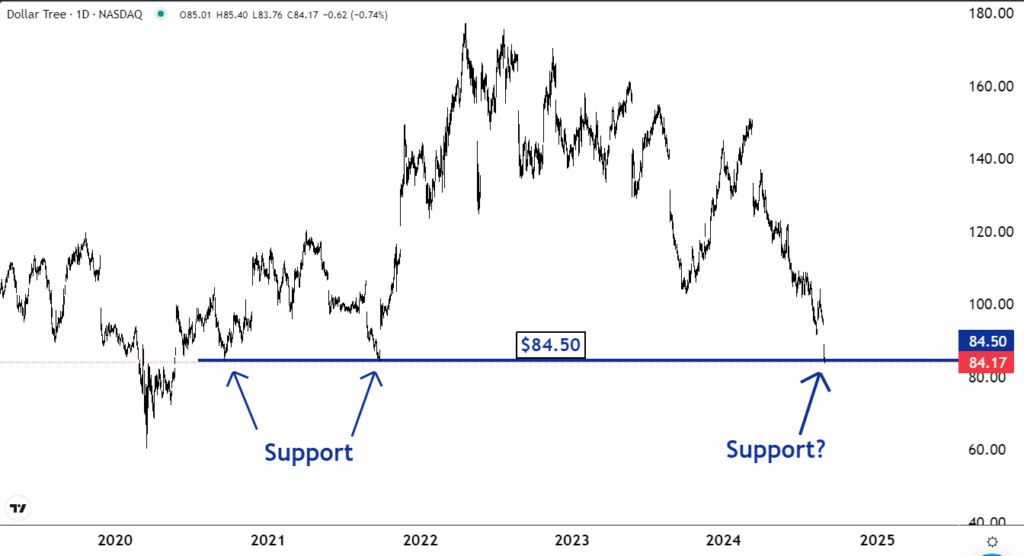

- The chart of Dollar Tree (DLTR) is an excellent example of this.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Sometimes a support or resistance level can retain their importance for a long time. It could be days, weeks, months or even years. Traders refer to this as market memory.

As you can see on the following chart, this is the case with the $84.50 level for shares of Dollar Tree Inc DLTR. This level has been important for years. This is why our team of trading experts has made it our “Stock of the Day.”

The stock found support there in September 2020. Then it reversed and rallied. One year later in September 2021, it found support there again.

Stocks tend to find support at levels that had previously been support because of seller's remorse. Some people who sold while the shares were at the support regret their decision to do so if the price moves higher.

If the stock eventually reverses and goes down to their selling price, a number of these remorseful sellers can decide to buy their shares back. Their buy orders create support at a level that had been support before.

Read Also: Why Dollar Tree Shares Are Falling Thursday

Now Dollar Tree found support at $84.50 again — and it may rally like the past two times it got down to this price.

Stocks tend to rally off of support levels when buyers get anxious. They are afraid other buyers will outbid them. These buyers know anyone looking to sell will go to whoever is willing to pay the highest price.

They don't want to miss the trade, so they increase the prices they are willing to pay. Other anxious buyers see this and do the same thing.

It could cause a snowball effect that can move the price higher.

Stocks can find support at levels that were previously support because of seller's remorse. And they can rally off of support because of anxious buyers.

When understood and applied correctly, technical analysis is the study of supply and demand, and investor and trader psychology.

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.